The ACA Principles of Taxation exam will be most ACA candidates first foray into the world of tax which will involve a whole new set of challenges. In the most recent exam season, the pass rate for the Principles of Taxation exam was 88.2% which suggests this is one of the easier certificate level exams. Despite this, Principles of Tax presents a unique challenge with a lot of rules, dates and methodologies to learn.

To pass the ICAEW ACA Principles of Taxation exam, candidates must memorise the key tax rules and dates through sustained question practice. The key to success on this exam is strong performance on the scenario based questions, being disciplined with exam timings and memorisation of details.

As a fully qualified ACA Accountant myself, I look back at the Principles of Tax module with good memories. Not only did I find this exam more comfortable than most in the curriculum, but a lot of the content is quite interesting. Despite my fond memories, many students struggle with this module due to the high volume of dates, tax rates and rules to learn.

I have created the below guide which should help anyone studying for the Principles of Taxation exam to devise a solid revision plan, a smart exam strategy and ultimately to pass this exam.

Please note, some sections of the below guide have been duplicated from my guides on other exam modules where the advice is applicable across both exams.

How to pass the ACA Principles of Taxation exam

The Principles of Taxation exam will involve students learning the fundamentals of tax, how to compute certain types of tax, memorisation of key dates/laws and ethics.

Much like the Accounting exam, the Principles of Tax exam involves a combination of multiple-choice questions and long-form questions.

As with any exam, passing will be down to a combination of pre-exam preparation and exam day performance.

Strong exam day performance will involve devising and sticking to an exam day strategy focused on achieving a score above the 55% pass mark, prioritising the two long-form questions and sticking to pre-determined timings.

Students will be more familiar with the ACA exam process by the time they sit the Principles of Taxation exam and so should be starting to manage exam nerves better. Despite this, candidates will need to ensure they are sufficiently well-rested to give their best performance.

Whilst understanding the course content during the learning phase will be crucial, the key to passing this exam will be the same as with many of the others certificate exams – repetitive question practice. As always, disciplined question practice isn’t a particularly exciting prospect but unfortunately, this is the number one most important action candidates can take to be successful.

Whilst there are no guarantees when it comes to passing the ACA exams, by doing the question bank front-to-back twice and by doing a few full-length mocks, candidates can put themselves in a great position to pass.

This volume of questions will allow students to memorise tax dates and rates and to practice key learning methods such as drawing out timetables for the tax year and the financial year for questions that ask about basis periods.

ACA Principles of Taxation exam – key information

All of the key information regarding the ACA Principles of Taxation exam is summarised below:

| Factor | Result | Notes |

| Exam length | 1.5 hours | |

| Pass-mark | 55% | |

| Pass-rate | 88.2% | At the most recent sitting, 88.2% of candidates passed the exam. |

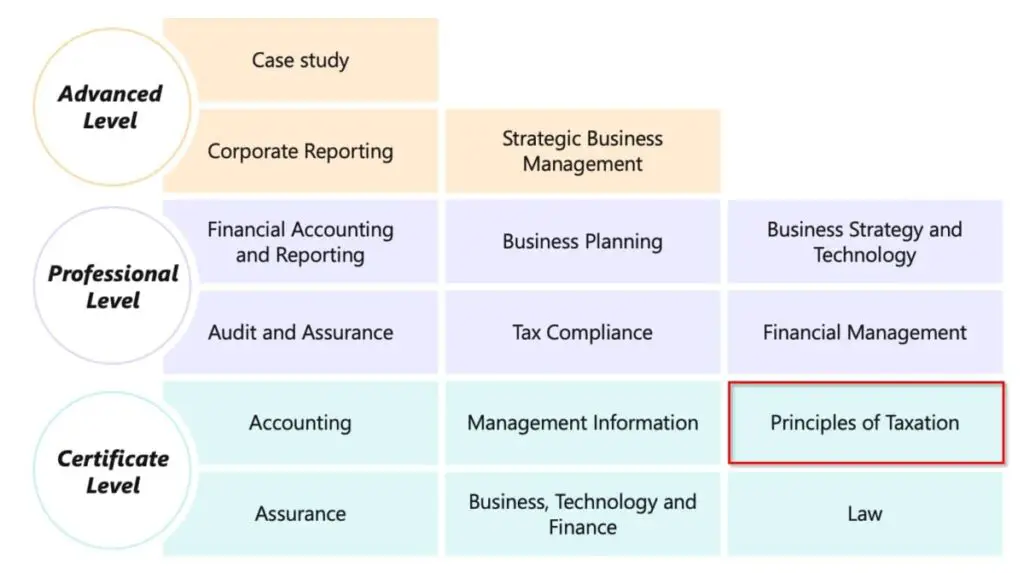

| Level | Certificate | The exams are in 3 levels; Certificate, Professional or Advanced. See the image below. |

| Structure | 2 scenario based questions (20%) 40 multiple choice questions (80%) | One long question is on income tax and NICs, the other is on Corporation tax. |

| Location | Any ICAEW-approved test centre | |

| CPL | Yes | It is possible to get a ‘Credit for Prior Learning’ (exemption) for this exam. |

| Open book? | No | You can’t take notes into this exam. You can take an approved calculator & blank paper / a whiteboard depending on if taking the exam in-centre or at home. |

| Precursor to: | Tax Compliance and Business Planning:Taxation | This exam is a precursor to the professional level exams Tax Compliance and Business Planning: Taxation. |

How the exam is structured

The ACA Principles of Tax exam falls within the certificate level as shown below.

The exam is made up of 40 multiple-choice / multiple-response / multi-part multiple-choice / numeric entry style questions worth a total of 80% of the exam.

The remaining 20% of the exam is comprised of two long-form questions. One of these questions will cover income tax and NIC’s and the other will involve a corporation tax computation.

As the exam is 90 minutes long, this suggests you have 18 minutes (90 minutes * 20%) to cover the two long-form questions which is 9 minutes per question.

The remaining 72 minutes (90 minutes * 80%) will therefore be spent on the 40 multiple-choice style questions. This leaves 1.8 minutes or 1 minute, 48 seconds per question.

To simplify, candidates should give themself 1.5 minutes per multiple-choice question. In total, this would take up 60 minutes (1 minute 30 * 40 questions) which would leave 30 minutes spare at the end of the exam to cover the two long questions and review answers to the previously answered questions.

This is an important point – if any single question is taking you longer than one and a half minutes to answer, move on! Most people who fail this exam will do so because they mess up their timings.

An advisable exam technique is to scan over a question and immediately assess whether you can answer it within 1 minute 30. If not, mark it and come back to the question at the end.

As with all certificate level exams, the pass mark is 55%. This means if candidates perform well on the long questions worth 20% and achieve close to full marks, only 18 out of the 40 multiple-choice questions would have to be answered correctly in order to reach the 55% pass mark.

My suggestion is to tackle the multiple-choice style questions in this exam first, covering as many as possible until 60 minutes of the exam have passed. At this point, regardless of progress, candidates should move onto the two long form questions to give themselves sufficient time to score well and achieve the easy data entry marks. More on this later.

With the multiple-choice questions, candidates should move through answering any individual questions they are confident on or look to be possible within 1 and a half minutes. Any questions that look like they may take longer than this should be skipped and revisited either at the end of the exam or before the initial 60 minutes has elapsed.

The key here is to make sure to get the “low-hanging fruit” marks and to avoid feeling time-pressured.

The Principles of Tax syllabus covers:

- Objectives, types of tax and ethics (10%)

- Administration of taxation (20%)

- Income tax and national insurance (26%)

- Capital gains tax and chargeable gains for companies (10%)

- Corporation tax (14%)

- VAT (20%)

What is the difference between multiple choice and multiple response questions?

Within the ACA Principles of Taxation exam, the questions will fall into four similar but different structures.

- Multiple-choice – candidates will be asked a question and have to select one answer out of a list of possible answers.

- Multiple-response – candidates will be asked a question and have to select a number of correct answers from the list.

- Multi-part multiple-choice – candidates will be asked a series of interrelated multiple-choice style questions wrapped up into one exam question.

- Numeric entry – candidates will be asked a question that involves inputting a number into the answer box. This will usually involve computing an amount of tax due.

Multiple-choice questions are fairly self-explanatory and are the easiest of the three question types laid out above.

Multiple-response questions are slightly more difficult in that there is a bit more variability. Rather than one correct answer, there could be three correct answers so as well as knowing the information, candidates will have to correctly state how many of the listed answers are correct.

Multi-part multiple-choice questions are the most difficult of the question types as they will involve correctly answering two separate parts of a question on a common topic. The risk here is that a candidate may correctly answer the first part of the question but get the second part incorrect. Despite having the knowledge, there are no half marks so the candidate would score 0 for that particular question.

The good news with this type of question is that the two sub-parts tend to be linked. Therefore, if a student knows the answer to the first part, there is a good chance they will also know the second part.

By their nature, multi-part questions will take longer to complete than the other two question types as there is more to read and more to think about. Candidates may consider skipping these questions on the first pass through and first taking care of the easier multiple-choice and multiple response style questions.

Similarly with numeric questions there is likely to be some time required to perform the calculations which may take longer than 1.5 minutes. If this is the case, students may be well advised to leave these questions for the second pass through of the paper and make sure they get the easy points first.

This advice represents good exam technique. In the heat of an exam, a student may start to tackle a numeric question and end up wrestling with it for 5+ minutes. This would make the rest of the exam feel rushed and small errors will start to appear through not reading the questions carefully.

ACA Principles of Tax exam – revision strategy

With the exception of self-taught students, most of your revision time will be determined by your tuition provider.

As alluded to above, the vast majority of revision time for this module should be spent drilling questions. It really can’t be stated strongly enough how important question practice is for all certificate level exams.

Whilst practising a lot of questions is important, students should make sure they are making this time as useful as possible by consciously learning from their mistakes, spotting frequently asked about topics and developing methods for answering questions quickly and accurately.

My technique for question practice was to open the question bank and work through each chapter in turn. At the end of each chapter, I would mark my answers and note my percentage score in an Excel document. Make sure you circle questions in the question bank in pencil on this first run through so you can erase them and do them for a second time later.

Once I had completed the entire question bank, I would review my scores and look for any topics I was scoring less than 60% on (giving myself a 5% buffer for lucky answers). On these topics, I would return to the course notes to refresh my understanding and answer the end of chapter questions.

Once this process was complete, I would start again but this time do each chapter under timed conditions. For example, if there was a chapter of 20 questions, I would give myself 30 minutes assuming 1.5 minutes per question as discussed above. This is great practice for exam conditions and will help to train candidates to answer questions accurately in a timely manner.

As you go through this process, many of the sections will begin to feel much more comfortable. For those with recurring issues, it’s critical that you are effective at learning from your mistakes. See the next chapter on the ‘notepad method’ for more.

Some students suggest that the tuition provider (BPP, Kaplan etc) question banks are not always representative of the types of questions actually asked by ICAEW. For this reason, candidates should include full-length timed mock exams as part of their preparation spread across the revision period. Over time, you should see your scores begin to increase.

It is a good idea to practice these full length mocks in conditions as close to the final exam itself as possible. Remove all distractions, start the exam at the same time as the real exam will begin and even consider wearing the same clothes as you plan to on exam day.

This may sound like overkill, but if you do all of this in a mock and pass, you’re conditioning your brain with the knowledge that you’ve already overcome the obstacle infront of you which is great for confidence and managing exam day nerves.

To maximise productivity whilst studying consider implementing the Pomodoro technique (which is explained briefly in this Youtube video). This will help avoid burn-out when it comes to the long nights with the question bank. This can be adapted for the ACA by doing one chapter of the question bank before taking a short break and then moving on.

When I did my ACA exams, I was in a study group of three people despite previously thinking I studied best alone. The benefits a study group can bring in terms of helping each other with topics you may not be comfortable on and with sticking to a pre-agreed timetable shouldn’t be understated.

How to learn from your mistakes effectively

To make the most of your revision sessions, you need to be diligent in learning from your mistakes and making sure you don’t make the same errors repeatedly.

I’ve found using the ‘notepad method‘ to be the best way of doing this.

Here’s how it works – buy a fancy new notepad and write ‘ACA Principles of Taxation exam – mistakes’ on the front cover. Any time you make an error in mock exams, the question bank or the end of chapter questions within the course notes, write a note in your notepad explaining what the error was, why you made it, what the correct answer should be and a reminder to yourself about how this error can be avoided in the future.

This may seem time-consuming and annoying at first but this is actually a good thing. Not only are you forcing yourself to be more conscious of your repeated errors and what the correct answer is, but you’re also tapping into the power of negative reinforcement.

At the start of each revision session, read through this notepad of mistakes and you’ll gradually stop making the same errors as you become more conscious of them.

ACA Principles of Taxation exam – timing and strategy

As well as having a revision strategy, candidates should think about an exam strategy to maximize their chances of success. This strategy should be based on a few core themes: answering easy questions first, being careful not to take too much time on any single question, doing the two longer questions at the end and and ‘playing the game’ to get over 55%.

Working out how long to spend on each question and being disciplined in sticking to these timings is the single most important thing to do in this exam to increase your chances of success.

As a reminder, there are 90 minutes available to answer 40 short questions and 2 long questions. This works out at just over one and a half minutes per multiple-choice question. Skip any question that looks like it will take longer than this and pick up the easy marks first.

On your first pass-through of the exam, answer any questions that look like they are comfortably manageable within one and a half minutes and skip any difficult or multi-part questions for now.

Have a go or at least an educated guess at the very difficult questions left at the end.

Remember, once 60 minutes have passed, you should be moving onto the two long-form questions. Don’t let time management be what ruins your chances in this exam.

As with all the certificate level exams, the goal here should be to pass the exam by getting a score above 55% not by going for 100%.

Whilst a great score is impressive, it’s ultimately not important. From my direct experience, I can say with confidence that nobody is really interested in what score you get as long as you pass.

Finally, it’s worth remembering that whilst you can’t take open book resources into this exam, there is a glossary of tax rates and dates found embedded within the software. My advice is to learn the important tax rates, dates and information prior to the exam but if you’re drawing a blank or second-guessing yourself, don’t forget to consult the glossary page.

How to tackle concepts you keep getting wrong

As with any exam, a certain proportion of the content will be challenging. It may even feel at times like you can’t understand a particular item no matter how much you read the course notes and practice questions.

If you find yourself in this situation and are beginning to get overwhelmed, here are my suggestions:

- Consider ignoring it. This will only work if it’s not a central concept which is slightly more difficult in the Principles of Tax exam due to the interrelated nature of all of the content. However, if for whatever reason, you just can’t seem to remember the Corporation tax filing deadlines. Don’t spend hours trying to memorise it. Chances are, it will be worth no more than one multiple choice question in the exam. Get as much out of every minute studying as you can and move onto topics that will genuinely move the needle.

- If the topic can’t be ignored – ask either your tutor or a classmate who does understand it for help. In my experience, both tutors and classmates are more than willing to explain a concept and sometimes a new perspective can help you understand something that was previously incomprehensible.

- Consider google-ing the topic. A lot of very specific tax questions are explained online on blogs, forums or within Youtube videos which may help unlock your understanding.

Common difficult concepts in the ACA Principles of Taxation exam

Different people seem to struggle with different forms of tax. Some people will wrestle with national insurance contributions for hours on end and to be totally honest, I’m still not fully onboard with VAT accounting having qualified a few years back!

As shown above, ethics will make up around 5% of the exam via 2 or 3 multiple-choice questions. These are easy marks you don’t want to be throwing away as the questions are fairly easy to predict – evasion vs avoidance, money laundering and under-reporting of tax. Create a crib sheet and commit these points to memory.

Many students struggle with basis periods i.e. the differences between tax years (April to April) and financial years (usually January – December but varies according to the needs of the Company).

In the heat of the exam, it’s really easy to mess up tax calculations based on the time periods laid out in the question. Luckily, I have a few suggestions which should help avoid this:

- As you read the question, highlight or note down the key information – rates, dates and specific info.

- Draw out your timelines. If you stick to the volume of question bank practice I laid out above, this should be second nature by the time of the exam. Draw one timeline representing the tax year, draw another below representing the financial year and visually show the overlap.

As laid out above, administration of taxation makes up a huge 20% of the exam. This section basically consists of filing dates, specific tax rates, penalties etc. Even if you’re hopeless when it comes to computing tax, this section should be easy points.

Unlike say Corporation tax which will require genuine understanding, this ‘administration of taxation’ topic is pure memorisation. Create a visually impressive crib sheet of all the key information within this section and stick it to your wall. At the start of each revision session, cover up the crib sheet and write it out from memory. At the start, you may only be able to remember a small percentage. After a few days, you will remember most of the sheet. By the day of the exam, you will be able to write out the whole thing without looking.

A few days after the exam, you’ll have forgotten most of it again – but who cares? The exam will be passed by that point and we can look it up in a book if the information is required.

As a general rule of thumb, if you are able to identify any specific tax as a point of weakness – prioritise this section in question practice. Do 20 questions on Corporation tax and then review your answers against the back of the book, noting in your mistakes notepad any errors you make along the way. Turning your weak points into your strong points will usually be easier than you think.

Tips for exam day

Please note the below tips are duplicated from my post on ‘How to pass the ICAEW ACA Accounting exam‘ – if you’ve already read that post, you may still read the below as a reminder. These tips do work if embraced.

I often use the metaphor of a boxer preparing for a fight for how candidates should prepare for the ACA exams. Both the pre-fight preparation and the fight-day itself are equally important. If you don’t prepare properly, you won’t be successful. Similarly, if you prepare well, but perform poorly on the day, you won’t be successful.

Extending the metaphor further, the pre-fight preparation involves a solid understanding of the content through question practice, honing weak areas through rereading the source material and preparing mentally for exam day.

On fight day itself, it’s all about managing your nerves, sticking to the strategy your coach laid out and making sure you are physically ready to perform through good sleep and arriving on time.

With this in mind, I’ve laid out a few tips to help optimise your exam day performance that worked consistently for me during my exam days.

Needless to say, mastery of the content is the single most important thing. It doesn’t matter how well you sleep the night before the exam or how dialled in your pre-exam ritual is if you don’t know the content. There is nothing that will help calm exam nerves to the extent that being over-prepared will.

Being well prepared goes beyond mastering the material. You need to be well prepared on exam day to avoid unnecessary stress. Murphy’s law tells us that “everything that can go wrong, will go wrong” and that’s particularly true for exams. Your train will be late, you will go to the wrong building, your software will glitch – all of these things can and do happen.

Do whatever you can to avoid them – leave early, confirm with a colleague the location and time, ask before the exam what happens in the event of an IT issue.

Let’s talk about sleep. High quality sleep in preparation for an exam is often overlooked as a luxury rather than a necessity. However, presuming candidates have put the effort in to learn the material, good sleep is crucial to success.

The research on sleep is very clear that consistently achieving 7-9 hours of sleep a night is hugely important for memory retention. Poor sleep, even for a few nights days before the exam, has a significant impact on cognition.

Remember, getting one good night of sleep does not make up for a week of poor sleep directly preceding it. For the week before the exam, do everything in your power to get 8 full hours a night even if it means cutting those late-night revision sessions short.

Finally, a quick point on when is the right time to stop revising. My advice is to stop revising a few hours before you sleep on the night before the exam and relax for a few hours. Trying to cram material late on the night before the exam will probably not help and almost certainly make it more difficult to sleep.

In my guides on the Accounting and Assurance exams, I wrote about how effective an exam day routine is. These two exams will have given candidates some time to work out the best routine for them but by Principles of Tax, this routine should be nailed down.

This way, when exam day comes around, your brain is not busied with questions of what time should I leave? what should I wear? where do I sign in? Where can I go to relax before the exam starts?

Instead, you can calmly pass through the motions of your exam day routine allowing yourself to relax and keep the key dates locked away in your memory.

Exam day nerves will impact some people more than others and it’s each person’s own responsibility to deal with this. However, my experience may reassure you – I was very nervous at the start and by the time I got around to doing the 10th, 11th, 12th exams, I had very few nerves at all.

As with all things in life, things are only intimidating when they are new. As you get used to exams, the negative impacts of exam day nerves will gradually decrease but you’ll retain that helpful boost of adrenaline needed for optimum performance.

This is one of the great benefits the ACA provides. A few years after doing most of my ACA exams, I did the CFA level 1 exam. Despite spending hundreds of pounds on learning materials and spending hundreds of hours practising, I was nerve-free come exam day due to my acclimation to exams during the ACA and I passed the exam comfortably.

Should you take your ACA exam exemption?

Some students will be exempt from certain exams due to the credit for prior learning (CPL) system. For students who have studied accounting at university or have done similar qualifications in the past, certain ICAEW ACA modules will be a duplication of content. Rather than repeating an exam already passed, students can apply for a credit for prior learning and become exempt from the exam.

More information on ACA exam exemptions can be found here.

Whether students apply for and take exam exemptions is up to them but it’s worth noting the below advantage and disadvantage of doing so.

The big advantage is clear – students can save themselves significant study time and exam stress by taking an exemption and use that saved time for other exams they are not exempt from taking.

However, the disadvantage is that the ACA qualification is structured in tiers as discussed above. For example, students will take ‘Principles of Taxation at the certificate level and ‘Tax Compliance’ at the professional level with the knowledge and skills being built upon and compounded throughout.

This means if a student were to take an exemption from the certificate level tax exam for example – when it comes to taking the more challenging professional level exam, the underlying content will not be fresh in mind which may prove to be a difficult barrier to overcome.

As always, please remember I am an Accountant, but not your Accountant. In this post (and all of my others) I share information and oftentimes give anecdotes about what has worked well for me. However, I do not know your personal financial situation and so do not offer individual financial advice. If you are unsure of a particular financial subject, please hire a qualified financial advisor to guide you.

This article has been written by Luke Girling, ACA – a qualified Accountant and personal finance enthusiast in the UK. Please visit my ‘About‘ page for more information. To verify my ACA credentials – please search for my name at the ICAEW member finder. To get in touch with questions or ideas for future posts, please comment below or contact me here.