Knowing how much to contribute to your pension each month can be a difficult decision, particularly if you don’t understand all of the information you need when it comes to both workplace and private pensions (also known as “SIPPs”). In this blog post, I’ve given my view on what the optimal pension contribution is and done some research to provide you with all of the information you need to know when it comes to understanding pensions.

A good employer pension contribution match will be at the 1:1 ratio or above. For example, if you contribute £200 to your pension, your employer will at least match this contribution. Employees can expect an employer contribution rate of anywhere from the minimum 3% right up to 15%+ in some cases.

Many people also invest in a personal pension, known in the UK as a self-invested personal pension (SIPP). For the purposes of this post, I will be talking about these SIPP’s and also defined contribution workplace pensions. Read on for the next 10 minutes and I can guarantee you’ll gain a strong basic understanding of pensions and know exactly how much you should be contributing each month.

How much should you contribute to your pension each month

A workplace pension is a way of saving for your retirement whereby each month both you and your employer contribute money to your pension. A good general rule of thumb is to contribute as much as you can afford in order to take advantage of the best contribution match your employer offers.

There is no exact answer to this question, I can’t for example say you should be investing £200 a month into your pension and call it a day because it’s highly dependent on your specific situation. When deciding how much to contribute to your pension, you need to consider the match your employer is willing to offer, how much you can afford to lock away until retirement age, if you have any use for the money not kept in a pension account i.e. you are saving for a home deposit and the opportunity cost of investing into your pension rather than a different investment which may be more profitable.

To secure a prosperous retirement, a good rule of thumb is to contribute as much as you can afford to each month into your pension. What you are striving for in your workplace pension is to contribute the optimum amount which enables you to take advantage of the best match your employer will offer.

For example, if you contribute 5% of your gross salary, your employer may match this with a further 3%. However, if you contribute 6%, your employer may be willing to contribute 5%. Clearly, this second option is the one where you can maximise the amount of money your employer contributes and the one that benefits your overall wealth the most. So if you aren’t contributing the amount to your pension which entitles you to the most optimum employer match, you should make sure you have a good reason to be missing out on what is essentially free money.

On this blog, we are all interested in the Financial Independence, Retire Early (FIRE) community and this brings about extra considerations when thinking about your pension. If you’re hoping to retire at an early age, say for the sake of example at 40 years old, you need to carefully plan both the amount you’re entitled to at pension age (currently 55 in the UK) and how you’re going to bridge the gap between ages 40 and 55.

What exactly is a workplace or employer pension?

Put simply, a pension is simply a pot of cash that you (and your employer in the case of workplace pensions) contribute to in order to allow you to pay for your retirement when you can no longer depend on your workplace salary. A pension typically provides a number of tax benefits and the pot of money tends to be invested into specific retirement-focused funds which are usually made up of a mixture of asset classes including equities, bonds and property.

As of 2008, the Pensions Act ensured that every employer in the UK had to provide staff with a workplace pension scheme and contribute towards it which the employee can opt-out of at their discretion. There are two primary types of workplace pensions in the UK; defined benefit and defined contribution.

Defined benefit pension: Also sometimes referred to as ‘final salary pension’ is a type of pension scheme where employers pay the members a proportion of their salary on their last year as an employee of the Company, with this amount then being paid every year between the retirement date and death. This type of scheme is becoming increasingly uncommon and most employers in the modern-day instead offer defined contribution pension schemes.

Defined contribution pension: How much this type of pension leaves you with at your retirement date is dependent on the amount contributed by both the employee and employer and also how the underlying investments perform. Employees in the UK will be auto-enrolled into their employer’s pension scheme and have the option to opt-out if they don’t want to contribute (which in my opinion is inadvisable).

The pension scheme is typically run by an independent pension manager which is independent of your employer and have autonomy in terms of how they invest your money. There is, in some cases, the option to change what your pension is invested into to better match your risk profile and investment goals. The contributions and associated tax benefits are typically taken care of by your employer’s payroll department which helps make contributing to your pension a simple exercise.

As well as formal workplace pensions, there are also personal pension plans which include SIPP’s whereby the individual can contribute and choose the underlying investments as they see fit. Like workplace pensions, these are also tax-advantaged and investing in them can save you significant money on your tax bill.

Should I be investing into a pension?

The answer here should be fairly clear – Yes! Unless you are in very specific circumstances such as having 3 months to live, you should almost certainly be investing in a pension.

Contributing to your workplace pensions allows you to access “free money” in the form of your employer’s contributions. For example, if you earn £50,000 per year and contributed 5% to your pension. Your employer may match that contribution and also contribute 5%. Therefore, your employer would contribute £2,500 a year to your pension which essentially takes your annual income from your employer to £52,500 albeit with the caveat that you can’t access this bonus money until you’re 55 without incurring tax penalties.

Further still, investing in a workplace pension will ensure you save a set proportion of your monthly income and invest it which means you will build wealth over time through capital appreciation and the payment of dividends. If you read my recent post on the importance of investing at least £100 a month (linked here) you’ll see how simply contributing to your pension can give you a shortcut to achieving this monthly investing amount.

How to make the most of the employer match for your pension

As of April 2019, the minimum pension contributions are 5% employee contributions and 3% employer contributions. Of course, every employee has the option to opt-out completely but outside of that, you want to contribute the percentage which gets the best employer match.

The minimum, for example, is 5% employee, 3% employer which means for every 1% you contribute, your employer will contribute 0.6%. Let’s say, for example, if you were willing and able to afford to increase your contribution to 7%, your employer may offer a match of 5%. Now for every 1% you contribute, your employer now contributes 0.71% (5% divided by 7%). As you can see in this situation, by increasing your contribution you have got your employer to provide a better match and earn yourself more of this “free money”.

It’s also worth considering, the more you (and your employer) contribute at an early age, the more years your investments can benefit from compounding and the greater level of wealth you will have built by the time you retire.

Putting this simply, you want to contribute the largest amount to your pension you can afford to (whilst still being able to pay your monthly expenses) whilst taking advantage of the best match your employer offers.

Liquidity vs wealth-building

Given your employer may offer you larger percentage matches as you contribute a greater proportion to your salary, you may find yourself asking – what’s stopping me from contributing a truly large percentage of my salary like 50% to get all of the extra money from my employer than I can.

Well, two things as it turns out. Firstly, most employer matches plateau after a certain level i.e. the contribution matches will increase to a certain level before easing off.

As a simple example, your employer may be willing to match your contributions up to 10% but after this point, employer contributions are capped at 10%. Returning to the maths we looked at above, up to 10%, for every 1% you contribute, your employer contributes 1% as well – which is a strong 1:1 match. However, if you wanted to contribute 20% of your salary, your employer would cap out at 10% and your match would decline to 1: 0.5 which is no longer the optimum ratio.

Secondly, you need to consider your liquidity which basically means the amount of assets you have that are easily accessible i.e. in cash form. If you contribute too much to your pension, you will have locked away a large part of your money until retirement age which may mean you don’t have cash for important things like an emergency fund, a house deposit or your basic living costs.

When deciding on how much to contribute to your pension each month, you need to consider the trade-off between building wealth in your pension and maximising your employers match vs. your liquidity and cash needs to cover your monthly expenses.

What if i’m self-employed

The situation is slightly different if you’re self-employed as you miss out on one of the big perks of being employed – employer contributions. Despite that, this shouldn’t stop you from investing in your pension. Rather than a workplace pension, the self-employed will usually set up a personal pension plan where the individual gets to choose how much they contribute and what assets their money is invested in depending on what the pension provider offers.

Much like workplace pensions, these too are tax-advantaged as the provider will claim tax relief at the basic rate of tax on your behalf from the government and add it to your pension savings.

There are two main types of pension plans that are used by the self-employed; ordinary personal pensions and self-invested personal pensions (SIPPs) as mentioned above. The main difference is simply the level of control the individual has over their investments, with SIPP’s typically offering a wider range of possible investments.

Whilst you can freely save as much into either a personal pension or a SIPP as you please, there is a limit on the amount you can contribute that will get tax relief. For the current year (2020/2021) that limit is £40,000. However, you are able to carry forward any unused allowance from the previous three years meaning if you hadn’t contributed to a personal pension for three consecutive years, in the 4th year you would be able to contribute £160,000 (£40,000 * 4 years).

What is a SIPP and should I be contributing to this too?

As mentioned above, a SIPP is basically just a ‘wrapper’ that you invest your income into up until your retirement date, at which point you start to draw on your pension. Unlike most workplace and ordinary personal pensions, SIPPs allow you far greater autonomy in terms of the investments which allows you to adjust your asset mix i.e. your split of equities, bonds and other asset classes as you best see fit.

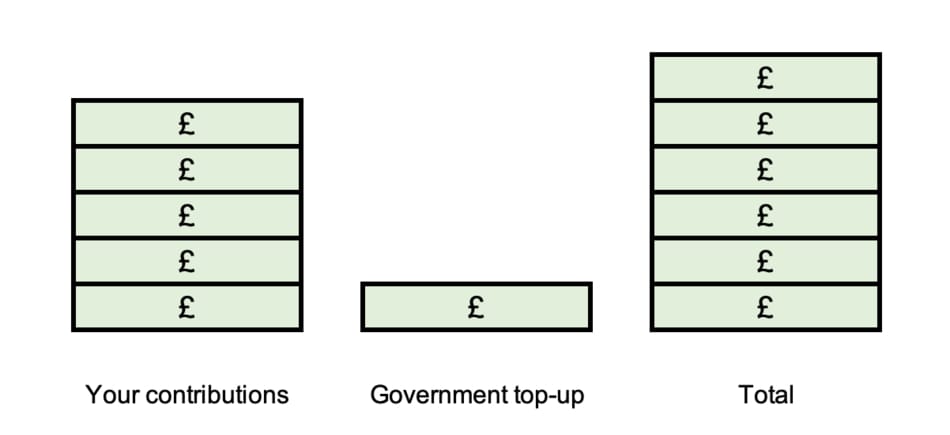

A SIPP works in the same way as the personal pension plans mentioned above in so far as the government will top up your contributions by 20% (the basic tax rate) as tax relief. If your income puts you into the higher or additional tax rate, a SIPP will allow you to claim back more within your annual tax return.

With a SIPP, accessing your money works in a similar way to a workplace pension as you can access your savings once you reach 55 years of age without incurring tax penalties. Once you hit your 55th birthday, you can start to draw on your pension and can take the first 25% of the pot tax-free with the rest being taxed as income.

If you’re employed and already investing a reasonable sum into your workplace pension, there is no real need to invest into a personal plan as well unless you find yourself in the enviable situation of having excess income burning a hole in your pocket which you are looking to invest – in this case, the personal pension or SIPP route may be a wise idea particularly if you have already maxed out your ISA contributions for the year.

What does an ISA have to do with how much you contribute to your pension each month?

An ISA is an individual savings account that, like a SIPP, is a tax-advantaged savings account but unlike a SIPP isn’t necessarily used for retirement. You can only contribute to one ISA of each type (cash, LISA, stocks & shares etc) in any given tax year which has a combined total annual allowance of £20,000 for the current tax year (2020/2021).

For more on the rules around ISAs check out my post on Can I Pay Into Two ISAs In The Same Tax Year?

ISA’s come in many different forms, with the most common being the cash ISA and the Stocks and Shares ISA where the words before ISA are what you will be investing in. Regardless of which type you invest into, the main benefit is you can earn interest or capital appreciation on your investments without paying any tax on this income.

Whilst these savings accounts may not directly relate to your pension, they are indirectly related in two different ways:

Firstly, the balances you accumulate within ISA’s over the years may make up part of your retirement strategy. Unlike a pension, you do not have to wait until you are 55 to access your money saved in ISA and can withdraw it as and when you please but many people will use the ISA as another way to save for retirement using the even greater tax benefits the ISA offers.

Secondly, an ISA impacts your pension contributions in terms of the timing of your savings. Due to the added flexibility and tax benefits associated with an ISA, most people choose to max out their ISA allowance (£20,000 p/a in the current year) before investing into their personal pension.

Both ISA’s and SIPP’s can usually be invested using a single provider such as Hargreaves Lansdown, Vanguard or AJ Bell all of which have their pro’s and con’s depending on your individual situation. I will be doing sign-up tutorials and investment platform reviews on these websites in upcoming posts.

Conclusion

Your pension is simply a tax advantaged account in which you can contribute and save money for your retirement. The three main types are the workplace pension, the personal pension and the self invested personal pension (SIPP).

For workplace pensions, as well as making your own contributions, your employer is legally obliged to contribute as well. To take advantage of this, you want to contribute to your pension each month the maximum amount you can afford in order to secure the best match.

If you are self-employed, you should still consider investing into either a personal pension plan or a SIPP, where the main difference is the breadth of options you are able to invest in. This has significant tax benefits whereby the government will top up your contributions by the basic tax rate (20%). I.e. if you contributed £100, the government would top this up by a further £20, making your total pot worth £120.

ISA’s are a seperate and more flexible tax-advantaged savings account, however, they typically make up part of peoples retirement plans and are invested into as a priority over your pension due to the easier access to your invested money and the greater tax benefits.

Please note nothing in this article constitutes individual or personal finance advice. I have laid out the factors worth considering when deciding how much to contribute to your pension each month.

As always, please remember I am an Accountant, but not your Accountant. In this post (and all of my others) I share information and oftentimes give anecdotes about what has worked well for me. However, I do not know you personal financial situation and so do not offer individual financial advice. If you are unsure on a particular financial subject, please hire a qualified financial advisor to guide you.

This article has been written by Luke Girling, ACA – a qualified Accountant and personal finance enthusiast in the UK. Please visit my ‘About‘ page for more information. To verify my ACA credentials – please search for my name at the ICAEW member finder. To get in touch with questions or ideas for future posts, please comment below or contact me here.