Investing £100 a month may sound way too much or far too little depending on your current financial situation. However, with a few tweaks, this amount should be manageable for the vast majority of us.

You should start investing £100 a month (at least) as soon as you have the financial means to do so. Investing monthly will allow you to protect your money from inflation, steadily build wealth and help you become financially independent much faster than you otherwise would.

What you should invest in (asset allocation) and the practical steps to start investing (platform/service choice) will be covered in detail in future blog posts, for now though, let’s get round to convincing you exactly why you should start investing £100 a month (at least) in order to secure a prosperous financial future.

Why you should start investing £100 a month as a minimum

Investing early and consistently is perhaps the best thing you can do to secure your financial future. Getting into the habit of saving a proportion of your income and spending it on your own future via investing is a major step in securing financial independence.

I have mentioned £100 a month as a target here as this should be an achievable amount for most people. Even if you don’t have any spare income left over at the end of each month, it shouldn’t be too difficult to shave £100 off of your expenses and invest this each month. Let’s look below at a few options that together could save you £100 a month:

- Drive your car less and walk more often to save on your fuel bill.

- Have fewer takeaway meals each month.

- Go on one or two fewer nights out per month to avoid expensive drinks bills.

- Shave money off of your grocery bill by buying fewer high price items.

- Cancel unused subscriptions to things like Audible or television streaming services.

Whilst you may not immediately like the idea of giving up these things in the short term, the long term benefits of becoming financially independent earlier and not having the obligation to work 5 days a week surely outweighs this.

The second major benefit of investing your money is to protect it from inflation. If you leave your money in a bank account, its actual value in terms of purchasing power is being eroded every year by inflation. Investing your money into a portfolio of investments helps protect against this risk.

Investing in stocks and shares within your investment portfolio is also a great way to diversify your income streams via dividends. For your personal finance, establishing a number of different income streams is a wise strategy, this makes you far less reliant on the income from your job which may be unreliable as many of us have found out during the recent COVID-19 pandemic.

When you invest in Company stocks and shares, you own a small part of each Company you are invested in, for example, Coca Cola. These companies will pay a dividend periodically (usually every quarter) which is a distribution of the Company’s earnings paid to investors (like you and me) as a reward for their investment.

As you invest more into stocks and shares, the greater the dividend income you will receive each period. For the greatest long term accumulation of wealth, it is best to reinvest this dividend income back into more units of Company shares.

Check out my post on the difference between accumulation (ACC) and income (INC) funds for more on this.

Should I invest more than £100 a month?

Previously on this blog, we have talked about the importance of building a surplus. A surplus is the difference between your income and your total expenses.

For example, if you earned £2,500 after tax and you had total expenses of £2,000, your surplus would be £500 each month. For most people, they see that extra £500 and their first thought is “what should I spend this extra money on?” and end up booking an expensive holiday, going to a fancy restaurant or visiting your favourite online shops.

If this were my situation, I’d invest the full £500 every month. The reason I’d do that is that I know I would value having the freedom associated with being financially independent much more than anything I would purchase that month that I probably didn’t need. That’s not to say never go to a restaurant or buy a pair of shoes, these should be accounted for within your £2,000 total expenses in the example above.

The point is this, investing £500 a month rather than £100 will get you to your goal net worth significantly faster. You can work out your target net worth by using the guidance in this article I wrote on the 4% rule. What would seem obvious is that by investing £500 rather than £100 a month, you would get to your target net worth 5* faster, but the reality is it will have an even larger impact than that due to the phenomenon of compounding.

The maths behind investing £100 a month

When you start investing, understanding how compounding works is going to be hugely important. You can invest in a number of different assets, whether that be Company stocks (small pieces of a company such as Coca Cola), bonds (where you loan a company or the government money in return for interest payments and your money back at the end) or even precious metals such as gold.

For the purposes of the below examples, I am going to assume your investments will return you, on average, 6% a year which is generally considered to be a reasonable, unspectacular return on investment (ROI) figure within investing.

Let’s say you invested £100 into a stocks and shares account and then left it for 5 years, what would happen?

| Year | Money invested by you | Total investment value | Returns at 6% a year ( e.g. £100 * 6%) | Cumulative total |

| 1 | £100 | £100 | £6 | £106 |

| 2 | £0 | £106 | £6.36 | £112.36 |

| 3 | £0 | £112.36 | £6.74 | £119.10 |

| 4 | £0 | £119.10 | £7.15 | £126.25 |

| 5 | £0 | £126.25 | £7.57 | £133.82 |

What should be clear from this table is two things:

- Your investment is now worth £133.82 despite you only putting in £100 to start with. You have made investment returns of £33.82 over a 5 year period .

- Each year, your returns are getting bigger (£6 in year 1, £6.36 in year 2 etc.) The reason for this is compounding, in year 2 you are making 6% on the £100 you initially invested but also 6% on the £6 you made in year 1 as shown below.

£100 * 6% = £6

£6 * 6% = £0.36

Total = £6.36.

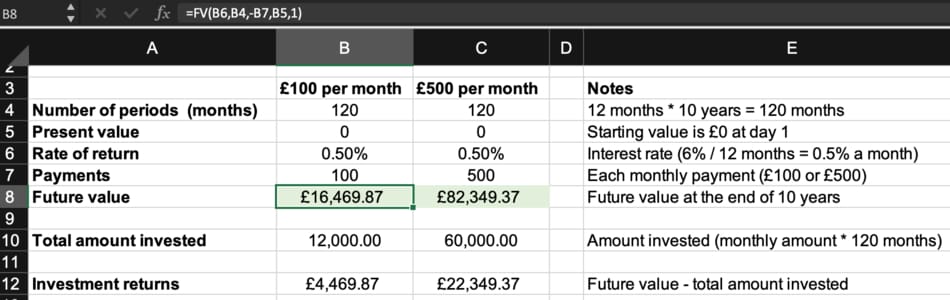

Returning to our example from above, investing £500 a month compared to £100 a month will have significant differences for your net worth. Let’s compare the total impact on your net worth of both situations after 10 years assuming you invest monthly and with average annual return of 6%.

As you can see, using excel’s future value function, investing £100 a month for 10 years will give you an ending investment value of £16,469.87, providing investment returns of £3,469.87.

Investing £500 a month for 10 years gives you an ending investment value of £82,349.37, providing investment returns of £22,349.37.

The amount of time you have money invested is also important, for example, let’s say you invest £50,000 on day 1 and then leave it for 40 years, you would have £514,285 at the end of the period assuming average returns of 6% a year – which shows the power of being in the market for a long time.

It’s important to note that the 6% returns are an average. In reality, the stock market doesn’t work this way and you will have certain years with significant 20+% returns and other years where you make a loss. On average, 6% a year is a reasonable return to expect with a portfolio geared towards equities (Company stocks and shares)

Cutting expenses in order to invest £100 a month.

In our example discussed above, we had an after-tax monthly income of £2,500 and expenses of £2,000 which left us with a surplus of £500. This isn’t a bad position to be in as we are investing 20% of our income which is far more than the average person. However, to become financially independent faster this percentage must be much greater.

Even without considering investment returns, if you saved half of your income each month and the other half went to expenses (£1,250 a month), that would mean for each year you worked, you would not have to work the year after.

Earned in a year: £2,500 * 12 = £30,000

Saved in a year: 50% * £30,000 = £15,000

Monthly expenses: £1,250

Months you could now afford not to work: £15,000 saved / £1,250 a month = 12 months.

I.e. you could cover your monthly expenses for the next 12 months with the money you saved without having to work in that period.

This was one of the most important lessons for me when I was first becoming interested in the concept of financial independence – if you save a high enough proportion of your income, you can dramatically reduce the amount of time you have to work in your ordinary job.

Going from £500 saved a month to £1,250 is a matter of cutting a significant proportion of your expenses. Whilst this level of saving may be too much for even the extremely frugal of you, the point is hopefully clear.

The importance of an emergency fund

An emergency fund is a pool of money you set aside and leave within a bank account which is reserved for unexpected emergency expenses. The amount required varies by person but you should have enough to cover at least one month’s expenses.

Whilst investing is critical to becoming financially independent, I would first advise you to build up this emergency fund within a cash bank account. Whilst this doesn’t provide the wealth-building benefits of investing, this will provide peace of mind in case you or your family ever run into a financial emergency like a broken down car, urgent house repairs or medical bills.

In 2019, CNBC reported here that 60% of Americans don’t have enough money to cover an unexpected $1000 dollar emergency expense. Whilst I would like to think the situation in the slightly less consumerist UK would be better, I imagine the results would be fairly similar.

If you don’t have an emergency fund of at least £1,000 in your bank account, this constitutes a financial emergency and you should put as much effort as you can into fixing it – even if it means living well below your means for a month or two. If, for example, your car broke down tomorrow and you had no way to get to work other than by having it fixed for £1,200, you would be forced to go down the disastrous route of payday loans with extortionate interest.

I personally keep an emergency fund of £5,000 which strikes a nice balance between being enough to cover a few months expenses should I need it and not so much that I am missing an opportunity to earn returns on this money within the stock market.

Conclusion

In simple terms, you should be investing as much as you are able to each month if you hope to become financially independent anytime soon. Investing your money provides major benefits including speeding up the wealth-building process, protecting your money from being eroded by inflation and diversifying your income streams so you are not so dependent on a corporate salary.

The maths of investing £100 is simple using the future value calculations shown above, the earlier and more often you invest, the more successful you will be in reaching your target net worth.

There is no upper limit to the amount you should save and invest and cutting frivolous expenses is a great way to increase your investable amount and buy years of freedom later down the line.

How much are you able to invest every month? Let me know in the comments below!

As always, please remember I am an Accountant, but not your Accountant. In this post (and all of my others) I share information and oftentimes give anecdotes about what has worked well for me. However, I do not know your personal financial situation and so do not offer individual financial advice. If you are unsure about a particular financial subject, please hire a qualified financial advisor to guide you.

This article has been written by Luke Girling, ACA – a qualified Accountant and personal finance enthusiast in the UK. Please visit my ‘About‘ page for more information. To get in touch with questions or ideas for future posts, please comment below or contact me here.