There is a lot of confusion surrounding the terms “accounting” and “accountancy.” Some people use them interchangeably, while others think they are two completely different processes.

Accounting is the process of recording, classifying, and summarizing financial transactions to provide information that is useful in making business decisions. Accountancy, on the other hand, is the profession that provides professional services related to accounting.

So whether you’re interested in becoming an accountant, or looking to hire an accountancy firm for your business, it’s important to understand the distinction between these two terms. In this blog we will look at the many aspects of financial services and come to understand the differences between them.

What is the difference between Accounting and Accountancy?

The terms “accounting” and “accountancy” are often used interchangeably, but there is a distinct difference between the two. Accounting is the process of recording, classifying, and summarizing financial transactions to provide information that is useful in making business decisions. Accountancy, on the other hand, is the profession that provides this type of financial information. In other words, accounting is the process of keeping track of financial transactions, while accountancy is the profession that provides services related to this process.

While both accounting and accountancy are essential for businesses, they can serve different purposes. Accounting provides the raw data that businesses need to make informed decisions, while accountancy interprets this data and provides guidance on how to use it effectively. As a result, businesses need both accounting and accountancy services in order to operate effectively.

If you are looking to pursue a career in this field then the term “accountancy” refers to the study, principles and theory of accounting, while the term “accounting” is more commonly used for practices and procedures in application.

What actually is ‘Accounting’?

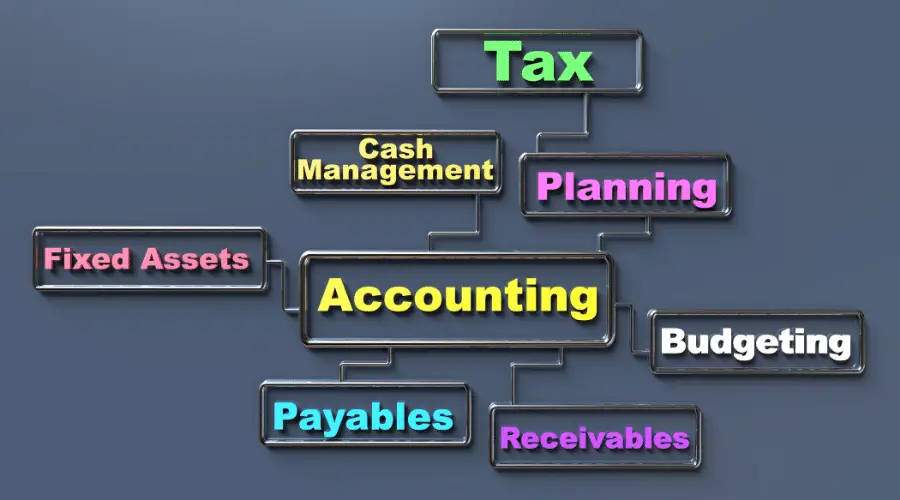

When most people hear the word “accounting,” they think of bookkeeping or preparing tax returns. However, accounting is actually much more than that. In its broadest sense, accounting is the process of recording, categorizing, and summarizing financial transactions to provide information that can be used to make decisions. This information is often presented in the form of financial statements, which show a company’s assets, liabilities, and equity. Accounting also includes the process of auditing, which is used to verify the accuracy of financial statements. By understanding accounting, individuals and businesses can make informed decisions about how to save and spend money. As a result, accounting plays a vital role in our economy.

Is the profession known as ‘Accountancy’ or ‘Accounting’?

While the two terms are often used interchangeably, strictly speaking, “accountancy” is the more accurate term for the profession as a whole.

What is the difference between bookkeeping and accounting?

Though the terms ‘accounting’ and ‘bookkeeping’ are often used to describe the same process, they actually denote two different aspects of financial record-keeping. Bookkeeping is the process of recording financial transactions, while accounting is the interpretation and analysis of those records to provide information about a business’s financial health.

Accounting is primarily concerned with making decisions about how to allocate resources, accountants use financial information to advise businesses on strategic decisions and assess risk.

Bookkeepers, on the other hand, maintain ledgers and create financial statements focusing solely on recording transactions.

Accounting is about planning and decision-making, while bookkeeping is about record-keeping and reporting. Both play an important role in ensuring the financial health of a business, but they serve different purposes.

Do I need an accountant or a bookkeeper?

When it comes to managing your finances, you may be wondering whether you need an accountant or a bookkeeper. If you’re not sure which service your business needs, or you’re just starting out and aren’t sure what to expect, this will explain the difference between accounting and bookkeeping in more detail.

Both professionals can offer valuable services, but there are some key differences to consider. First, bookkeepers generally provide more transactional services, such as recording and categorizing transactions. On the other hand, accountants typically offer more strategic services, such as tax planning and financial analysis. Second, bookkeepers usually work with small businesses, while accountants often work with both small and large businesses. Finally, bookkeepers typically charge lower rates than accountants. Ultimately, the decision of whether to hire an accountant or a bookkeeper depends on your specific needs and financial situation. If you need help with transactional services and want to save money, a bookkeeper may be the right choice for you. However, if you need more strategic advice or have a complex financial situation, an accountant may be a better option.

What is more difficult – bookkeeping or accounting?

Both bookkeeping and accounting are essential financial skills that can be difficult to learn. Because bookkeeping is more focused on data entry and tracking, it is often seen as the simpler of the two disciplines. However, since it forms the basis for all accounting activity, it is essential to have a strong understanding of bookkeeping before moving on to accounting. You can become a bookkeeper if you prove you are good with numbers and have strong attention to detail. In fact, many aspiring accountants work as bookkeepers to get a foot in the door while still studying for their qualifications. Bookkeepers who excel at their jobs would be advised to pursue a career in accountancy.

An accountant typically uses accounting software to keep track of financial information for their clients. This includes data such as invoices, receipts, and bank statements. By keeping accurate records of this financial information, accountants are able to provide their clients with an up-to-date picture of their financial situation. In addition to tracking financial information, accountants also prepare tax returns and other financial reports. This ensures that their clients are compliant with tax laws and are able to make well-informed financial decisions.

In reality, both bookkeeping and accounting require a significant investment of time and effort to master. Students who are interested in pursuing a career in accounting should plan on spending considerable time honing their skills in bookkeeping alongside broadening their knowledge of the other areas of accountancy.

Do qualified Accountants know how to do bookkeeping?

The simple answer to this question is yes, qualified accountants do know how to do bookkeeping. However, bookkeeping is just one aspect of accounting and there is much more to it than simply recording financial transactions. A qualified accountant will have studied accounting principles and gained an understanding of how businesses operate. They will be able to use this knowledge to provide advice on financial planning, taxation and business strategy. While bookkeeping is an important part of accounting, it is only one part of the picture. Qualified accountants are able to offer a much broader range of services that can be of great benefit to businesses.

What skills do I need to pursue a career in accountancy?

To pursue a career in accountancy, you will need strong mathematical skills and the ability to analyse financial data. You should also be able to communicate clearly, both in writing and verbally, as you will be working with clients and colleagues on a daily basis. Organisational skills are also important, as is the ability to meet deadlines and work under pressure. In addition, you should be comfortable using computers and various accounting software programs. If you have these skills, then a career in accountancy, whether as an accountant or bookkeeper, may be the right choice for you.

Do I need a degree to become an accountant?

While a degree is not strictly required to become an accountant, it can be very helpful in developing the skills and knowledge needed for the job. Accounting is a complex field that covers a wide range of topics, from financial reporting to tax compliance. As a result, it can be difficult to learn everything you need to know without some formal training. A university degree in accounting can give you a solid foundation in all of the core accounting concepts, as well as providing opportunities to gain hands-on experience through internships and other programs. While there are no hard and fast rules about what it takes to become an accountant, a degree can give you the skills and knowledge you need to be successful in the field.

When it comes to pursuing a career in bookkeeping, there is no one-size-fits-all answer. While some bookkeepers do have a degree in accounting or a related field, it is not always required. In many cases, bookkeepers are able to get started in their careers with on-the-job training or by completing a short certification program. The most important thing for bookkeepers is to have strong math skills and be detail oriented. With these qualities, bookkeepers can be successful in keeping accurate financial records for businesses of all sizes.

As always, please remember I am an Accountant, not your Accountant. In this post (and all of my others) I share information and often give anecdotes about what has worked well for me. However, I do not know your financial situation and I do not offer individual financial advice. If you are unsure of a particular financial subject, please hire a qualified financial advisor to guide you.

This article has been written by Luke Girling, ACA – a qualified Accountant and personal finance enthusiast in the UK. Please visit my ‘About‘ page for more information. To verify my ACA credentials – please search for my name at the ICAEW member finder. Please comment below or contact me here to get in touch with questions or ideas for future posts.