Making use of the hourly salary calculator laid out below can be a significant moment in understanding your personal financial situation. Once you know how much your time is worth to your employer by the hour, you have the information you need to make all of the important financial decisions in your life.

To work out your hourly salary, simply divide your annual salary by 1,820. E.g. an annual salary of £50,000 would give you £27.47 per hour. This assumes a working week of 35 hours. If you don’t work 35 hours a week, divide your annual salary by 52 weeks multiplied by your average weekly hours.

To understand the simple maths behind this, how this information can help you achieve your financial goals and for an easy to use table showing hourly salary by different salary levels, read on below.

Using the hourly salary calculator to work out what you earn each hour

Most salaried workers in the UK are on a typical 35 hour per week contract, i.e. the 9-5 with an hour for lunch routine we’re all familiar with. If this is the case for you, working out your hourly salary is simple – just divide your annual salary by 1,820.

The 1,820 is simply the number of weeks in the year (52) multiplied by the number of hours worked per week (35). 52*35 = 1,820.

For example, let’s say you earn a gross salary of £32,000 per year and work an average of 35 hours per week, your hourly rate is £32,000 divided by 1,820 = £17.58 per hour. This number can often come as a bit of a surprise to people, particularly when you realise that the minimum wage in the UK is £8.72 per hour.

It’s important to use the average number of hours you work in a week rather than simply what you are contracted to work. In my previous job as an auditor for example, I was contracted to 35 hours per week but averaged closer to 50 hours per week over my audit career.

A first-year auditor in a Big 4 firm in London could expect to earn £27,500 in their first year so the number of hours you work per week can make a significant difference as shown below.

35 hour week – £27,500 / (52 * 35) = £15.11 per hour.

50 hour week – £27,500 / (52 * 50) = £10.58 per hour.

As you can see, working long hours can have an incredible impact on your hourly rate and somewhat shockingly, in a reputable professional services firm, the hourly income is only marginally better than minimum wage when working 50 hours plus a week.

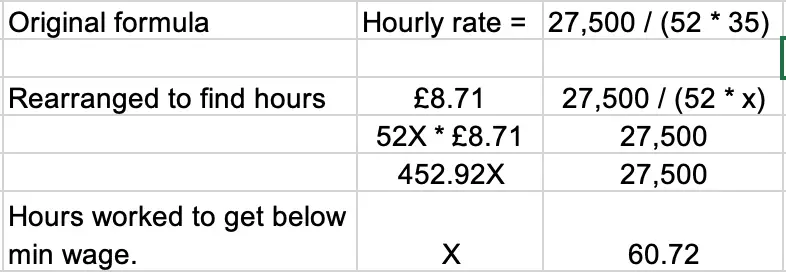

Taking this point further, if I were to reverse our hourly salary calculator formula from above, a 1st-year auditor working 61 hours a week or above, is earning less than the minimum wage of £8.72 an hour on an hourly basis (and this does happen, particularly within the financial services arms of these firms) – the maths is shown below for those interested with X being the hours worked.

Hopefully how to calculate your hourly gross salary and why it’s important should be clear by now, so let’s move on to how this information can help you achieve financial independence.

How the hourly salary calculator can help you become financially independent

Financial independence can be defined as the point in your life when the passive income your investments (stocks, bonds, real estate, business ventures) earn you exceeds your living costs. To achieve this, you need to amass a level of wealth that provides you with this annual income.

For those interested in the simple maths behind financial independence, click on the following link to have a read of my post on the 4% rule which can help you calculate how much money you’ll need to retire.

To achieve this level of wealth as quickly as possible, you need to increase your income surplus (total income minus total expenses) and wisely invest the difference.

This is where your hourly rate comes in – to maximise your income and therefore increase your surplus, you can either set out to earn as much money from your formal job as possible (high annual salary, a high number of hours worked) or you can diversify your income streams and earn from a number of different places. Which route you choose is largely dependent on your career choice.

For ideas on how to maximise your income in your current role, spare five minutes reading my post on How to get promoted quickly. The post is tailored to those working in accounting and finance but the tips are pretty universal.

For example, as part of a Lawyer’s career, they may have to work 60 hours per week and will have little time to spare to earn other income. However, a part-time photography Teacher may be better suited to the second route, i.e. earn your Teacher’s salary and set up side projects such as private photography tuition or an online photography course in the other available hours of the week.

In both cases, once you have determined the maximum number of hours you are willing to work in any given week, you then need to work towards maximising your hourly salary.

As discussed above, the first practical application of this is deciding between jobs. A key point in most job searches is the salary but just as important is the number of hours you can expect to be working. I’d recommend researching this point on job review sites like Glassdoor and trying to get a sense of it in interviews before accepting any job.

Calculating your hourly salary can also be important in knowing which menial tasks to do yourself and which to outsource. For example, let’s say you work as a freelance writer and due to the quality of your writing you can command £20 an hour and get work whenever you please on any of the big freelance writing sites.

Let’s say you realise you need to clean your car and estimate that to do it properly, it will take about 1 hour. Most people would do it themselves rather than spend £15 at the car wash and be proud of themselves £15 they have just saved.

But the thing is, you haven’t, cleaning the car yourself has actually cost you £5 because if you had outsourced this task, you could have worked that hour and earned £20.

Do it yourself: No income, no expenses (£0 net result)

Outsource: £20 income working for the hour you saved, £15 car wash expense (£5 gain net result)

Once you know your hourly rate, you can assess all tasks in your life this way and determine whether doing them or outsourcing them is the better financial choice. Clearly, for a typical job with an annual salary, things aren’t quite as clear-cut as this, but the general point stands that you should weigh up paying for tasks vs your own hourly rate.

Hourly salary by income

| 20 hours pw | 35 hours pw | 40 hours pw | 50 hours pw | 60 hours pw | |

| 20k a year | £19.23 | £10.99 | £9.62 | £7.69 | £6.41 |

| 30k a year | £28.85 | £16.48 | £14.42 | £11.54 | £9.62 |

| 50k a year | £48.08 | £27.47 | £24.04 | £19.23 | £16.03 |

| 75k a year | £72.12 | £41.21 | £36.06 | £28.85 | £24.04 |

| 100k a year | £96.15 | £54.95 | £48.04 | £38.46 | £32.05 |

| 200k a year | £192.31 | £109.89 | £96.15 | £76.92 | £64.10 |

Some of the scenarios presented above aren’t particularly realistic (I’m sure most of us would take 200k per year for 20 hours of work a week!) but hopefully what this table is showing is the relationship between annual salary and hours worked per week.

For example, let’s say you had 2 friends of the same age, Clara and Tim who are both similarly educated and career-driven.

Tim has got a new job as an Investment Banker earning £75k per year and Clara has accepted a role working in market research earning £50k per year. Your initial reaction may be that Tim has got the better deal here and it certainly seems that way as he earns 50% more than Clara does on a gross basis.

However, what about if you learnt that Tim’s banking job would involve 60 hours of work per week whilst Clara’s market research would involve 40 hours per week. As the table above shows, both of your friends are earning the same wage per hour (£24.04).

Neither route is ‘the right way’ – Tim may be happy to exchange more of his time for a larger overall salary whilst Clara is happy earning the same strong hourly rate whilst also having sufficient time to pursue other hobbies or side businesses.

What may also be a helpful exercise is to calculate your net worth in order to see exactly how much all of your investments and assets are worth at a single point in time. The easiest way to do this is to follow the steps I’ve laid out in my post on How to calculate your net worth on Excel or Google Sheets.

Conclusion

To summarise, you can calculate your hourly rate by using the below formula:

= annual salary (£) / (52 weeks * average hours worked per week)

For those who work a classic 9-5 job, simply divide your annual salary by 1,820 to work out your hourly rate.

To include the impact of holiday days, simply remove the number of weeks of holiday you receive from the 52 weeks in the above formula. I.e. if you have 5 weeks holiday, the formula would change to annual salary / (47 weeks * average hours worked per week)

This formula doesn’t include the impact of things like tax, national insurance or pensions contributions and if that detail is something you’re interested in – there are plenty of useful interactive calculators, like the one linked here: https://www.thesalarycalculator.co.uk/hourly.php

For our purposes, knowing and understanding your gross hourly rate allows you to make better decisions for your financial future including which tasks you should outsource, which job gives you the best combination of hours vs total salary and how to understand your worth.

As ever, nothing in this article constitutes an individual or person financial advice.

This article has been written by Luke Girling, ACA – a qualified Accountant and personal finance enthusiast in the UK. Please visit my ‘About‘ page for more information. To get in touch with questions or ideas for future posts, please comment below or contact me here.