Using the Vanguard UK investor platform is a cheap, no-frills method of starting to invest your money. If you’re looking to start investing, read this post and not only will you learn all of the essential knowledge when it comes to passive index investing, I’ll also show you the practical steps to open a stocks and shares ISA on Vanguard so you can invest your first pound within half an hour of finishing this post.

A simple, low-cost way to start investing in the UK is to open a stocks and shares ISA on the Vanguard Investor UK platform. This platform is easy to set up, intuitive to use and offers access to dozens of low-cost Vanguard tracker funds which allows you to build your wealth passively over time.

Whenever I speak with friends or family who are yet to start investing, I am always met with a similar answer which sounds something along the lines of “I want to, I just don’t really know how to get started”. Many people will likely relate to this response, but if this is you, it is actually a bit of an emergency as you’re missing out on years of being able to grow your money through the phenomenon of ‘compounding returns’.

Luckily, you can respond to this emergency today by reading this post for the next 15-20 minutes of your life and then implementing the steps within the Vanguard investor UK platform for 30 minutes after that. A total of less than an hour of your life for what history tells us will result in a huge increase in wealth. Sound like a good deal? Let’s get started.

Why should I invest my money?

When it comes to becoming financially independent, we would all struggle if it weren’t for the transformative benefits of investing our money. Whilst a cash account is safe, secure and familiar – the sad truth is that due to the erosive powers of inflation, leaving money in cash is actually losing you wealth each year as the money you have saved progressively loses its purchasing power.

The natural alternative is to invest your money and this can come in many different forms, whether it be equities (Company shares), bonds, property, commodities or other more fancy financial contracts such as options.

For me, I want to invest my money in things I understand, take up almost none of my time and have a proven track record of growing in value. Specifically, I invest in Company shares (equities) and bonds. Due to being both relatively young and having a high-risk tolerance, the majority of my portfolio is in equities which has higher risk and higher expected higher returns.

If you’re not currently investing your money, I suggest you start with my recent post ‘Start investing £100 a month to secure your financial future‘ before coming back to read the rest of this post.

There are three main accounts in which we can start to invest our money:

a) Your pension (either workplace or private) will typically be invested in a specific pension-focused fund which gradually increases the proportion of investments in bonds as the investor progresses towards retirement age.

b) In a standard investing account that is available at investment providers (also referred to throughout this post as “platforms”). These accounts don’t tend to offer tax benefits.

c) Stocks and shares ISAs as covered below.

What is a stocks and shares ISA?

An ISA is an individual savings account. A stocks and shares ISA is a tax-efficient investment account that allows you to invest up to £20,000 per year into various products (e.g. Company shares, investment funds, bonds etc) without the possibility of being taxed on your investment gains.

It’s important to note that unlike a cash ISA, in an investment account, your money can go down as well as up. For example, let’s say in your stocks and shares ISA you only invested in one Company – Company X. If you invested £100 into your account and each share of Company X is valued at £5 per share, that means you have purchased 20 shares.

If the worst were to happen and Company X was involved in a public scandal, the valuation of their shares may fall from £5 per share down to £2.50 per share. Clearly, this would have a negative impact on the valuation of your investments as your account would now only be worth £50 (20 shares * £2.50 per share).

It’s important to note, at this point you wouldn’t have technically lost any money – whilst your shares are now valued at less than they were yesterday, your “loss” is not locked in until you actually sell those 20 shares. Who’s to say that a month from now those shares aren’t valued at £10 per share and you have made money?

You may have heard the common investing expression ‘buy low, sell high’ and this is what’s meant by that. If you bought at £5 per share and sold at £2.50 per share, you would have this completely the wrong way round.

To avoid this problem completely, a beginner should never invest in a single company but rather invest passively into a well-diversified portfolio i.e. into lots of different companies across various countries and industries.

Sound complicated? It isn’t. Once you’re set-up, all you need to do is make sure your monthly direct debit goes through and all of your investing will be taken care of for you within the platform.

What is passive investing?

The first thing to understand is that there are two broad strategies when it comes to investing; active and passive.

Active investing refers to a strategy whereby investors give an investment manager their money in order to make specific investments on their behalf with the goal of outperforming an investment benchmark index or target return. Due to the cost of this management and the technology and resources they deploy, active management tends to be more expensive.

Passive management is an investing strategy that simply tracks an index e.g. the FTSE 100 (the largest 100 Companies in the UK). Passive management is most common on the equity market through ‘index funds’ which simply track the performance of an index without trying to ‘outperform’ anything which history tells us is a very difficult thing to do.

For example, you may choose to invest in an S&P 500 fund that simply tracks the largest 500 companies in the United States which includes the likes of Microsoft, Facebook and Apple. This would mean as the value of these companies grew, so would your investment.

Passive investing is also known as a buy and hold (or “set and forget“) strategy whereby investments are bought and then held for the long-term with minimal trading. Passive investing is cheaper (due to lower fund management fees), less complex and on average produces superior returns to actively managed investments over the long term. These three factors make it the ideal choice for most individual investors.

Don’t just take my word for it – investing titan Warren Buffett (net worth $69 billion) told shareholders of his Company Berkshire Hathaway “My regular recommendation has been a low-cost S&P 500 index fund”.

Isn’t investing in stocks and shares risky?

Investing in Company stocks can be seen as risky as your returns aren’t guaranteed and you could get back less than you initially invested. Having said that, numerous studies (including this Barclays study) have shown that historically, holding your money in stocks outperforms cash in the vast majority of cases.

It’s also worth noting that whilst you can’t lose money in a cash account, over time it becomes less valuable due to inflation.

For example, let’s say you had £100 in a bank account and a box of Frosties cereal cost £2 each, you would be able to buy 50 boxes today. 20 years later, you will still have £100 in the bank (maybe slightly more due to the tiny bank account interest rates) but due to inflation Frosties cost £4 per box. Now you can only buy 25 boxes. As you can see, whilst you haven’t lost money, the money you do have loses purchasing power.

Investing your money is a commonly used method to protect yourself from this as your average investment returns exceed the inflation rate each year.

Generally speaking, people seem to overstate how risky it is to invest in stocks and shares due to the horror stories they hear on the news. The truth is, if you invest in a low cost, well-diversified portfolio investing in stocks and shares isn’t particularly risky at all given you are investing in the most established companies in the world.

Looking at our example of the S&P 500 above, the annualised average return over the past 90 years is 9.8% (Source here) which includes periods of time that were historically bad for stocks such as the 2008 financial crash in which the SP500 lost 37% in the year. This should tell us that even though the stock market may fluctuate up and down (sometimes dramatically), if investors stick to the buy-and-hold strategy over the long term, their wealth will grow year on year if the historical returns are anything to go by.

If you use Vanguard to invest in the stock market, your investments are covered up to £85,000 by the Financial Services Compensation Scheme should the platform become insolvent. Given Vanguard is one of the biggest names in investing, this scenario isn’t something I personally worry about but for other less established platforms, this may be a genuine concern.

What is Vanguard and why is this platform a great choice to get started with?

The Vanguard Group is an American investment company with over $6 trillion assets under management and is the largest provider of mutual funds in the world. The Company was founded by John Bogle in 1975 and is best known for its philosophy of low-cost, index-tracking investing.

What’s interesting is that Vanguard offers both individual index-funds such as the hugely popular Vanguard Lifestrategy funds and has its own platform which allows investors to sign-up and invest in Vanguard products whilst paying low fees.

Up until recently, if UK investors such as you and I wanted to invest in Vanguard products, we would have to invest through a 3rd party broker or fund platform such as Hargreaves Lansdown. However, as of 2017, Vanguard launched its UK platform called ‘Vanguard Investor’ which allows investors to purchase Vanguard products through its own platform at notably low platform fees.

For many first-time investors in the UK, the Vanguard platform is considered a great place to get started with the main benefits being:

Low cost

Vanguard charges an annual platform fee of 0.15% of assets (capped at £375 for portfolios over £250,000) which is significantly lower than some other popular platforms in the UK such as Hargreaves Lansdown (0.45%) or Charles Stanley Direct (0.35%).

Take a look at the below table to see the impact this would have on your investments if you had £10,000 in your account on each of these platforms.

| Platform | Vanguard Investor | Hargreaves Lansdown | Charles Stanley Direct |

| Amount in account | £10,000 | £10,000 | £10,000 |

| Annual fee % | 0.15% | 0.45% | 0.35% |

| Annual platform fee £ | £15 | £45 | £35 |

In each case, the platform fee isn’t a ridiculous amount of money and is well worth the service offered but both of these competitors are more than twice as expensive as using Vanguard. The more you invest, the more money you are potentially wasting on fees.

It’s worth noting there are a couple of platforms out there that are cheaper than Vanguard in certain situations such as Iweb which charges £5 per share. So for our example above, if you invested all £10,000 in one go, this would cost you only £5 on Iweb which is cheaper than Vanguard. However, many people choose to invest a set amount each month, so this would cost you £60 on Iweb (£5 fee * 12 months) which would make it the most expensive of the above options.

As well as a platform fee, investors have to pay an ongoing charge for the specific funds they are invested into. Vanguard offers access to a wide array of cheap funds with the cheapest fund offering an ongoing charge of just 0.06% of assets or £6 on a £10,000 investment.

Simplicity and ease of use

Unlike some platforms which are convoluted and difficult to use, Vanguard investor is user-friendly and simple. If you’re the type of person who can see yourself getting overwhelmed or confused when it comes to investing, Vanguard investor is probably a good option simply due to how easy it is to set up and operate.

The practical steps to setting up a Vanguard account

So let’s talk about how we actually start investing using Vanguard. The goal here is to set up a stocks and shares ISA within the Vanguard platform and to start investing a bit of money each month.

The first step is to go to Vanguardinvestor.co.uk and in the top right corner you will find the option ‘Open an account’ and then follow the below steps:

- Click the ‘open an account’ button

- Get your national insurance card and have your bank details handy*

- Press the ‘start my application’ button.

- A number of options will appear including Vanguard stocks & shares ISA, Vanguard junior ISA etc – select ‘open an account’ under the ‘Vanguard stocks and shares ISA’ heading.

- Read the ‘important information’ details and then tick the box at the bottom of the page and press ‘proceed’.

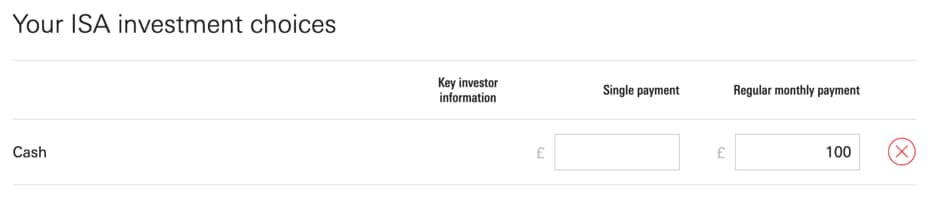

- Next you will be given a lot of options about where to invest your money. For the time being, scroll to ‘cash’ and put £100 in the ‘regular monthly payment box’ which is the minimum amount you can select at this stage. (Don’t worry if you want to contribute less than this, we can always cancel this once the account has been set up)

- Fill in your personal details including national insurance number and current address.

- Set up a secure username and password following the prompts and add your mobile number for account security.

- Add your bank account details to set up the monthly direct debit of £100 a month from step 6. Again, we can cancel this once the account is set up if required.

- Follow the remaining prompts through to complete the account set-up.

‘* The national insurance card is to put in your national insurance number as a personal identifier. This can often be found on your Company payslip if that’s easier. The debit card is so that you can transfer cash into your Vanguard account to start investing.

To cancel the monthly contribution of £100 from step 6, simply navigate to ‘payments’ in the left-hand menu and cancel the recurring payment you had previously set up. You can then invest whatever value you’re comfortable with either on a one-off or monthly direct debit basis.

To access your account from this point onwards, simply visit the Vanguard investor webpage and enter your username and password as set up above.

How much should I invest each month?

This is dependent on your individual situation but generally speaking, it is a good idea to invest an affordable amount each month via direct debit.

For example, if you’re paid at the end of each month, you could set up a direct debit from your bank account to your new Vanguard account a couple of days after to ensure you are investing at least a small amount consistently.

To do this within Vanguard, simply go to the ‘payments’ option within the left-hand menu and then click ‘+ new regular’ and select the day and month you wish your direct debit to start on (a few days after payday may be a good choice).

You will then be asked how you would like to invest this money within your ISA which is discussed in the next section.

Which funds should I invest into within Vanguard?

When selecting what to invest into within your Vanguard stocks & shares ISA, you will be given the following choices: Blended funds, equity funds, fixed-income funds or cash. Taking each of these in turn:

- Cash – you are simply transferring money from your bank account to your Vanguard account. You will not earn any interest on cash in your Vanguard account and the only reason you would do this is to have cash available to invest into other funds at a later date or to leave a nominal amount of cash in your account (say £20) to cover future account fees.

- Equity funds – a fund that invests solely in Company shares. Vanguard will give you various options which allows you to invest across different geographies or industries.

- Fixed-income funds – a fund that invests solely in either Government or Company bonds. I.e. You give the government or a Company a sum of money for a fixed period of time and in return they will give interest payments each month before returning your money to you at the end of the period. The interest payments are to compensate you for the risk of lending your money.

- Blended funds – a combination of #2 and #3 above. Generally speaking, funds with a higher proportion of equities are seen as more risky (but with higher returns on average) whilst a fund with a higher proportion of bonds is safer but will generally attract lower returns.

What you choose to invest in depends entirely on your age, risk profile and personal preference. I would recommend doing some research before deciding. For me, I invest in either #2 equity funds or #4 blended funds with a high proportion of equities. I choose equity heavy investments as I am relatively young and am willing to accept some risk in order to earn returns. For someone approaching retirement or who has a low-risk tolerance – a fixed-income fund or a blended fund heavy on bonds may be the more suitable choice.

For an investing beginner, Vanguard’s Life Strategy range is advertised as a good starting point. You will see Lifestrategy 20, LifeStrategy 40, LifeStrategy 60 etc all the way up to LifeStrategy 100 where the number represents the proportion of the fund invested into equities. I.e. LifeStrategy 60 is invested 60% into equity funds and 40% into fixed-income funds as shown below.

The 0.22% that can be seen refers to the ongoing charge of being invested into this fund. As well as the 0.15% platform fee discussed above, there is a further charge of 0.22% for being invested into this particular fund.

Taking our earlier example of £10,000 invested, that would give you the below total fees for the year assuming that £10,000 was invested for a full year.

| Platform | Vanguard investor |

| Amount invested | £10,000 |

| Platform fee (0.15%) | £15 |

| Fund fee – LifeStrategy 60 (0.22%) | £22 |

| Total fee | £37 |

As should be clear, paying a total of £37 on £10,000 of invested capital for the ability to use the Vanguard platform and invest into a fund of carefully selected equities and bonds which is periodically rebalanced for you is very good value.

It’s also worth noting, there are other funds on Vanguards that are cheaper than the 0.22% shown above. For example, S&P 500 UCITS ETF which tracks the S&P 500 index has an ongoing charge of 0.07%. This is one of the funds I am invested in within Vanguard simply due to the very low cost and reliability of the SP500 index over time. For me, being invested in the 500 biggest companies in the US (including the likes of Microsoft, Apple and Google) doesn’t feel particularly risky but that is a choice each individual will need to make.

Are there any downsides to using Vanguard?

Since starting to use Vanguard last year, I only have had two minor problems with the Vanguard platform.

- Unlike some other fund providers, Vanguard investor does not currently offer an App. For me, it would be nice to check on my investments on my phone but this may actually be a blessing in disguise as it means I look at my investments less often and can truly stick to a passive strategy of investing each month and leaving for the long-term.

- You can only invest in Vanguard products. On other fund providers, you can invest in 3rd party products. For example, I used to use Charles Stanley Direct as my platform which allowed me to invest into a Blackrock mutual fund. However, with Vanguard, I wouldn’t be able to invest into this fund even if it was a personal favourite of mine. Having said that, due to the wide array of strong, low cost funds offered by Vanguard, this is not a particularly big issue.

Some alternative choices to using the Vanguard platform

A couple of other providers have been mentioned above; Charles Stanley Direct and Hargreaves Lansdown. I have used both of these in the past and they are both very solid platforms. The primary reason I switched to Vanguard was the low fees and the simplicity of the website.

Some people who feel under-confident in taking a do-it-yourself approach to investing prefer to use services like Nutmeg which invests on your behalf based on your risk preferences which you layout at the start. I haven’t used this service myself but have heard positive reviews from a few friends who have. It’s worth noting though, investing this way is more expensive than using Vanguard with total charges being between 0.75% and 1% depending on which specific options you take compared to 0.37% with Vanguard using a LifeStrategy fund as shown above.

Some motivation to get started

When it comes to investing, it sounds a lot more complicated than it is. Once you have set up your Vanguard account which should take as little as 15 minutes, investing can simply be boiled down to transferring a monthly amount from your bank into a low-cost, index fund of your choice that matches your risk appetite and leaving it to grow over the long-term.

Whilst I can’t tell you what returns your investments will return (nor can anybody else), I am confident in my prediction that by investing my money into equities within Vanguard, I will build my wealth to a far greater level than would have been possible had I left my money in cash.

Start today and your future self will thank you.

Conclusion

Investing your money is a crucial component in building long-term wealth. One of the avenues available to UK investors is to invest up to £20,000 per year into a stocks & shares ISA without being subject to tax charges.

As of 2017, Vanguard has bought out a highly competitive UK based platform that can boast low platform fees (0.15% of assets) and low ongoing charges for funds (as low as 0.06% on the cheapest fund) as well as an intuitive, simple to use website.

What to invest in and how much to invest are personal choices specific to each investor’s personality, risk appetite and personal financial situation. A strategy that involves investing a consistent monthly amount into one of Vanguard’s LifeStrategy range (selecting whichever proportion of equities that best matches the appetite for risk) is a reliable starting point for most investors and what the Vanguard platform appears to recommend.

As always, please remember I am an Accountant, but not your Accountant. In this post (and all of my others) I share information and oftentimes give anecdotes about what has worked well for me. However, I do not know your personal financial situation and so do not offer individual financial advice. If you are unsure on a particular financial subject, please hire a qualified financial advisor to guide you.

This article has been written by Luke Girling, ACA – a qualified Accountant and personal finance enthusiast in the UK. Please visit my ‘About‘ page for more information. To verify my ACA credentials – please search for my name at the ICAEW member finder. To get in touch with questions or ideas for future posts, please comment below or contact me here.

Hi

Are you able to invest in both a blended fund and an index tracker within one year’s ISA allowance on vanguard.

Or do you split this over different years. Ie life strategy vs S&P 500

Many thanks

Hi Caroline – you can invest in both in one year’s ISA allowance as long as it’s less than the allowance in total. I.e. you could do 10k in an index tracker and 10k in a blended fund if you wanted to.

Thanks so much, this was really helpful in gaining a holistic understanding of investing!