The ACA Accounting exam is often the first exam ACA candidates will face and the importance of getting off to a good start can’t be understated. In the most recent exam season, the pass rate for this exam was 67.8% which despite being lower than the other five certificate level exams, shows that this exam is passable for the majority of students.

To pass the ICAEW ACA Accounting exam, students will need to understand the fundamentals of double-entry accounting, repetitively practice questions, stick to a revision schedule and develop a smart exam strategy. Effectively dealing with the ‘long question’ will be key to passing this exam.

Having now passed all fifteen exams and qualified as an ACA Accountant, I look back on the Accounting exam with mixed memories. Whilst the content is certainly easier than some of the professional and advanced level exams, Accounting was the exam module I had the most difficulty with due to the amount of new information being presented having never directly studied accounting before in university or school.

With that in mind, I have created the below guide which should help anyone studying for the Accounting exam to organise a revision and exam strategy and ultimately pass this tricky first exam.

How to pass the ACA Accounting exam

Passing the ACA Accounting exam will come down to two key things. Firstly – how well the candidate prepares and their mastery of the content and secondly how well the candidate performs on exam day.

Whilst both are as important as each other, performing well on exam day is the easier part. This will simply be a case of managing exam nerves, managing the practicalities of arriving and signing in for your exam on time and being sufficiently well rested to allow for optimum performance on the day and to adhere to the planned exam strategy. See exam day tips below for more.

The difficult part is learning, revising and mastering the content. For most students and particularly those who have not studied Accounting before – this will involve actively engaging with the tuition and practising questions repetitively. There is no silver bullet here – it’s simply a case of putting the work in and sticking to a smart plan.

Success in the preparation phase will come down to the below points:

- Listening intently to the tutor and actively engaging with exercises and questions. Speak up if you don’t understand a concept or method.

- Creating a realistic but thorough revision timetable that you can stick to and that will provide enough study hours to master the content whilst also leaving some time to relax.

- Pummeling the question bank and mock exams repeatedly and learning from mistakes when you make them.

- Devise a smart strategy for exam day.

You only need 55% to pass and this fact should be your best friend when it comes to this exam. Answer all of the easy questions that you’re confident on first and decide before the exam whether you will attempt the long question before or after the multiple choice section (more on this later).

ACA Accounting exam – key information

All of the key information regarding the ACA Accounting exam is summarised below:

| Factor | Result | Notes |

| Exam length | 1.5 hours | |

| Pass-mark | 55% | |

| Pass-rate | 68.7% | At the most recent sitting, 68.7% of candidates passed the exam first time. |

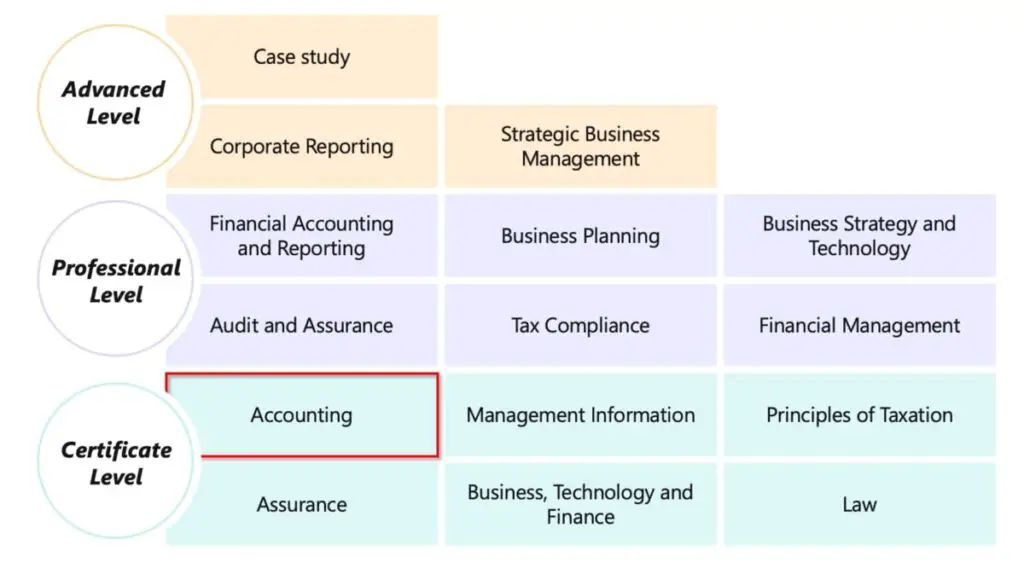

| Level | Certificate | The exams are in 3 levels; Certificate, Professional or Advanced. See the image below. |

| Structure | 1 long question (40%) 24 multiple choice questions (60%) | The long question involves producing financial statements using a pro forma template. |

| Location | Any ICAEW-approved test centre | |

| CPL | Yes | It is possible to get a ‘Credit for Prior Learning’ (exemption) for this exam. |

| Open book? | No | You can’t take notes into this exam. You can take an approved calculator & blank paper / a whiteboard depending on if taking the exam in-centre or at home. |

| Precursor to: | Financial Accounting & Reporting | This exam is a precursor to the Financial Accounting and Reporting module at the professional level (see image below) |

How the exam is structured

The ACA Accounting exam is often the first exam candidates will sit and falls within the certificate level as shown below.

The exam is made up of 24 multiple-choice / multiple-response style questions worth a total of 60% and 1 long-form question worth a total of 40%.

As the exam is 90 minutes long, this suggests you should spend 36 minutes on the long question (40% * 90 minutes) and 54 minutes on the multiple-choice stage (60% * 90 minutes). This suggests you will have just over 2 minutes per multiple choice question (54 minutes / 24 questions = 2.25 minutes per question).

This is an important point – if any single multiple-choice question is taking you longer than two minutes, move on! The single biggest reason people will fail this exam (other than not understanding the content) – is time management. If you look at a question and don’t think you can complete it in 2 minutes, mark it and come back to it and the end. Pick the low-hanging fruit first. You only need 55% to pass.

The multiple-choice questions will cover: maintaining financial records, adjustments to accounting records and financial statements and preparing financial statements.

The long question will require candidates to prepare single company financial statements, either a profit and loss statement + a balance sheet OR a cash flow statement using a pro forma template provided.

Understanding debits and credits with DEAD CLIC

Regardless of how much practice you put in, it will be very difficult to be successful in this exam without properly understanding debits and credits, the double-entry accounting system.

Learning the Dead Clic mnemonic (which I wrote about in detail here and highly recommend you read) is an important first step. Write out this mnemonic as many times as it takes until you remember it. Use the power of spaced repetition by writing it out a couple of times at the start of each revision schedule. Memorise the debits and credits of common transactions like earning revenue, paying an expense or capitalising an asset.

Debits = increases in expenses, assets and drawings.

Credits = increases in liabilities, income and capital.

ACA Accounting exam – revision strategy

With the exception of self-taught students, most of your revision time will be determined by your tuition provider.

For the Accounting exam, revision or practice outside of the classroom should focus on the following items; question bank questions, mock exams, reviewing particular topics within the course notes and updating / reviewing your mistake notepad as outlined below.

Most time outside of the classroom should be spent with the question bank, split between multiple-choice questions and the long question. The priority when it comes to studying should be the long question for two reasons. Firstly, preparing well for this more predictable question will allow students to be confident for 40% of the exam content.

If, for example, a student got 75% of the long question correct that would mean they have 30/100 points already in the bank. Only a further 25 points out of 60 would be needed to reach the 55% pass mark. This would mean you only need to answer 10 of the 24 multiple-choice questions correctly.

Secondly, by prioritising the long question, you cover the content that is tested by the 24 multiple choice questions by default.

As you begin to practice, particular sub-topics will begin to emerge as easy, manageable with a few mistakes or difficult. For the difficult topics, my advice is to go back to the course notes or study manual and re-read the section that is causing trouble.

For the manageable topics with a few mistakes, you will want to note down the mistake and the correct answer to avoid making the same mistake in the future (more on this below).

When studying, implement the pomodoro technique (which is explained briefly in this Youtube video). This will maximise your productivity and help to avoid burnout and concentration lapses.

If it suits your studying style, consider joining a study group with one or two other students. I found this immensely helpful, not only does it help keep you accountable to study in line with your revision timetable, you and your study group can help cover each other’s weaknesses.

Beyond the above points, the most important thing is to listen and implement the advice of your tutors. They have likely taught this exam module several times and are well placed to advise on the best ways to revise and practice.

How to learn from your mistakes effectively

To make the most of your revision sessions, you need to be diligent in learning from your mistakes and making sure you don’t make the same errors repeatedly.

I’ve found using the ‘notepad method‘ particularly effective for this.

Here’s how it works – buy a nice new notepad and write ‘ACA Accounting exam – mistakes’ on the front cover. Any time you make an error in mock exams, the question bank or the end of chapter questions within the course notes, write a note in your notepad explaining what the error was, why you made it, what the correct answer should be and a reminder to yourself about how this error can be avoided in the future.

At the start of each revision session, read through this notepad of mistakes and you’ll gradually stop making the same errors as you become more conscious of them.

ACA Accounting exam – timing and strategy

As well as having a revision strategy, candidates should think about an exam strategy to maximize their chances of success. This strategy should be based on three core factors: doing the long question first, being careful not to take too much time on any single question and ‘playing the game’ to get over 55%.

Alongside the right preparation, doing the long question first can put candidates in a great position for the rest of the exam, particularly if they manage to achieve a good score on that 40% portion.

Working out how long to spend on each question and being disciplined in sticking to these timings is the single most important thing to do in this exam to increase your chances of success.

As a reminder, spend 36 minutes on the long question and 54 on the multiple-choice questions. This works out at just over two minutes per multiple-choice question. Skip any question that looks like it will take longer than this and pick up the easy marks first.

The goal here should be to pass the exam by getting a score above 55% not getting a score in the 90s. Speaking from experience, nobody really cares what score you get on any specific exam and the fact that I couldn’t accurately recall my score on this exam should be a testament to that fact.

This should be a comforting thought to candidates to know they only need to do slightly better than score one out of every two points and they can build their exam strategy around this knowledge. Equally important will be avoiding complacency.

The importance of the ‘long question’ in the ACA Accounting exam

I spoke in some detail above about the importance of the long question and how performing well on this question would put candidates in a great position to pass this exam.

The long question in this ACA accounting exam is unique among the certificate level exams which are predominantly multiple-choice. This presents both an opportunity and a threat.

The difficulty is that this long question could be either a profit & loss + balance sheet preparation question or a cash-flow preparation question which unfortunately means candidates need to prepare for both eventualities.

The opportunity here is that regardless of which long question you get, the answer is very formulaic with little variability. This means that if an exam candidate can repeatedly practice the long question, by the time the exam comes around, they can go through the gears and pick up most of the points on this question within the 36 allotted minutes.

To aid with this preparation, a top-tip is to prepare a profit & loss and balance sheet or cash flow pro forma within Excel and print this out to save time writing it from scratch each time.

How to tackle concepts you keep getting wrong

As with any exam, a certain proportion of the content will be challenging. It may even feel at times like you can’t understand a particular item no matter how much you read the course notes and practice questions.

If you find yourself in this situation and are beginning to get overwhelmed, here are my suggestions:

- Consider ignoring it. This will only work if it’s not a central concept. This may sound counter-intuitive but if for example, you are really struggling on ‘suspense accounts’ and just can’t seem to get it, it may not be the worst idea to forget it. Remember, you only need 55% to pass the exam and suspense accounts are unlikely to make up more than 5% of the total points. Does it not, therefore, make sense to avoid spending hours trying to understand this concept when that time could be spent on more useful revision?

2. If the topic can’t be ignored – ask either your tutor or a classmate who does understand it for help. In my experience, both tutors and classmates are more than willing to explain a concept and sometimes a new perspective can help you understand something that was previously incomprehensible.

3. Consider google-ing the topic. A lot of very specific accounting questions are explained online on blogs, forums or within Youtube videos which may help unlock your understanding.

Common difficult concepts in the ACA Accounting exams

Having asked a few students who have recently passed the Accounting exam which topics they found the most difficult, a few key themes began to emerge.

Firstly, small errors around pro-rating numbers were common. For example, if there was a question around purchasing a £100 asset with a useful economic life of 5 years, most students would correctly identify that there would be £20 of depreciation expense each year. However, if the asset was only purchased halfway through the year, the depreciation charge would need to be prorated for the 6 months so only £10 would hit the profit and loss statement.

The key here is a careful reading of the question, noting down important details including the date of purchase as you go. This is often easier said than done and will come with repeated practice.

Many students struggle with the accounting treatment over disposing of assets and the resultant profit/loss on disposal and I remember feeling the same way at the time. I think this is a good example of the theory being more complex than reality. When you look at the course notes, this seems like a complex string of double entries.

However, in reality, all you’re dealing with here is:

- Debit cash (for whatever amount of money you receive for the asset)

- Credit PPE assets (for the book value of the asset you are selling)

- Post the difference to the profit and loss statement. If you receive more cash than the asset is worth, it’s profit (a credit). If not, it’s a loss on disposal ( a debit).

Tips for exam day

I often use the metaphor of a boxer preparing for a fight for how candidates should prepare for the ACA exams. Both the pre-fight preparation and the fight-day itself are equally important. If you don’t prepare properly, you won’t be successful. Similarly, if you prepare well, but perform poorly on the day, you won’t be successful.

With this in mind, I’ve laid out a few tips to help optimise your exam day performance that worked consistently for me during my exam days.

Needless to say, being well prepared is crucial. It doesn’t matter how well you sleep the night before the exam or how dialled in your pre-exam ritual is if you don’t know the content. There is nothing that will help calm exam nerves to the extent that being over-prepared will.

As well as being well prepared on the exam content, it also pays off to be well prepared practically speaking. Things go wrong in exams so have contingencies planned. If you’re doing your exam from home as many are at the moment, have a backup plan if your wifi cuts out e.g. a mobile phone hotspot connection. Take an earlier train into the exam centre in case there are signal failures (which there seem to be most days).

As Accounting will be most candidates first ACA exam, the exam day experience will be new which can add a layer of stress. To counter this, arrive early, sign in and find out details like which room you’ll be sitting in good time.

My next tip may sound a bit like something your Grandmother would say but with age comes wisdom. Get a good night’s sleep for the week leading up to the exam. One good sleep does not make up for poor sleep every other night. Get your 7-8 hours per night. Believe me, this will have a bigger impact than another hour of revision late at night. The research is very clear that good sleep is crucial for memory retention which is a big part of all of the ACA exams, particularly the multiple-choice focused certificate level.

Next up is the all-important exam routine. Obviously, this will vary by whether you’re taking exams in person or at home online. Regardless, develop a routine, stick to it for each exam and it will serve you well. Here are the highlights from mine:

- 8 hours sleep each night for the week leading up to the exam

- The night before the exam – I write down timings going backwards from the start time of the exam. E.g. 9.00 am start the exam, 8.00 am arrive at the exam centre, 7.15 am leave the house, 6.30 am wake up. Assume your commute will be delayed and plan accordingly. Don’t let your hard work go to waste by poor time management.

- Arrive at the exam centre at least an hour before the exam is due to start. This may mean an early start and going to sleep earlier than you normally would but it’s only 15 times you’ll need to do this.

- Sign in and know exactly where you’ll be sitting the exam.

- Find a quiet place and relax until 10 minutes before the exam starts. Flick over your notes if helpful, but nothing too strenuous.

- Take your seat & speak up if any obvious issues with technology or exam materials.

This was my routine but we all work differently and something less regimented may be better suited to some individuals. If you’re the type of person who’s often late, make a plan to ensure you’re not late for the exam. Nothing will make you lose faith in yourself faster than messing up an exam you prepared hard for because you lack time management skills.

Finally, a quick point on when is the right time to stop revising. My advice is to stop revising a few hours before you sleep on the night before the exam and relax for a few hours. Trying to cram material late on the night before the exam will probably not help and almost certainly make it more difficult to sleep.

Should you take your ACA exam exemption?

Some students will be exempt from certain exams due to the credit for prior learning (CPL) system. For students who have studied Accounting at university or have done similar qualifications in the past, certain ICAEW ACA modules will be a duplication of content. Rather than repeating an exam already passed, students can apply for a credit for prior learning and become exempt from the exam.

More information on ACA exam exemptions can be found here.

Whether students apply for and take exam exemptions is up to them but it’s worth noting the below advantage and disadvantage of doing so.

The big advantage is clear – students can save themselves significant study time and exam stress by taking an exemption and use that saved time for other exams they are not exempt from taking.

However, the disadvantage is that the ACA qualification is structured in tiers as discussed above. For example, students will take ‘Accounting’ at the certificate level, ‘Financial, Accounting and Reporting’ at the professional level and ‘Corporate Reporting’ at the advanced level with the knowledge and skills being built upon and compounded throughout.

This means if a student were to take an exemption from the Accounting exam for example – when it comes to taking the difficult Financial Accounting and Reporting exam, the underlying content will not be fresh in mind which may become a difficult obstacle to overcome.

As always, please remember I am an Accountant, but not your Accountant. In this post (and all of my others) I share information and oftentimes give anecdotes about what has worked well for me. However, I do not know your personal financial situation and so do not offer individual financial advice. If you are unsure of a particular financial subject, please hire a qualified financial advisor to guide you.

This article has been written by Luke Girling, ACA – a qualified Accountant and personal finance enthusiast in the UK. Please visit my ‘About‘ page for more information. To verify my ACA credentials – please search for my name at the ICAEW member finder. To get in touch with questions or ideas for future posts, please comment below or contact me here.