The tax-free allowance in the UK can simply be described as the amount of income you earn for which you do not have to pay tax. Understanding tax in the UK is a time-consuming and difficult thing to do, particularly when you consider all of the different taxes we pay and how the rules seem to change each year. As of the most recent budget, the Chancellor announced his intention to freeze a number of UK tax-free allowances to help fund the costs amassed during the Covid pandemic.

In the 2021 budget, Chancellor Rishi Sunak announced the freezing of a number of allowances and thresholds until 6th April 2026 in response to the costs of the Coronavirus pandemic. This freeze will impact the tax-free allowance on income tax, capital gains tax and inheritance tax amongst others.

Over time, tax-free allowances tend to increase which reduces each qualifying individuals tax burden. What exactly a tax allowance is, how it has changed over recent history and factors which may impact your tax-free allowance will all be explored in this post as well as providing further information over the freeze of tax-free allowances until 2026.

Which tax-free allowances have been frozen until 2026 in the UK?

Following the 2021 budget, a number of tax-free allowances and thresholds have been frozen until the 6th of April 2026 in response to the costs of the COVID pandemic.

The freezing of thresholds and allowances is sometimes referred to as a stealth tax as the expected increases in these thresholds are prevented, leaving people with more to pay in tax than they may have anticipated. This is an easier way for governments to earn greater tax income than increasing tax rates which can be politically dangerous.

The main tax thresholds and rates impacted are:

- Income tax tax free allowance – the tax free allowance on personal income will be frozen at £12,570 per year from the 2021/2022 tax year until 6th April 2026.

- Capital gains tax free allowance – the capital gains tax free allowance will be frozen at £12,300 per year from the 2021/202 tax year until 6th April 2026.

- Inhertiance tax free allowance – the inhertiance tax nil-band will remain at £325,000 from the 2021/2022 tax year until 6th April 2026.

- Pensions lifetime allowance – the lifetime allowance for pension contributions will be continue to be limited to £1,073,100

- ISA contribution limit – ISA contributions will be limited to £20,000 per year until at least 6th April 2026.

What is the tax free allowance?

The UK tax-free allowance is the amount of income you can earn before you have to start paying income tax. For the current tax year, the allowance is £12,570. The allowance is reduced for every pound you earn over £100,000 up to £125,000, at which point you no longer receive a tax-free allowance.

A tax-free allowance is the portion of your income that you don’t pay tax on. For the current tax year 2021/2022, the tax-free allowance is £12,570. That means if you earnt a salary from your day job of £50,000 per year and no other income, you would be taxed only on £37,430 of it (£50,000 – £12,570).

The purpose of the tax-free allowance is to enable UK citizens to earn some income without being taxed. It would generally be considered unfair for a low earner i.e £10,000 per year to be taxed in the same way as someone earning £45,000 a year, as the lower earner may have insufficient income to cover the essential expenses such as rent/mortgage, food and utilities. Having to pay 20% of an already small income over to the government would be punitive and increase the poverty rates within the country. The tax-free allowance is one of the ways this situation is avoided.

A common misconception is that the first £12,570 you earn in the year is tax-free, however, in reality, those in formal employment are taxed as if you have exceeded this allowance and HMRC perform an annual assessment of the total income of each person. If they find that the tax-free allowance hasn’t been exceeded, a rebate will be paid to return the tax erroneously paid.

How does your tax free allowance work if you are formally employed vs. self employed

The standard tax-free allowance is the same regardless of whether you are employed or self-employed. However, the practicalities of how you will make use of your tax-free allowance differ.

For those of us who are employed by an organisation, your tax will typically be automatically deducted from your payslip via PAYE. PAYE stands for Pay-As-You-Earn whereby your tax is paid directly to HMRC on your behalf by your employer.

This system cuts out the middleman and saves you the headache of a tax self-assessment. At the end of each tax year, you will receive a P60 form from HMRC which details the amounts paid to you and the amounts deducted as tax. This informs HMRC’s assessment of whether they owe you a tax rebate or if you owe them more money having underpaid tax in the year.

The system is slightly more complex if you are self-employed. Each tax year, a self-assessment (otherwise known as a ‘tax return’) is filled in and sent to HMRC which takes into account your personal allowance. The self-assessment can be sent to HMRC electronically at the end of each tax year and based on what you report, HMRC will calculate what tax bill is owed which you pay via payments on account or as a one-off payment.

The tax self-assessment can be difficult if you are unfamiliar with it. Some people choose to appoint an Accountant to do it for them. Advice on this can be found here.

Situations which may change your tax free allowance

For most people, the annual tax-free allowance on income tax is £12,570. However, there are 3 notable situations that may change this; being a high earner, the marriage allowance and the blind person allowance.

High earner

Up to £100,000 of annual income, your tax-free allowance will typically be the standard amount of £12,570. However, if you are in a position where you earn more than this, your tax-free allowance starts to reduce.

For every £2 that your annual income goes above £100,000, your tax-free allowance decreases by £1. So for example, if you earnt £100,002 in a year, your tax-free allowance would then be reduced to £12,569.

Once you get to an annual income of £125,140, you have completely wiped out your tax-free allowance as you now earn £25,000 over the £100,000 threshold. Your tax-free allowance declines £1 for each £2 over you are, meaning that the entire £12,570 is now utilised. Therefore, if you earn £125,140 or more per year, you will not have a tax free allowance for income tax.

This is an example of how tax in the UK is structured so that high earners are taxed at a greater level than low earners. Whether you agree with this or not, the reasoning behind this is two-fold; firstly this provides the government with greater tax revenue and secondly this system is deemed fairer to low-income earners who may struggle with other living expenses if they were not tax-advantaged.

Marriage allowance

The second situation which may alter your tax-free allowance is via the marriage allowance. Being married in the UK entails a number of financial benefits, one of which is the marriage allowance, whereby a married couple in which one person earns below £12,570 a year (i.e. a part-time worker or full-time parent) can transfer £1,250 of their allowance over to their spouse, to reduce the high-earners income tax bill.

There are a few conditions to this which make this less common in practice – not only do you have to be married (or in a civil partnership) but also one member of the marriage has to be earning less than £12,500 per year whilst the other pays tax at least the basic rate i.e. earns an income between £12,570 and £50,270 per year.

This is a good way to make married couples more tax-efficient, particularly in the situation where you have a child and one parent stays at home and doesn’t earn an income. In the current year, filing for a marriage allowance could save you £250 from your income tax bill (£1,250 transferred allowance * 20% basic tax rate).

Blind person allowance

A less common exception is the blind person allowance whereby blind people are entitled to an extra £2,500 of tax-free income taking their total tax-free allowance to £15,570. For the current tax year, this could save you £500 if you’re blind and earning a salary in excess of £15,000 per year.

Historical tax free allowances

When considering the tax implications of your tax-free allowance, it’s worth taking a look at the historical tax-free allowances by year to spot any trends which may inform future years.

| Tax year | Standard tax free allowance (£) |

| 2021-2022 | £12,750 |

| 2020-2021 | £12,500 |

| 2019-2020 | £12,500 |

| 2018-2019 | £11,850 |

| 2017-2018 | £11,500 |

| 2016-2017 | £11,000 |

| 2015-2016 | £10,600 |

| 2014-2015 | £10,000 |

| 2013-2014 | £9,440 |

| 2012-2013 | £8,105 |

| 2011-2012 | £7,475 |

| 2010-2011 | £6,475 |

The above table shows the standard tax-free allowance by year, not adjusted for any of the exemptions discussed above. Every year for the past decade, the tax-free allowance has either stayed the same or increased which should provide some confidence that the tax-free allowance is unlikely to be dramatically reduced anytime soon.

For the reasons discussed above regarding taxing higher earners, whilst not impossible, it is unlikely the tax-free allowance will be reduced as this disproportionately impacts low-earners which would be a political own-goal for the government.

Is my tax free allowance likely to increase in the future?

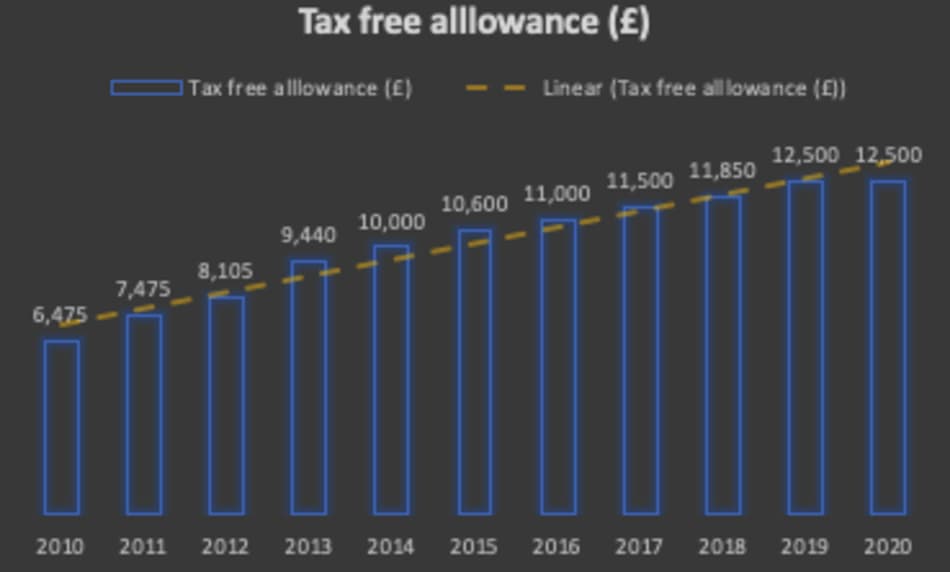

As can be seen in the below graph, the standard tax-free allowance is trending up over the last 10 years as it has increased from £6,475 in 2010 to £12,500 in 2020 (almost doubling in a decade).

Although it’s by no means guaranteed, this does suggest the tax-free allowance will continue to go up in the future. The big winners from this are those people earning in excess of the tax-free allowance but below the £100,000 mark where this benefit starts to be lost. As a practical example, a business owner may choose to pay themselves below the £100,00 threshold to give themselves the best possible effective tax rate although this doesn’t consider the tax advantages of dividend payments which are discussed further below.

Other types of tax and tax-free allowances

Throughout this post, we have talked exclusively about the tax-free allowance on UK income tax. However, it is worth noting there are a number of other taxes UK residents pay that have a similar allowance.

National insurance contributions

National insurance contributions are a type of tax paid by UK residents and employers to fund government welfare programmes including the state pension as part of the welfare state. The rates vary depending on if you are employed or self-employed but as with income tax, there are allowances before you start paying any national insurance contributions (NIC) as shown below:

| Type of NIC | Applicable too | Allowance before paying NIC’s |

| Class 1 – employee | Business employees | £6,240 per year |

| Class 1 – employer | Employers | £6,240 per year per employee* |

| Class 2 | Self-employed | £6,475 per year |

| Class 4 | Self-employed | £9,500 per year |

‘* There are further exemptions for employers, in the current year – the employer’s national insurance contribution bill is relieved up to a total amount of £4,000 meaning employers don’t pay any national insurance contributions until they are more established businesses.

Capital gains tax

Capital gains tax is a tax applied to gains made on sales of property, investments or other capital items. For example, if you bought a painting for £2,000 and sold it for £20,000, not only have you done very well for yourself, but you have an £18,000 gain liable to capital gains tax.

The tax-free allowance for capital gains tax for the current year is £12,300. For our example above, we would only be liable for capital gains tax on £5,700 of our gain (£18,000-£12,300 allowance).

Capital gains tax is 28% on residential property and 20% on other chargeable assets. So for our example above of a painting, our chargeable gains tax would be 20% * our gain of £5,700 = £1,140 for the year. If you were to make losses in a similar fashion, you could report this to HMRC via a self-assessment to offset future gains.

Inheritance tax

Inheritance tax is a tax paid by an individual after somebody has died and left them money, property or other physical possessions.

For the current year, the tax-free allowance on inheritance tax is £325,000 + an additional £175,000 if the estate includes the family home. The rules around inheritance tax are a bit more complex than this so for now I have just laid out the basics.

The inheritance tax is 40% so if you inherited an estate on a relatives death of £500,000 (not including a home) – the tax bill would be £500,000 – £325,000 = £175,000 * 40% rate = £70,000. Many people use life insurance policies to cover the inheritance tax bill their relatives are likely to be left with.

Dividend allowance

Dividend income is income received from a Company an individual has invested in as a reward for their ownership. Each individual in the UK in the current year is entitled to earn £2,000 of dividend income before being taxed on it. This can have practical implications for those who are self-employed and are looking to become as tax efficient as possible, who may choose to remunerate themselves partly via dividends to make use of this allowance.

Many self-employed people utilise a tax-efficient strategy whereby they pay themselves a nominal salary of £12,500 per year (thereby not incurring any income tax) and pay themself the remainder via dividends. This allows them to take advantage of an extra £2,000 tax-free allowance as well as the much lower tax rates on dividends as compared with normal income – 7.5% on dividends for basic rate taxpayers compared to 20% on ordinary income.

Clearly, this could save you a substantial sum on your tax bill. Let’s say you earned £40,000 a year from your formal job whilst your friend paid themselves £40,000 per year from their small business.

Your simplified tax bill would be £40,000 – £12,500 (personal allowance in 2020) = £27,500 *20% rate = £5,500 owed to HMRC.

Your friend meanwhile, would pay themself a salary of £12,500 and dividends of £27,500.

£0 tax is payable on the salary of £12,500 as the tax-free allowance is used in full.

You would then have a £2,000 tax-free allowance on your dividend income which would leave you with £25,500 (£40,000 – £12,500 personal allowance – £2,000 dividend allowance) to pay tax on at a rate of 7.5%. £25,500 * 7.5% = £1,913.

Being self-employed in this case has saved you £3,587 (£5,500 employed – £1,913 self-employed). Clearly, this saving is not trivial at 9% of your total income which should highlight the importance of using your tax-free allowances to optimise your tax status.

Please note – the example above is highly simplified and other factors would come into play.

Trading allowance

In the current year, UK residents are entitled to a £1,000 tax-free allowance on ‘trading activities’ which could entail small freelance services or buying and selling on online shops such as Gumtree and Etsy. Whilst this may not sound like a significant allowance, it will save you £200 from your yearly tax bill.

There are other tax allowances and solutions out there but those listed above are the most commonly used and will be most widely applicable.

Conclusion

The tax-free allowance on income tax is the portion of your income that you earn that you don’t have to pay tax on. For most people, this is £12,570 in the current year (2021/2022). This can change if you’re a high earner, married with a low-earning spouse or blind based on specific allowances.

The tax-free allowance has increased or stayed the same every year for a decade which suggests it will continue to increase into the future. Those earning between the tax-free allowance and the upper limit (currently £100,000) have the most to gain from this allowance increasing.

There are similar tax-free allowances on other tax types common within the UK including a capital gains tax allowance, an inheritance tax allowance and specific allowances for dividend and trading income.

I will update this post and repost it each tax year as the rates change.

For all of the information, you would need on UK income tax – navigate to the government website here for the latest guidance.

This article has been written by Luke Girling, ACA – a qualified Accountant and personal finance enthusiast in the UK. Please visit my ‘About‘ page for more information. To verify my ACA credentials – please search for my name at the ICAEW member finder. To get in touch with questions or ideas for future posts, please comment below or contact me here.