Index funds are a popular starting point for those beginning to invest their money in the stock market but there are a lot of misconceptions about what an index fund is and the risks of being invested in one.

It is possible to lose money in an index fund. If you buy units of an index fund and the value of those units goes down (as the stock price of the underlying investments decreases), your investment value will decrease. This ‘loss’ is only locked in if you decide to sell your units at this point.

If you are considering investing in an index fund and are wondering whether they are a safe bet or not, read on for the rest of this post (estimated reading time: 10 minutes) to find out more.

Can you lose money in an index fund?

It is possible to lose money in an index fund and many investors do end up losing money in this investment type as they panic and sell their units during market lows.

For example, if a new investor were to buy 100 units of an index fund for £500, it would mean each unit is valued at £5 which reflects the value of all of the individual stock prices of the companies held within that fund.

If there was then a period of economic upheaval, and the index funds units fell from £5 per unit to £4 per unit, the investor’s pot would now only be £400.

Clearly in this case the investor’s value has fallen by £100 but at this point, this is what is known as an ‘unrealised loss’. I.e. the valuation may have fallen by £100, but who’s to say that tomorrow those same 100 units are not worth £500 again?

The investor would have only truly lost money if they had decided to sell whilst their investment was worth £400 and therefore locked in a loss of £100. I.e. £500 initial investment – £400 closing investment = £100 loss.

This is a common mistake that beginner investors make, they see their investment values falling, get worried and sell to avoid their valuation decreasing further.

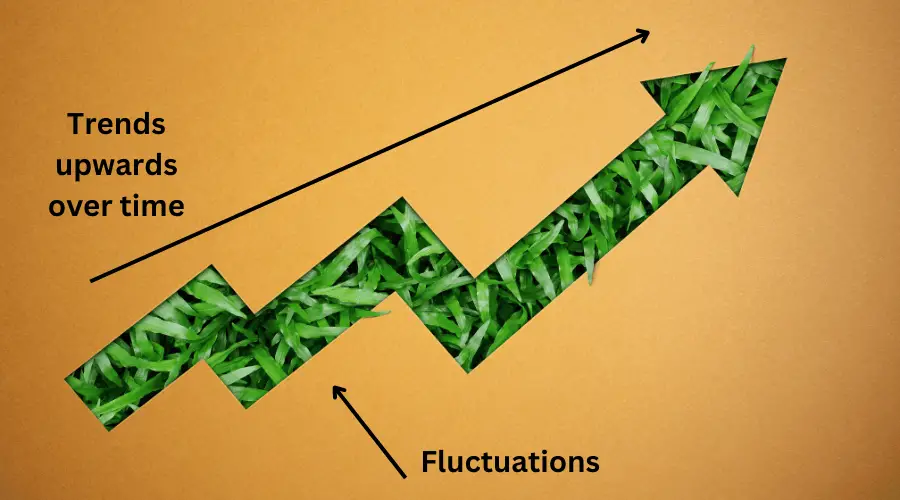

Whilst this point of view is understandable, it’s almost always a mistake. The stock market in its entirety tends to always go up over a long enough time period. So even though there may be upwards and downward fluctuations along the way, the trend is positive as shown below.

It’s important to note that whilst this rule of thumb has held true for the stock market as a whole historically, certain individual stock prices of Companies don’t follow the same pattern – some go to zero, some go to incredible highs.

The lesson here is to understand that index funds will go up and down and to avoid panicking during low periods and selling your units. In fact, the better course of action is to buy more units during periods of low valuations as the units will be cheaper at this point in time, so your money can purchase more units of the fund and therefore more individual slices of companies.

What is an index fund?

If you’ve read the above section and find yourself confused, let’s take a quick step back to discuss what exactly an index fund actually is.

Index fund investing is thought of as a passive investment strategy whereby an individual invests in investment funds (a product which purchases numerous securities such as company shares or bonds) which track against a predetermined index such as the S&P 500 or the FTSE 100.

This strategy is deemed passive as all you need to do is periodically contribute money to this fund and leave it for the long term to grow. An active investment strategy, by comparison, would be where you are paying higher fees for a fund manager to attempt to beat the market or the chosen benchmark.

A passive fund doesn’t need to beat the market, it just tracks it as accurately as possible based on the logic that the chosen index has historically risen over time. For example, the S&P 500 index has increased by 9.8% per year on average since 1927 (check the yearly stats here)

This investment type is particularly suitable for beginner investors due to its simplicity, all you need to do is the below:

- Set up an account on a popular investing platform like Vanguard or Hargreaves Lansdown

- Invest some money into an index fund tracking an index like the S&P500 or a global equities tracker

- Set up a direct debit to invest whatever amount you can afford each month

- Periodically check on your investments

For guidance on this process, click on the below link to read my post on getting started with investing using the excellent Vanguard platform:

Is an index fund a ‘safe bet’?

Investing in stocks has some inherent risks which can’t be avoided. In a recession, stock prices across the board may decline and the valuation of an index fund would then follow suit, so there is always a risk.

It’s also worth noting that equities (i.e. company stocks) are a riskier asset class with greater volatility (fluctuations in value) than other asset classes like property or bonds.

However, as a rule of thumb, the greater the risk, the greater the expected reward as the investment rewards the investor for the greater risk taken on.

Investing in an index fund is a far safer bet than investing in individual stocks due to diversification. In an index fund, you will be holding small slices of hundreds of companies, so if one of them tanks, it only impacts a small proportion of your portfolio.

However, if you only invest in a few individual stocks and one of those tanks, it would impact a large percentage of your invested money.

An index fund is also seemingly a safer bet than an actively managed fund (i.e. a fund whereby a fund manager attempts to beat a given index by picking investments he thinks will provide returns in excess of the index itself).

The problem with funds like these is two-fold. Firstly, on average, these funds fail to beat the market so the index fund tends to produce better returns and secondly, these actively managed funds involve far greater fees than index funds which eat into the investor’s returns.

Some of you may think, wouldn’t it just be safest to hold my money in cash? Obviously, cash, even in a savings account, has pretty low returns but due to the erosive power of inflation, keeping all of your money in cash is quite risky in itself as the value of this cash declines over time in terms of your purchasing power.

What are the advantages of investing in an index fund?

The advantages of investing in an index fund are:

- It’s easy to set up and invest in over time

- It is an easy investment to understand (unlike say cryptocurrency or derivatives)

- It involves being invested in the stock market which is the best way of building wealth over time

- It benefits from compound interest which I wrote about extensively here.

- Index funds have low fees as they are simply tracking an index, not doing work to try and beat the index.

- They are well diversified across many different companies which reduces risk.

- Historically reliable returns

- Exposure to the broad market and all industries

What are the disadvantages of investing in an index fund?

The disadvantages of investing in an index fund are:

- It will take a long time to truly get rich from investing solely in index funds

- You have no control over what you’re invested in i.e. you may be invested in a Company that you don’t like or are morally opposed to.

- They can’t react to market changes quickly as an actively managed fund could.

- It’s out of your hands, so you learn less about investing and the stock market.

- Difficulty knowing which index to track for optimal returns

- Limit to upside potential (whilst index funds outperform actively managed funds on average, some actively managed investments far outperform the index)

Where can I invest in an index fund in the UK?

Investing in index funds in the UK is simple and will just require an account on a reputable investment platform in the UK. I have linked some good examples below and my article comparing five of the better investment platforms available in the UK.

Options: (click on the hyperlink to visit the platform’s website and follow the sign-up instructions)

1. Vanguard

The below article compares five good investment platforms:

Can you beat the returns of an index fund?

It is completely possible to beat the returns of an index fund and it’s actually a mathematical fact that some people must beat the index.

Stock market investing is player vs player i.e. for one person to win, another has to lose. To extend this, to arrive at the average index fund returns, some companies will have had to of done better than the index whilst others will have had to of done worse.

So whilst it is guaranteed that some people will beat the returns of an index fund, this is far easier said than done and many professional investors fail to beat this target.

With this in mind, most novice or retail investors like you or I can probably assume that over time, we too would struggle to reliably beat the returns of an investment fund.

Can you lose everything in an index fund?

Whilst possible, it is not realistic that you will lose all of the money you invest in an index fund.

If you invest in a single stock and that Company goes bankrupt and liquidates, you may lose all your money. With an index fund, you are invested in hundreds of companies so this risk is very remote.

An index fund could decrease in value dramatically during a recession or global event, but even then, you would still hold the units in the fund which represent ownership in many different businesses. Once the recession passes, many businesses will return to previous highs and your investment value will go back up.

Another remote risk is that platform you are investing through goes bust but with reputable companies like Vanguard or Hargreaves Lansdown, this is very improbable and even in the worst-case scenario, you will get up to £85,000 back from the FSCF so not all of our money would be lost.

Overall, it’s extremely unlikely you will lose all your money in an index fund and the risks should be considered similar to the risk of losing all your money in a bank account.

As always, please remember I am an Accountant, but not your Accountant. In this post (and all of my others) I share information and frequently give anecdotes about what has worked well for me. However, I do not know your personal financial situation and so do not offer individual financial advice. If you are unsure of a particular financial subject, please hire a qualified financial advisor to guide you.

This article has been written by Luke Girling, ACA – a qualified Accountant and personal finance enthusiast in the UK. Please visit my ‘About‘ page for more information. To verify my ACA credentials – please search for my name at the ICAEW member finder. To get in touch with questions or ideas for future posts, please comment below or contact me here.