The ACA Corporate Reporting exam is one of three advanced-level exams within the ACA syllabus. This exam can best be thought of as a combination of the professional level Audit and Assurance and Financial Accounting and Reporting exams but with a greater focus on practical recommendations rather than on the theory. The pass rate for this exam was 80.2% in the most recent exam season which shows that this exam is a tough one to pass.

To pass the ICAEW ACA Corporate Reporting exam, candidates should focus on repetitive question practice to become comfortable with the overwhelmingly detailed scenarios and create an efficient open book resource. Within the exam, sticking to timings and dealing with fatigue will be key.

In my experience, the Corporate Reporting (CR) exam is one of the toughest exams ACA candidates will face. On top of the content being challenging, the exam will present candidates with a new set of problems, namely: fatigue due to a three and a half-hour exam length, time pressure, applying scenario-specific recommendations and being overloaded with information.

With that in mind, I have created the below guide which should help anyone studying for the Corporate Reporting exam to organise a revision and exam strategy and ultimately pass this exam.

How to pass the ACA Corporate Reporting exam

Passing the ACA Corporate Reporting exam will come down to doing a few key things well. Firstly – how well the candidate prepares via question bank practice and preparation of the open-book resource and secondly how well the candidate can perform on exam day.

Whilst both are as important as each other, performing well on exam day is the easier part. This will simply be a case of managing exam nerves (which should be second nature by this stage of the ACA qualification), managing the fatigue of taking a three and a half hour exam and finally getting enough sleep leading up to the exam to be able to perform optimally on exam day.

The difficult part is learning, revising and mastering the content. For most students, this will involve actively engaging with the tuition and practising questions repetitively. There is no silver bullet here – it’s simply a case of putting the work in and sticking to a smart plan. Unlike previous exams, a lot of the content in this exam will be taken from and built on previous ACA modules (‘Financial Accounting and Reporting’ and ‘Audit and Assurance’).

Unlike the SBM advanced level exam, Corporate Reporting will add in a fair chunk of new material to learn both in the accounting and audit focused syllabus areas.

The big challenge when preparing for this exam isn’t necessarily understanding the content but being able to apply the knowledge to a specific exam scenario as a fully qualified accountant would have to in a real-life scenario.

Success in the preparation phase will come down to the below points:

- Listening intently to the tutor and actively engaging with exercises and questions. Speak up if you don’t understand a concept or method.

- Creating a realistic but thorough revision timetable that you can stick to and that will provide enough study hours to master the content whilst also leaving some time to relax.

- Pummeling the question bank and mock exams repeatedly and learning from mistakes when you make them.

- Creating and improving an excellent open-book resource for exam day.

- Devise a smart strategy for exam day which considers the 50% pass mark and the fatigue associated with a long exam.

In the advanced level, candidates only need to score 50% to pass which should be a great source of confidence. If you manage to practice questions repetitively, get to grips with the permitted texts, calculate and stick to preset timings and write as much as you can for each question, you’ll be in a great position to pass this exam.

ACA Corporate Reporting exam – key information

All of the key information regarding the ACA Corporate Reporting exam is summarised below:

| Factor | Result | Notes |

| Exam length | 3.5 hours | The ICAEW ACA Corporate Reporting (CR) exam is 3.5 hours long. |

| Pass-mark | 50% | The pass mark for the ICAEW ACA Corporate Reporting (CR) exam is 50%. |

| Pass-rate | 80.2% | The pass rate for the ICAEW ACA Corporate Reporting (CR) exam was 80.2% at the most recent exam sitting. |

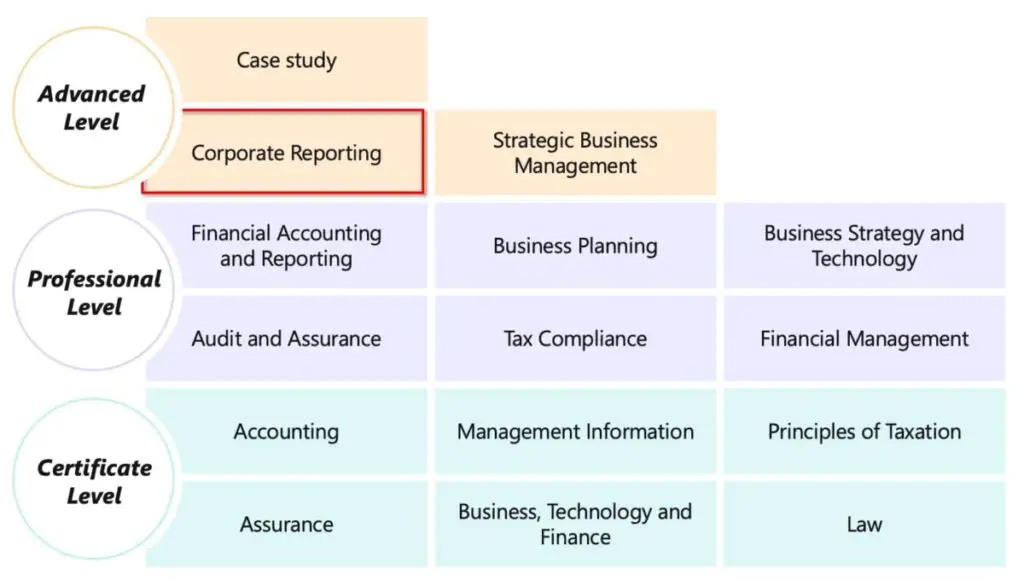

| Level | Advanced | The exams are in 3 levels; Certificate, Professional or Advanced. See the image below. |

| Structure | 3 long-form questions (100%) | The 3 long questions are typically split 40/30/30 in terms of marks and contain numerous sub-requirements. |

| Location | Any ICAEW-approved test centre | |

| CPL | Yes | It is possible to get a ‘Credit for Prior Learning’ (exemption) for this exam. |

| Open book? | Yes | This is a full open-book exam which means students can take any written or printed material into the exam, subject to practical space restrictions. |

How the exam is structured

The ACA Corporate Reporting exam is within the advanced level as shown below.

The exam is made up of three long-form questions which are typically split into a 40 mark mini-case study and two 30-mark questions one of which focuses on financial accounting and the other on audit and assurance. All three questions will involve a number of sub-requirements which should be answered via specific subheadings in candidates answers.

The single most important thing you can do on this exam is to get your timings right and spend the correct amount of time on each question and sub-question.

To do this effectively, you’ll need to calculate the correct amount of time to spend on each question (process shown below) and be highly disciplined in sticking to these timings. Even if you’re halfway through a sentence when your time for the question is up, move on!

So what’s the most efficient way of working out the time you should spend per question?

Step 1 – write down how long the exam is in minutes. We know the exam is three and a half-hour long. This converts to 210 minutes in total.

Step 2 – Take off 10 minutes from the total which is the time set aside to work out and write down your timings per question. This leaves 200 minutes of actual question-answering time.

Step 3 – We now know we have 200 minutes to answer questions worth 100 marks. This is 2 minutes per question.

Step 4 – Go through the exam script and for each question or sub-question, calculate the time per question. For example, if a question is worth 40 marks, you would give yourself 40 * 2 minutes = 80 minutes = 1 hour 20.

Step 5 – Once you have done this for each question, confirm the timings for each question sums up to 200 minutes in total so you know you haven’t gone wrong anywhere.

This may sound like a hassle but with practice, you can do all of this for an exam script in under five minutes.

Taking the time to do this and then being strict with yourself to stick to the timings is the single most effective thing you can do. This simple technique will make sure you apply a reasonable amount of time to each question and don’t fall victim to running out of time which is the reason many candidates fail this exam.

Remember, you only need 50% to clear this exam. This simple strategy (and being comfortable with the content) is the most effective way of achieving this.

Having two minutes per mark gives candidates sufficient time to really flesh out each point they are making and link it directly to the scenario laid out in the question.

This is an important point – if any single question is taking you longer than the calculated time, move on! The single biggest reason people will fail this exam (other than not understanding the content) – is time management.

If you believe you have completed your answer to a particular question within the predetermined time, feel free to move onto the next one. You have just saved yourself a few minutes which can be put towards any question you have more to write for at the end.

The syllabus will cover:

- Corporate Reporting – Compliance and Financial Statement Analysis (55%-65%)

- Audit and Assurance (30-40%)

- Ethics (5-10%)

It should be clear from this syllabus how much overlap there is with other exams. Points 1 and 2 above directly relate to the Financial Accounting and Reporting and Audit and Assurance professional-level exams which make up a combined 90% of the marks.

My suggestion is to take the Corporate Reporting and Strategic Business Management exams together to reap the benefits of these overlaps in content between the two exams.

The final advanced level exam, Case Study, is better left until the end of the ACA course given the unique nature of that exam.

How to make your ACA Corporate Reporting open book resource

The Corporate Reporting exam allows students to bring in an open-book resource which is defined as “any written or printed material into the exam, subject to practical space restrictions.”

To create an effective open book resource for the ACA Corporate Reporting exam, students must bring in the optimum amount of materials to be helpful without becoming overwhelming. To be successful, the open book resource must be simple and fast to use to avoid wasting time during the exam.

Being able to bring in any resource you deem helpful can be a huge advantage when implemented effectively. However, this opportunity often ends up tripping candidates up who make the mistake of bringing in vast quantities of written materials that are poorly organised and end up spending far too much time searching for answers in an already time-pressured exam.

Candidates are already bombarded with a huge volume of information in this exam through the scenarios laid out in the question paper. Don’t add to this by bringing in unnecessary open-book documents.

Whilst I would always recommend listening to the advice of your tuition provider, here are my simple, effective recommendations for a successful open-book resource.

Take in a well-organised binder of general course notes.

This resource should have an index page, be tabbed up and be simple to use and follow. Create this resource as soon as possible and get used to using it whilst answering questions. As you do this, you can iterate the resource to make it as useful as possible before exam day. This resource should be contained within a binder that is easy to flick through quickly.

My advice is to have this resource open throughout the exam either next to your answer paper/online software or even resting on your lap due to how often you will likely be referring to it. By the time of the exam, using this resource should be second nature. Remember to apply points from your notes to the specific examined scenario.

A smaller cheat sheet pack.

I would also create a much smaller binder (<20 pages in total) with each page representing a cheat sheet on each topic. For example, one sheet would cover the topic of ethics. At the start of this pack, I would have an index page saying which topic is on what page.

I would recommend creating this resource in a bound stack of papers that allows you to flick through quickly and open up a whole page at a time. The rationale behind this resource is that you have a sheet of related points at hand for any topic that comes up on the exam.

An insurance policy binder of past exams & question bank questions and answers

My final open-book resource would be another binder that contains as many questions (either from past exams or the question bank) and model answers as possible. This too will need to be very organised with an index page laying out the page references of questions and answers by topic.

This resource should act more as an insurance policy than anything else in that if you see a question you are completely stuck on, you can identify the topic, locate similar questions in this resource and use the model answers as inspiration (or even directly copy them if applicable) to earn marks. If you have any time left at the end of the exam, this can be used to bolster your answers with a few points from model answers on similar questions.

Please remember that most of the marks on the Corporate Reporting exam relate to applying the knowledge from the course to specific points mentioned in the scenarios. As such, simply copying out answers from past exams or the course notes will not be an effective strategy. You must tailor them to the scenario at hand to score well.

ACA Corporate Reporting exam – revision strategy

With the exception of self-taught students, most of your revision time will be determined by your tuition provider.

For the Corporate Reporting exam, revision or practice outside of the classroom should focus on the following items; question bank questions, mock exams, reviewing particular topics within the course notes and updating/reviewing your mistake notepad as outlined below.

In terms of how revision should be structured, my advice would be to complete a full long question, mark it and then note down improvements that could be made.

When studying, implement the Pomodoro technique (which is explained briefly in this Youtube video). This will maximise your productivity and help to avoid burnout and concentration lapses.

If it suits your studying style, consider joining a study group with one or two other students. I found this immensely helpful, not only does it help keep you accountable to study in line with your revision timetable, you and your study group can help cover each other’s weaknesses. A study group of any more than three people is a bad idea as it becomes too complicated to manage.

Beyond the above points, the most important thing is to listen to and implement your tutors’ advice. They have likely taught this exam module several times and are well placed to advise on the best ways to revise and practice.

How to learn from your mistakes effectively

To make the most of your revision sessions, you need to be diligent in learning from your mistakes and making sure you don’t make the same errors repeatedly.

I’ve found using the ‘notepad method‘ particularly effective for this.

Here’s how it works – buy a nice new notepad and write ‘ACA Corporate Reporting exam – mistakes’ on the front cover. Any time you make an error in mock exams, the question bank or the end of chapter questions within the course notes, write a note in your notepad explaining what the error was, why you made it, what the correct answer should be and a reminder to yourself about how this error can be avoided in the future.

At the start of each revision session, read through this notepad of mistakes and you’ll gradually stop making the same errors as you become more conscious of them.

ACA Corporate Reporting exam – timing and strategy

As well as having a revision strategy, candidates should think about implementing a specific exam strategy to maximize their chances of success. This strategy should be based on three core factors: writing as much as possible for each question, being careful not to take too much time on any single question and ‘playing the game’ to get over 50%.

As discussed earlier, the key to success in this exam is being diligent with timings. For each question, multiply the number of marks by 2 minutes to calculate the total time to answer the question and then stick to this time.

By doing this, candidates will make sure they spend sufficient time answering each question. This is linked to the third factor which is that the pass-mark is only 50%. By leaving sufficient time for each question, candidates can have a good stab at every part of the exam which makes achieving the 50% pass mark much easier.

For the advanced level exams, there are a couple of additional factors to consider. The first is fatigue. During a 3.5 hour long exam, the exam adrenaline will wear off and fatigue will set in at some point. To combat this, factor in a few minutes break in between the three questions during which you will use the bathroom, have a drink and snack and relax your brain for a few minutes. This may sound like a waste of precious minutes, but this mental reset will pay off compared with writing an hour-long question whilst already mentally depleted.

ACA Corporate Reporting resources and past papers

Please use the links below for valuable resources (including past papers) to help pass the ACA Corporate Reporting exam:

- ACA Syllabus Handbook – refer to page 92 for Corporate Reporting.

- Details over closed book vs open book vs permitted texts

- For other past papers and useful resources – click here.

How to tackle concepts you keep getting wrong

As with any exam, a certain proportion of the content will be challenging. It may even feel at times like you can’t understand a particular item at times, no matter how much you read the course notes. If you find yourself in this situation and are beginning to get overwhelmed, here are my suggestions:

- Consider ignoring it. This will only work if it’s not a central concept. This may sound counter-intuitive but if for example, you are really struggling in one area and just can’t seem to get it, it may not be the worst idea to forget it. Remember, you only need 50% to pass the exam and this area is unlikely to make up more than 5% of the total points. Does it not, therefore, make sense to avoid spending hours trying to understand a very specific concept when that time could be spent on more useful revision?

- If the topic can’t be ignored – ask either your tutor or a classmate who does understand it for help. In my experience, both tutors and classmates are more than willing to explain a concept and sometimes a new perspective can help you understand something that was previously incomprehensible.

- Consider google-ing the topic. A lot of very specific questions are explained online on blogs, forums or Youtube videos which may help unlock your understanding.

Tips for exam day

I often use the metaphor of a boxer preparing for a fight for how candidates should prepare for the ACA exams. Both the pre-fight preparation and the fight-day itself are equally important. If you don’t prepare properly, you won’t be successful. Similarly, if you prepare well, but perform poorly on the day, you won’t be successful.

With this in mind, I’ve laid out a few tips to help optimise your exam day performance that worked consistently for me during my exam days.

Needless to say, being well prepared is crucial. It doesn’t matter how well you sleep the night before the exam or how dialled in your pre-exam ritual is if you don’t know the content. There is nothing that will help calm exam nerves to the extent that being over-prepared will.

As well as being well prepared on the exam content, it also pays off to be well prepared practically speaking. Things go wrong in exams so have contingencies planned. If you’re doing your exam from home as many are at the moment, have a backup plan if your wifi cuts out e.g. a mobile phone hotspot connection.

Prioritise getting a good night’s sleep for the week leading up to the exam. One good sleep does not make up for poor sleep every other night. Get your 7-8 hours per night. Believe me, this will have a bigger impact than another hour of revision late at night. The research is very clear that good sleep is crucial for memory retention which is a big part of all of the ACA exams.

Finally, a quick point on when is the right time to stop revising. My advice is to stop revising a few hours before you sleep on the night before the exam and relax for a few hours. Trying to cram material late on the night before the exam will probably not help and almost certainly make it more difficult to sleep.

Should you take your ACA exam exemption?

Some students will be exempt from certain exams due to the credit for prior learning (CPL) system. For students who have studied Accounting at university or have done similar qualifications in the past, certain ICAEW ACA modules will be a duplication of content. Rather than repeating an exam already passed, students can apply for a credit for prior learning and become exempt from the exam.

More information on ACA exam exemptions can be found here.

Whether students apply for and take exam exemptions is up to them but it’s worth noting the below advantage and disadvantage of doing so.

The big advantage is clear – students can save themselves significant study time and exam stress by taking an exemption and use that saved time for other exams they are not exempt from taking.

However, the disadvantage is that the ACA qualification is structured in tiers as discussed above. For example, students will take ‘Accounting’ at the certificate level, ‘Financial, Accounting and Reporting’ at the professional level and ‘Corporate Reporting’ at the advanced level with the knowledge and skills being built upon and compounded throughout.

This means if a student were to take an exemption from the Accounting exam for example – when it comes to taking the difficult Financial Accounting and Reporting exam, the underlying content will not be fresh in mind which may become a difficult obstacle to overcome.

As always, please remember I am an Accountant, but not your Accountant. In this post (and all of my others) I share information and oftentimes give anecdotes about what has worked well for me. However, I do not know your personal financial situation and so do not offer individual financial advice. If you are unsure of a particular financial subject, please hire a qualified financial advisor to guide you.

This article has been written by Luke Girling, ACA – a qualified Accountant and personal finance enthusiast in the UK. Please visit my ‘About‘ page for more information. To verify my ACA credentials – please search for my name at the ICAEW member finder. To get in touch with questions or ideas for future posts, please comment below or contact me here.