Becoming financially independent in 10 years is a difficult but exciting goal for many people. 10 years of consistent work towards this goal could allow you to be financially free for the rest of your life insofar as you could work or otherwise spend your time as you please without worrying about how to meet your financial obligations such as your mortgage, food and bills.

The maths behind becoming financially independent in 10 years is simple; maximise your surplus (income minus expenses), invest the difference wisely, avoid significant financial mistakes and wait until your investments reach a number whereby the annual investment returns cover your yearly expenses.

More than perhaps any of my other blog posts, this one is what this website is all about. Achieving financial independence in as shorter time as possible is the goal I am working towards and also what I hope to assist readers of this blog with if they share the goal. As mentioned above, the maths is simple but what’s difficult is the consistency, good decisions and daily commitment to maximising your surplus which makes this possible.

How to become financially independent in 10 years

Let’s first start with defining what ‘financial independence’ is. Whilst this definition varies depending on who you ask, I think of financial independence as the point in your life when your annual passive income exceeds your annual living expenses and you are no longer required to work (although you may choose too) in order to maintain your quality of life.

This is a huge moment in the lives of most people as it allows you to spend your time on what you choose (whether that be work, leisure, relaxing etc) rather than what you are obligated to do (work) in order to cover your expenses.

For the purposes of this post, I have shown how to achieve financial independence in 10 years as this time period is short enough to be exciting and difficult to achieve. Clearly, whether this is possible for you is dependent on your current financial situation in terms of a) current net-worth b) current salary you can command and c) current level of expenses.

If, for example, you are 18 with a negligible current net-worth and earning a salary below £25k per year, becoming financially independent in 10 years is going to be extremely unlikely unless you manage to drastically increase your income in that time period (which is doable).

The main assumptions I have used in this post are a 10% annual return on investments and a goal to become financially independent after 10 years. Any other assumptions I’ll make clear throughout.

For the purpose of this post, the strategy for becoming financially independent will be to maximise your surplus, invest the difference and accrue investments until such a point where you investment returns exceed your annual expenses.

It should be noted that this is not the only way – there are many alternatives such as simply earning an incredibly high salary, starting a hugely successful business, living a highly frugal life with very low expenses or geographical arbitrage whereby you earn in a currency such as US dollars but pay bills in a weaker currency such as the Costa Rican Colon. (1 USD = 580 Costa Rican Colon and Costa Rica has a comparatively low cost of living).

Is becoming financially independent in 10 years really possible?

Becoming financially independent in 10 years is possible but can be very difficult depending on your starting point. If your annual expenses are £14,945 (which is the average for a single person in the UK per this article), you would need to amass around £375,000 in investments to fund these living costs forever without your portfolio running out of money according to the 4% rule.

Getting up to £375,000 in total investments is possible for a lot of people. For example, let’s say you’re 30 years old and have been investing £10,000 per year between the ages of 20 and 30. Assuming returns of 10% per year, this gives us £175,312 as our starting point at age 30. Even if we left this investment without further contribution for the next 10 years with the goal of becoming financially independent at age 40, our investment pot would now be worth £454,713 at age 40 which already exceeds our target.

Between ages 30 and 40, our earning potential is likely to be increasing and nearing its peak. Let’s say, for the next 10 years we earn a great salary and manage to invest £20,000 a year and max out our ISA. Assuming 10% returns, this would give us another £350,623 at age 40. Added to our £454,713 from our savings we made between ages 20 and 30, this puts us to a total of £805,336 which is way above our target and would more than cover a spouse or child’s yearly living expenses as well (assuming the average shown above).

Hopefully, this has helped make clear that is is possible, particularly if you aren’t starting from zero and are managing to invest a good proportion of your income. Clearly investing £20k per year (£1.67k per month) or even £10k per year (£833 per month) is not going to be realistic for a lot of people. It’s also worth noting that the £14,945 annual expenses average as per money saving expert may seem low or high depending on where you live and your lifestyle and this amount can be adapted for your own situation. Just under £15k per person seems low to me but maybe that’s just my London bias!

This example also serves to show that the amount of wealth required to become financially independent is less than might be expected with people often thinking you need to amass far more money than in the example above.

Changing your mindset

Part of achieving financial independence is a shift in mindset. One way of thinking about it that has always stuck with me is that if theoretically, you were able to save half of your take-home pay, you could pay all of your expenses for both this year and next year and you wouldn’t need to work in the second year. The concept of financial independence is this but on a bigger scale where you front-load the years of work.

Part of this mindset shift is moving away from the thinking that the more money you earn, the more stuff you can buy and start thinking of more money as a way to buy income-producing assets that will fund your future in place of employment. For people that are successful in becoming financially independent, they quickly understand that financial freedom is worth far more material possessions.

In order to become financially independent in 10 years, the biggest points for success are being consistent in terms of maximising your surplus each month and year, investing it wisely and crucially, avoiding any big financial mistakes. A significant financial mistake like a bad investment, a major purchase you can’t afford or even the expenses associated with a divorce could spell disaster for your personal financial situation but more on this later.

Working out how much money you need a year

So let’s get down to the maths and specifically the 4% rule (which I wrote about here). The 4% rule is a rule of thumb which determines the safe withdrawal rate a portfolio can withstand without running out of money in a given time period. For example, a portfolio of £1 million could safely withdraw £40,000 annually.

So given the 4% rule states that you can safely withdraw 4% of your portfolio each year, you can reverse engineer this to work out how much investments you need to accumulate in order to cover your annual living expenses.

So the first step to financial independence is working out how much money you need each year. The best way to do this is to track a few months and add up all of your expenses; rent/mortgage, bills, food, entertainment etc. For the sake of example, let’s say you work out your monthly expenses are £3,000. Annualised, this is £36,000 per year in expenses you need to cover. To allow for a slightly higher quality of life, let’s round this up to £40,000 a year of income that you need to secure.

Using the 4% rule (or the multiply by 25 rule as it’s otherwise known) tells us that to make £40,000 of income each year, we would need an investment portfolio of £1,000,000 (£40,000 *25). This number can be called our ‘FIRE number’ whereby FIRE stands for ‘financial independence, retire early’ and is the total amount required in order to reach this financial landmark.

So we have now successfully worked out how much money we need to have invested – £1 million – in order to earn £40,000 per year in passive investment income. This £40,000 would more than cover all our annual expenses, which would make us financially independent. So, let’s move on to how we earn and invest this amount.

Increasing your surplus

In order to reach total investments of £1 million, the most important step is to increase our income surplus. By this, I mean the difference between your total income and total expenses. For example, if you earned £50k after-tax per year and spent £40k per year on your annual expenses, your surplus would be positive £10k.

Increasing your surplus can be done in two ways; increase your income or reduce your expenses.

The easier method, by far, is to cut expenses. When most people chart out their monthly expenditure, they’ll quickly see that there are outgoings that could be reduced or cut-out altogether if necessary. Frugality is a weapon that can be wielded which has dual benefits – firstly, you will naturally spend less and therefore increase your surplus in that way. Secondly, you realise that you don’t need to spend a particularly high amount each year and that will reduce your ‘FIRE number’ i.e. the amount of invested money you need to accumulate to become financially independent.

The second way of increasing your surplus is increasing your income. This is usually more difficult as you are limited by your employer and the slow, bureaucratic pay-scales most companies use. What I mean by this is that a lot of companies base compensation on time-served rather than on merit alone. For example, in many companies, regardless of how talented you are, it is difficult to move up in salary quickly without earning promotions because you would disrupt the organisations pay-grades. Similarly, promotions aren’t handed out on a regular basis and earning a promotion can often take years.

If you’re employed, I suggest you take a read of this post on ‘14 ways to become a high performer at work and earn promotions more quickly‘ because whilst increasing your income may be the more difficult of the two routes to increasing your surplus, it’s also the more effective. It’s very difficult to match the impact of a £10k jump in salary by reducing your annual expenses by a similar amount.

Your surplus can also be thought of as your savings rate by considering the below formula:

Savings rate % = total amount of money saved in the period / total amount of money earnt in the period.

The idea here is that by maximising your savings rate, you will naturally increase your surplus and have more money available to invest in income-producing assets – such as company shares.

Maximising your income

Increasing your income is highly dependent on the field you work in and the skills you offer. For those of us that are formally employed, maximising your income can come via increasing your salary year-on-year, earning bonuses, earning promotions which come with a higher salary or earning commissions if applicable to your line of work.

In each case, high performance in your job is likely to help. The most powerful of these methods is being promoted as this usually allows you to jump up a whole pay-grade rather than the incremental year-on-year changes you may otherwise see. Promotion can be a double-edged sword in that it often involves greater stress and time spent at work but if we have a goal of becoming financially independent in 10 years, working hard and progressing as fast as possible within our jobs is something we have to accept.

The considerations are slightly different for the self-employed who aren’t limited by the pace of progression at a formal employer but may be limited by capital, time and their capacity to work.

Regardless of your primary employment, side hustles are a popular method for increasing the income part of the equation and can vary from bar work in your spare time to starting an online business. The real benefit of supplementing your career with other hourly work is that you can adjust it so that you do just enough to meet your income goals in order to achieve your ‘Fire number’.

The final point on increasing your income is via tax efficiency. For business employees, this won’t be hugely applicable as in the UK tax is arranged by the Pay As You Earn (PAYE) system directly with the employers payroll department.

However, for the self-employed, researching tax efficiencies could save you significant money. For example, writing off business expenses against your business profits will reduce the tax burden you face. I.e. if you work from home, you are able under tax law to write off a certain proportion of your homes rent/mortgage costs against profit. That way, your business makes a smaller profit in its financial statements at year-end and therefore pays a lower tax bill, meaning you keep more of your income.

Minimising your expenses

The other side of the coin is reducing your expenses to as lower level as possible. Frugality is your best friend in this regard as it will help warn you away from any unnesary purchases and steer you towards the best deals.

It should be made clear, being frugal and being tight with money are not the same thing. Being frugal is only going out drinking a few times a month because you’re wary of overspending, being tight is not buying your friends a round of drinks after they have all bought you one.

Cutting expenses is one of the perceived sacrifices becoming financially independent entails but in some respects, this may not be as bigger sacrifice as you may expect. Modern-day advertising of products alongside human natures ‘keeping up with the Jones’ mentality leads people into a consumerist lifestyle.

In this life-style, we end up buying things we don’t need to impress people we don’t really care about. Think about the last thing you bought on Amazon or online clothes shopping for example. When you pressed ‘buy’ you probably received a jolt of excitement and then again when it arrived in the post, but now, a few weeks later can you honestly say you would be any less happy if you had never ordered it?

A powerful method of getting around this is to frame all purchases in terms of working hours. For example, thinking of spending £200 on a pair of designer trainers? Would you still go ahead with the purchase if you were told you could only press buy after working 10 hours? This is in effect what is happening (assuming you earn £20 an hour) – you are trading 10 hours of your time for one pair of shoes.

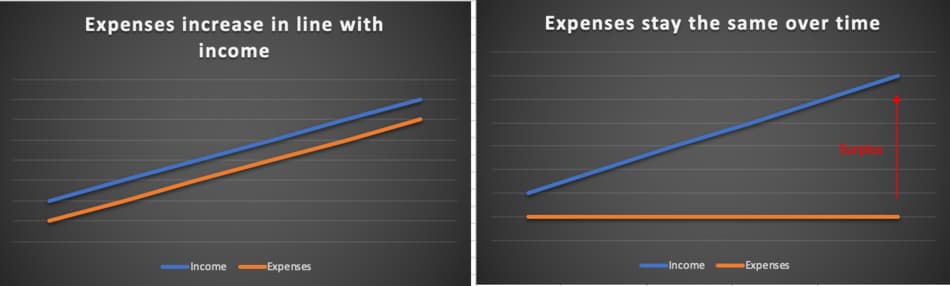

Another common pitfall when it comes to spending money is to increase your lifestyle in line with your income as that increases over time. Take a look at the graphs below which show expenses increasing in line with increasing income (on the left) and expenses staying the same whilst income increases (on the right).

In the second graph, we can see a widening surplus over time. It’s this difference that will allow us to reach our ‘FIRE number’. In the graph on the left, our difference between our income and expenses is so low over time, it becomes very difficult to ever accumulate a big enough surplus to meet our goals.

Many people fall for this trap due to the temptation to visually show wealth i.e. how will everybody know how successful I am if I’m not driving a nice car, don’t own a nice flat or don’t wear the fanciest clothes? The problem is, this is your ego talking and the type of harmful thinking that will steer you away from becoming financially independent. Again, if those things are what you want, go for it and follow the graph on the left. For those of us who want to achieve financial independence, it’s the graph on the right we must follow as our income increases.

Investing the difference

Now we have achieved a good surplus by maximising our income and minimising our expenses, let’s talk about what we do with the difference.

The short answer is, as far as i’m concerned, invest the money into low-cost, index-tracking funds but this is only one possibility – how you choose to invest your money is a personal choice based on your risk-profile, personality and the opportunities that come your way.

The reason I follow a low-cost, passive investing strategy into the stock market is because I think it has the best risk-reward ratio. Based on history, the S&P 500 index has returned 10% per year (rounded to the nearest whole number) and over any significant time period, the S&P 500 has not decreased in value.

For others, this may be too risky and for some it may not be risky enough – the point is, you want to maximise your investment returns without going overboard on the risk. I mentioned above one of the key things that will help people to become financially independent is avoiding big financial mistakes in their lives – investing all of your money into a risky venture could be one of these mistakes.

I know when investing in the stock-market that even if share prices crash and my portfolio loses value – I still own small slices of ownership in all of the biggest companies of the world. If you invested all of your money into your cousins’ tech start-up because you felt sure it would make the big time and help you get rich quickly – you could stand to lose 100% of your money and be left with nothing.

For my strategy, investment returns will come in two main ways: dividends and capital appreciation.

A dividend is basically just a sum of cash a company pays out to it’s investors (share holders) on a periodic basis, usually annually as a reward to the investors for their ownership. Dividend payments are typically more common for established companies as younger companies are not in a financial position to give back cash to investors as they need the cash to reinvest into their business.

Whenever I receive dividends, I don’t cash them out to my bank account but rather reinvest them into more units of the fund to maximise the benefits of compounding.

The second method; capital appreciation is simply the value of your investments increasing because the share price of the underlying companies have increased.

A key concept within investing is diversification – which basically means spreading out the risk, whether that be across products, geographies, sectors or anything else.

If you were to invest in the S&P 500 – you would be reasonably diversified – you would own equity in companies across sectors and industries and whilst they are all registered in the US, they operate across the globe. This isn’t perfect though – you are only invested into a single asset class – equities (company shares) so it may be a good idea to have some investments in other asset classes such as bonds, property, cash or other.

The key point here is; make sure your investments are spread out enough so that an event that impacts a specific company or a specific sector wouldn’t impact the whole of your portfolio.

If, for example, you were totally invested into a hotel chain company, your portfolio value would have been hit hard by the recent COVID-19 pandemic whereas if you were invested across sectors, the growth in technology stocks may help to offset this loss.

Factoring in your pension to financial independence

As discussed in my recent post ‘How much to contribute to your pension each month‘, most pensions don’t become available until age 55 in the UK without incurring tax penalties. When aiming to become financially independent within 10 years, it’s crucial to factor in the size of your pension and the number of years until you are able to draw on it.

For example, if you have calculated that your pension at age 55 will be large enough to see you through for the rest of your life, your financial independence calculations only need to cover the period between your financial independence date and your 55th birthday.

It’s also worth noting that if you’re retiring from formal work early, your pension pot may sit for many years. Whilst this pot wouldn’t be receiving regular contributions, it will be growing each year thanks to the compounding of the underlying investments.

Whilst I’ve spoken above about maximising your income surplus, this shouldn’t come at the expense of making smart pension contribution decisions. To make a long story short, the most optimum pension contribution strategy is the one where you contribute the amount which gets you the biggest employer match. This is essentially free money – take advantage of it.

Could I also retire early?

Part of the ‘FIRE’ movement (which you can read more about here) is the ‘retire early’ part. By definition, when you become financially independence i.e. once your passive investment returns exceed your expenses, you have the option to retire if you chose as you are no longer dependent on the income your job provides.

In some aspects, it may be safer not to retire as on top of your investment returns you would still have your work salary coming in which would allow you increase your monthly expenses if that’s what you wanted to do or factor in big future payments such as contributing to your child’s education costs.

One of the main benefits of financial independence is that you are not trapped into a career you are unhappy with, fearful that if you quit you won’t be able to pay the bills. This can be liberating as it allows you to shift focus to a career or work that you find more rewarding or go out on your own and start your own business.

For a lot of people, starting a business is a scary proposition as to be successful, they require time and money. For those of us who are not yet financially independent, time and money isn’t something we’re sure we can commit to a business – our time is taken up by our full-time careers and our money is being used to cover our expenses and invest.

When these limitations are taken away i.e. you have amassed some wealth and are no longer required to work, the path to your own business is much easier. I suspect people who start businesses in this position are successful far more often than the average person. Whilst both the discipline and money skills that have been developed over time will help, the key factor I would have thought, is the knowledge that you’re doing this because you want to, not have to.

Conclusion

This blog post really encapsulates The Progression Playbook as a whole – explaining the logic and thinking behind how to become financially independent in as little time as possible. I think financial independence in 10 years for me is unlikely simply because of my current age, but i’d like to think 15 years or 20 years would certainly be possible.

The maths of financial independence is the easy part – increase your surplus (income minus expenses) and invest the difference in low-cost assets until you reach your ‘FIRE number’, at which point, your annual investment returns should fund your life style in perpetuity.

The difficult part is commiting to the steps necessary to increase your income and crucially, decrease your expenses. Being frugal is an underrated super power – not only does it allow you to save more of your income each month, developing your frugal muscle means you will not need as much money to live on even after you’ve become financially independent – therefore making your ‘FIRE number’ lower.

It’s important to note that becoming financially independent does not necessarily mean you are retiring. What it could mean, however, is that you would feel more free to change careers to something you are passionate about without the worry of whether you can pay your bills. This, I imagine, would be a hugely liberating feeling and is just one of the many benefits of becoming financially independent.

As always, please remember I am an Accountant, but not your Accountant. In this post (and all of my others) I share information and oftentimes give anecdotes about what has worked well for me. However, I do not know your personal financial situation and so do not offer individual financial advice. If you are unsure of a particular financial subject, please hire a qualified financial advisor to guide you.

This article has been written by Luke Girling, ACA – a qualified Accountant and personal finance enthusiast in the UK. Please visit my ‘About‘ page for more information. To verify my ACA credentials – please search for my name at the ICAEW member finder. To get in touch with questions or ideas for future posts, please comment below or contact me here.