Pound cost averaging (also known as dollar-cost averaging) may be a familiar term for those who are interested in investing. For most new investors, it’s hard to fully understand what pound cost averaging is, let alone whether it will provide superior returns over time.

Using pound cost averaging to invest in index funds will help establish good consistent investing habits and help investors avoid trying to “time the market”. However, large-scale research suggests money invested up-front as a lump-sum achieves higher returns than pound cost averaging in most cases.

As readers of this blog will know, my strong investing preference is low-cost, passive index funds held for the long term simply because it’s my view that this investing strategy offers the best risk to reward ratio of all of the strategies I have read up on. The question is; does pound cost averaging reduce risk over time and what impact does it have on returns?

Should you use pound cost averaging to invest in index funds in the UK?

The evidence suggests that investing money as a lump-sum up-front will tend to achieve superior returns than investing via dollar-cost averaging. However, dollar-cost averaging does help establish good investing habits like investing consistently each month.

Generally speaking, most people do not have significant sums to invest as a lump sum from the outset. A common method used by successful investors is to maximise their surplus between their income and expenses each month and invest this difference into low-cost index funds making use of automation as much as possible.

Because of this, most people make use of pound cost averaging by default. However, if you were to receive a significant sum of money as a gift, inheritance or winnings, the research shows the money will generally achieve better returns by investing it all in one go from the start.

The conventional wisdom underpinning pound cost averaging suggests that by investing slowly each month, investors will buy units of the fund at an average price and avoid using the entire cash windfall at a time when the price per unit may be high.

So to summarise, you’re probably using pound cost averaging by default and that is fine, it gets your money into the markets in a consistent, reliable way. However, if you receive a one-off sum, you’re probably better off investing it all in one go as soon as possible assuming total returns is what you’re most interested in.

What is pound cost averaging?

Pound cost averaging is an investment strategy where investments are spread evenly over a period of time rather than investing money all at once as a lump sum. The strategy supposedly averages out the purchase price of investments, smoothing out the high and low prices (volatility) over time.

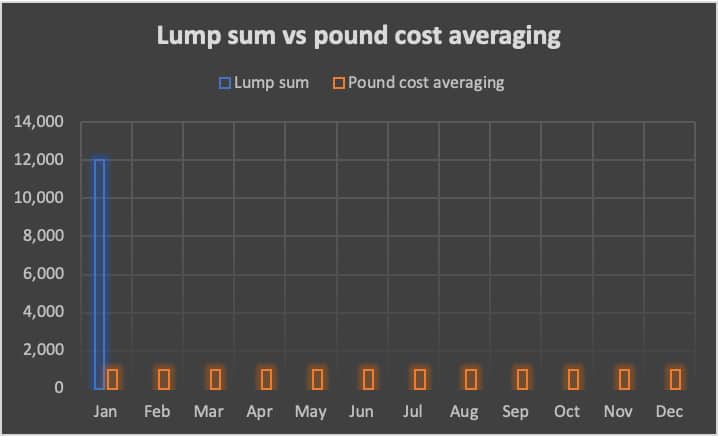

They say an image speaks a thousand words, so with that in mind, I’ve turned to a trusted old friend – Excel and made the fancy graph below which illustrates exactly what pound cost averaging is all about.

Let’s say you are gifted £12,000 by a generous benefactor. What are your options? Obviously, you could drop the whole load on a new car or a load of fancy dinners but here at The Progression Playbook, we know a gift like this one could make a huge difference to achieving your financial independence goals.

The answer, therefore, is to invest this money and let it compound over time. £12,000 held in a fund returning 10% a year for 40 years will be worth £543,111 by the end. So if you received a gift of this amount in your 20’s and do the smart thing and leave it to compound, it could be worth more than half a million pounds before you retire.

The only question left is this – do I invest the whole £12,000 at once on January the 1st as a lump sum (as per the graph above) or do I spread it out a bit (pound cost average) and invest £1,000 per month for 12 months?

This is the dilemma that pound cost averaging provides. Interestingly, this dilemma neatly represents an even bigger conundrum people come up against – cold, hard logic or emotional intuition?

Does pound cost averaging reduce price volatility?

When purchasing investments such as an index fund, one of the key considerations is the valuation of the fund. The fund value will fluctuate over time based on the valuations of the underlying Companies within the fund with their respective highs and lows.

This is one of the big risks of lump-sum investing. What if, for example, you invested your £12,000 gift introduced above on the 1st of January and the fund was trading at a high valuation at this point. Let’s say our £12,000 buys us 100 units of the fund with each unit worth £120.

If the fund valuation dropped to £90 per unit by the end of January, our investment would now only be worth £9,000 which would be a £3,000 loss in a month. Many investors would find this loss very difficult to accept and may even make a desperate move like selling up at this price to avoid further losses.

Unfortunately, this is a fallacy. Even if the price per unit tumbled, what’s important is that we own the same 100 units of the fund regardless of the current valuation. As long as investors don’t get scared of these fluctuations and ride out the bad periods, no ‘loss’ is really locked in.

The logic behind pound cost averaging states that investors can avoid buying at the wrong time by spreading their investments out over time. This strategy is deemed to offer protection against a market downturn or a ‘bear’ market.

Returning to our above example, instead of investing the full £12,000 on the 1st of January, what if we invested £1,000 each month for a year. This way, sometimes we may buy units when the price is high and other times when the price is low.

Conventional wisdom states that these will average out over time and the average price of our units will be somewhere in the middle i.e. lower than the units purchased in our alternative lump-sum strategy.

The question is – what produces higher overall returns – lump-sum investing or pound cost averaging?

What is the impact of pound cost averaging on returns?

If you were to ignore the price of the investments, basic maths tells us that investing our full £12,000 on day one will provide superior returns to investing £1,000 a month for 12 months.

This can be done using a future value calculator (like this one) online or by using Excel’s future value formula. Here are the ending results in each scenario:

| Related data | Lump-Sum | Pound cost averaging |

| Present value on day 1 | £12,000 | £0 |

| Rate of return – 10% per year assumed | 10% per year | 10% per year |

| Number of periods | Compounds over 12 months | Compounds over 12 months |

| Payments (Periodic payments | £0 | £1,000 per month |

| Future value (value after one year) | £13,257 | £12,670 |

In this simple example, clearly, the lump-sum method offers superior returns – our ending value is £13,257 which gives a £1,257 return over the year compared with just a £670 return using pound cost averaging.

This makes intuitive sense, under the lump-sum strategy, the full £12,000 can compound each month for a full year by 10% whereas in the pound cost averaging scenario only £1,000 can compound for the full year and a further £1,000 for 11 months and so on.

The problem with this example is that it ignores the number of units the invested money can buy you at each stage. To work out which strategy offers higher returns, we will have to turn to larger studies performed which have reviewed these strategies over various periods of time and across different asset classes.

Pound cost averaging vs lump sum investing

Luckily, Vanguard has performed this research for us (which can be found here) and to cut a long story short, the data from their study supports what I’ve said above.

Here are the key findings that should be of interest to us:

- In a portfolio of 100% equities (company shares) – lump-sum investing outperforms pound cost averaging 66% of the time in the United States and 68% of the time in the United Kingdom.

- In a portfolio of 60% equities and 40% bonds (a slightly more risk-averse portfolio) – lump-sum investing has outperformed pound cost averaging 67% of the time in both the US and UK.

We’re all familiar with the common investment platform warning that ‘historic returns are not indicative of future returns’ but despite that, it’s hard to avoid concluding from the above two findings that you’d be better off investing your money as a lump sum.

Vanguard’s research concludes by saying “if markets are trending upward, it’s logical to implement a strategic asset allocation as soon as possible because it should offer a higher long-run expected return than cash“.

To add to this – over a long enough time period, the market pretty much always ‘trends upward’ when invested in equities so my take on Vanguard’s conclusion is this – if the aim of the game is maximising returns and growth on your investments, then lump-sum investing is the superior choice.

Benefits of pound cost averaging

Whilst the data shows that lump-sum investing will lead to higher returns on average than pound cost averaging, that doesn’t mean PCA is without its benefits.

The big one as far as I’m concerned is that pound cost averaging encourages a great investing habit – investing consistently over time.

Whilst the primary goal when it comes to investing should always be to maximise returns and overall investment portfolio value, developing good investing habits and systems is a great first step.

The truth is, most of us end up pound cost averaging by default. Anyone who gets a monthly salary and immediately transfers a portion to their investment account will be earning the benefits of dollar-cost averaging as described above.

When done properly, pound cost averaging will involve investing the same amount of cash at the same time each month. This helps to avoid one of the most common investing mistakes – trying to time the market. The research is pretty clear on this; very few people can successfully time the market and those that say they can are usually trying to sell something.

The only caveat to this is that lump-sum investing takes this one step further. Not only does lump-sum investing avoid trying to ‘time the market’ it also embodies the wise investment advice of ‘time in the market trumps timing the market‘.

The emotional benefits of pound cost averaging

As alluded to above, pound cost averaging is a commonly used strategy amongst investors to defend against the emotional factors of investing.

The simple fact of the matter is that investing a significant sum of money as a one-off lump-sum feels a bit scary, whilst investing smaller amounts each month over time feels more comfortable.

When investing, it’s hard to tell whether the price you are paying is too much, about right or if you’re getting a bargain. As the name suggests, pound cost averaging allows investors to average out each of these scenarios and end up paying an average price.

Psychologically, paying an average price rather than a ‘too high’ price represents a win for investors but how much you pay for your investments isn’t what really matters, it’s how much your investments return for you and how much they are worth that is what’s important.

Investors need to review their tolerance for risk and their emotional capacity for coping with investment fluctuations. For those who can separate the emotional from the logical considerations, the best course of action when deciding how to invest a sum of money is to invest it all at once.

For those who think they may struggle with this, you can do a lot worse than pound cost averaging this money over time. At least you’d still be in the advantageous position of investing your money in our greatest wealth-building tool – the stock market.

Conclusion

Put simply, pound cost averaging is the process of staggering an investable amount into the market evenly over a period of time rather than investing money all at once as a lump sum. The strategy purports to smooth out the high and low purchase prices (volatility) of investments over time.

There are a number of benefits to this investment strategy. Not only does it promote strong investing habits like investing consistently over time, but it also helps investors mitigate the psychological impacts of big investment losses which can knock many amateur investors off course.

Despite this, the research seems to suggest that investing money as a lump sum on day one will provide superior returns, on average, than pound cost averaging.

Intuitively, this makes sense. My expectation of the market is that it will, on average, increase over time with fluctuations along the way. With that in mind, it makes complete sense that money in the market for longer will on average produce higher returns.

At the risk of sounding unsympathetic, my stance on this for new investors looking to mitigate the emotional impacts of losing money on investments with pound cost averaging is this – toughen up, accept that the stock market fluctuates (but always increases over time) and don’t sacrifice returns by pound cost averaging – just invest your money as a lump sum and benefit from increased time in the market.

As always, please remember I am an Accountant, but not your Accountant. In this post (and all of my others) I share information and oftentimes give anecdotes about what has worked well for me. However, I do not know your personal financial situation and so do not offer individual financial advice. If you are unsure of a particular financial subject, please hire a qualified financial advisor to guide you.

This article has been written by Luke Girling, ACA – a qualified Accountant and personal finance enthusiast in the UK. Please visit my ‘About‘ page for more information. To verify my ACA credentials – please search for my name at the ICAEW member finder. To get in touch with questions or ideas for future posts, please comment below or contact me here.