A lifetime ISA is in many cases an interesting shortcut to building wealth, regardless of whether your goal is to save for a first home or for retirement. We’ll get into the details of what a lifetime ISA (LISA) actually is throughout this post but what’s important to know from the get-go is that using a lifetime ISA can supercharge your investment returns due to the ‘free money’ the government offers.

Lifetime ISAs (LISAs) are a form of ISA which allows people to save for retirement or their first home. Each year, the government will contribute 25% of whatever you contribute up to a maximum of £4,000, meaning the government could give you £1,000 per year in the best case scenario.

If the thought of this ‘free money’ gets you excited, you’re not alone. Whilst the maximum benefit of £1,000 a year isn’t necessarily life changing money, if you invest £4k a year, this gives you returns of 25% on your investment which is far superior to most other investments available to the average investor.

Should I invest into a Lifetime ISA (LISA)?

Investing into a Lifetime ISA (LISA) is a good idea for most people, regardless of if you plan to use the money for your first home or for retirement.

For a bit of background, the LISA is basically just the latest ISA (individual savings account) product available which allows you to save for your first home or retirement. The interesting part is, the government add 25% to all of your contributions up to a total of £4,000. That means if you invested £4,000 over the course of a year (or just £333 per month) – the government would gift you £1,000 over the course of the year.

This 25% return on investment (ROI) is much better than the returns you would expect to see elsewhere with cash accounts rarely offering above 1% returns and even with a portfolio of stocks, 10% returns a year would be seen as a very good return.

Simply based on the fact that you can get excellent returns on your first £4,000 invested suggests to me that the lifetime ISA should be the thing you max out first each year. For instance, if you are able to save and invest £10k per year, the first £4k would go to the LISA and the remaining £6k would go to your other investments whether that be stocks and shares, bonds, cash or other.

The only exception to this is if you’re involved in a project in which you expect returns greater than 25%, in this case, your investment may be better spent on that.

Clearly using your LISA for your first home will allow you to buy considerably earlier. For example, if your deposit on a new property was £20,000 and you are able to save £4,000 a year, it would take you 5 years to save the full deposit amount. Whereas with a LISA, it would only take 4 years (and that’s before even considering the investment returns on the capital you and the government have contributed)

If you’re already a homeowner, the LISA is still a great tool for retirement simply because of the great rate of return you can achieve. As long as you’re willing to lock your money away until you’re 60 years old, you may as well capitalise on the government’s £1,000 per year contribution.

What do I need to know about a LISA for my first home?

When planning to invest into a LISA for your first home, there are a couple of criteria you need to be aware of:

- Lifetime ISAs can only be used on property for first time buyers. This means if you’ve ever owned a home (even outside of the UK) you will not be able to use your LISA.

- The maximum value of your new home you can purchase with a LISA is £450,000. If you attempt to buy a home which is worth more than this, you won’t be able to use your LISA balance.

- You have to buy with a traditional mortgage. There are certain rules around using things like buy-to-let mortgages which would not be possible whilst using your LISA.

- The home you purchase with your LISA balance has to be for you to live in – not a home you plan to rent or only stay in part of the year.

Although these rules may sound stringent, for most people, these shouldn’t be a big issue. When you are in a position to buy your first home, simply contact your LISA provider (discussed further below) and they will assist you with the details over using your LISA balance.

For those of you who live in an expensive city, you may find it difficult to purchase a home under £450,000 that is suitable. If you think this may apply to you, before investing into a LISA, make sure you have considered the possibility that if you end up buying a more expensive home, you will not be able to access your LISA funds (without penalty) until you are 60.

Is using a LISA to save for retirement a good idea?

If you are already a home-owner or aren’t eligible to use your LISA for a first home, using the LISA to save to retirement is another great option.

Unlike a normal ISA which allows you to withdraw your money tax-free at any time, with a LISA you are only able to withdraw your money at age 60 or after.

An interesting point to note on this is you can only contribute (and claim the government’s 25% top-up) up until age 50. So between 50 and 60, your LISA value sits in the account either gaining interest (cash ISA) or investment gains / losses (stocks and shares ISA).

Although this reduces the control you have over your money, it is still worth contributing to a LISA in many cases simply due to the attractive returns you will receive due to the 25% government bonus. A good strategy for many may be to save £4k per year into your LISA so that you can claim the maximum bonus and then save anything else you are able to into an ordinary ISA so that your money is more flexible. This way, you make the most of both systems.

It’s also worth noting that you are not able to contribute more than £4,000 per year to your LISA, so you will never be in a situation where you are contributing money to your LISA and locking it away until retirement (or 1st home) without getting paid the government bonus.

Who is eligible for a LISA?

To be eligible for a LISA in the UK, you need to be between the ages of 18-40 when you first open the LISA and be a UK resident. You can get a LISA at banks, building societies or investment providers who offer the product.

It is also worth reiterating that you can only contribute to your LISA and receive the governments 25% bonus up until you are 50 years old.

You are also able to withdraw your money out of your LISA tax-free if you have been diagnosed with a terminal illness, regardless of age or purpose.

If you withdraw money from your LISA without being terminally ill, over 60 years old or using it to purchase your first home, you face withdrawal charges which is 25% of the amount you withdrew. This is more than the government’s initial 25% bonus as shown below.

Let’s say you invested £4,000 a year for 3 years in a row and each year you received the governments 25% bonus (£1000 a year, so £3000 in total. You now have a total LISA value of £15,000 (£4,000 contribution * 3 years + £1,000 government bonus * 3 years).

If you withdrew that whole £15,000 when you were 40 years old and didn’t use or it on your first home (and hadn’t been diagnosed as terminally ill), you would be charged 25% of that balance. £15,000 * 25% = £3,750. As you can see, the charge of £3,750 is more than the government contributed via bonus payments (£3,000) – so you do need to be careful to not withdraw your LISA savings incorrectly and face this fine.

*The withdrawal penalty is currently 20% due to the ongoing COVID-19 pandemic but is expected to return to 25% on 6th April 2021.

How do I claim my government 25% bonus?

The 25% bonus may sound appealing to some of you but let’s talk about how this money actually finds its way into your account.

Whilst this varies a little by provider, how this usually works is that your bonus is calculated based on the contributions you make to your LISA on a monthly basis (from the 6th of the month to the 5th of the following month so it’s aligned with the UK tax year which is the 6th April to the 5th April the following year) and the bonus will hit your account roughly two months after your contribution was made.

Let’s say you contributed the whole £4,000 into your LISA on the 10th January, your bonus would be calculated as £1,000 and this money would be deposited into your account typically two months after your initial deposit, so by the 10th March. This will all be automated by your LISA provider and there shouldn’t be any extra hoops you will need to jump through.

If you don’t receive your government bonus payment within 3 months of contributing money to your LISA, I would contact your LISA provider and query this.

Assuming you contribute the full £4,000 each year between the eligible ages of 18 and 50, you would receive bonus payments totalling £32,000 from the government and your total LISA would be worth £160,000 at age 50. For those who can afford to save and contribute £4,000 a year, making full use of this scheme is a great way to build your wealth and maximise what you get from the government.

What is the difference between a cash LISA and a stocks & shares LISA?

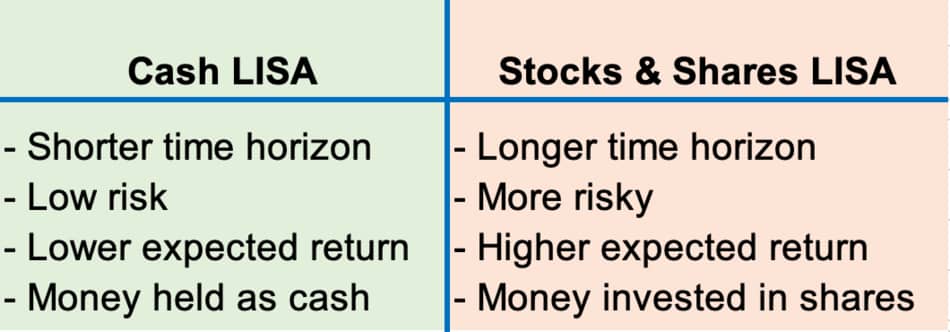

It is worth noting that you can choose to invest into a cash LISA or a stocks & shares LISA with the primary difference being what your money is invested in (cash or company shares).

When deciding between the two, it is worth considering your time horizon, risk appetite and investment goals.

As an example, if you’re saving for your first home which you project to be only three years away, your time horizon is clearly short and you’re going to withdraw your savings soon so a cash LISA may be more suitable as you don’t want to be in the position where you are withdrawing all of your cash from a stocks and shares LISA at a point in time where the market is low.

However, if you’re using the LISA to save for retirement, you likely have 20 – 40 years to go before withdrawing your money, so you may prefer to invest into a stocks & shares LISA and potentially gain from years of investment gains.

When choosing we also need to consider the risk reward equation which states that the higher the risk, the higher the reward on average. A cash account is very low risk but you are therefore rewarded with low interest rates. On the other hand, investing into company shares (equities) can be risky but you are more likely to be rewarded with higher rates of growth.

If your goal is growth, a stocks and shares LISA is a great option. Not only do you receive the 25% return in the form of the government bonus but you will also receive the investment returns on the Companies you invest into (in the forms of dividend payments and investment growth as your investments share prices increase).

This article from Nerdwallet.com suggests that “The stock market has historically returned an average of 10% annually, before inflation. However, stock market returns vary greatly from year-to-year, and rarely fall into that average.” – if we take this assumption for our own stocks & shares LISA’s, our first year return on investment starts to look very promising:

| Your contribution: | Government bonus: | Total LISA value: | Investment returns (10%) | Year-end value |

| £4,000 | £1,000 | £5,000 | £500 | £5,500 |

As you can see, from an annual contribution of £4,000 and assuming stock market returns of 10%, our total LISA becomes worth £5,500 after a year. This is an annual return in the first year of 37.5% (£1,500 total returns / £4,000 initial investment) which is a staggering ROI and far superior to what many of the biggest investors in the world are able to achieve consistently.

Although this ROI decreases after the first year in total, you will achieve returns of 37.5% on every new £4k you contribute assuming 10% stock market growth.

It’s also worth mentioning that when saving for retirement, using your company pension may be the better first choice for your money. Not only does your pension contribution come out of your gross salary (and therefore save you from paying income tax on that amount until pension age) – your employer is legally obliged to contribute a certain % to your pension (with many employers offering matches exceeding the legal minimum). Making use of this match will often result in an overall return in excess of what the LISA can offer.

Which providers offer a LISA?

For a full summary of the most cost-effective providers of both cash and stocks & shares LISA’s, take a read of this article on Money Saving Expert.

In short, the best providers for a Cash LISA as per the above article are the Nottingham Building Society (1.25 AER) and Moneybox (1% AER).

The Money Saving Expert article recommends AJ Bell, Hargreaves Lansdown and Nutmeg as good options for a stocks and shares Lisa.

Can I get a LISA if I already have an existing ISA?

Even if you have pre-existing cash ISA and stocks & shares ISA, you can still get a lifetime ISA. You can open more than one ISA in a tax year. For example, in your 19th year, you may choose to open both a lifetime ISA and a stocks and shares ISA.

Can I invest into my LISA and a different ISA in the same tax year?

You can contribute to both a LISA and a stocks & shares or cash ISA in the same tax year. The only caveat is, you can’t exceed the £20,000 a year limit across all of your ISA products together (you don’t get £20,000 per ISA).

It’s also worth noting, you can’t invest into two different lifetime ISAs or two different cash / investment ISAs in the same year. For example, you may open a cash LISA when you’re 19 and then open another a stocks & shares LISA when you’re 30. Whilst it is fine to have two open LISA’s, you could only invest into one or the other each year.

Conclusion

Ultimately, a lifetime ISA is a great choice for many people who are either saving for their first home or willing to lock the money away until they are 60. Making use of the governments generous 25% bonus will be in most people’s best interest and will allow them to earn a return on investment that is far greater than they may be able to achieve otherwise.

Setting up either a cash or stocks & shares LISA is fairly simple and the article linked to above lays out the best providers for both types. Receiving your government bonus money will be automated within the provider websites meaning all you have to do is set up an account and remember to contribute each year to make use of this deal.

As always, please remember I am an Accountant, but not your Accountant. In this post (and all of my others) I share information and oftentimes give anecdotes about what has worked well for me. However, I do not know you personal financial situation and so do not offer individual financial advice. If you are unsure on a particular financial subject, please hire a qualified financial advisor to guide you.

This article has been written by Luke Girling, ACA – a qualified Accountant and personal finance enthusiast in the UK. Please visit my ‘About‘ page for more information. To verify my ACA credentials – please search for my name at the ICAEW member finder. To get in touch with questions or ideas for future posts, please comment below or contact me here.

Trackbacks/Pingbacks