Preparing UK Company accounts is likely to be a time-consuming, difficult annual process for Company Directors out there who own a Limited Company. The truth is, for most Companies who have reasonable Accounting records throughout the year, producing your Financial Statements at year-end should be less than a day’s work.

Each year, UK companies will have to produce UK Company accounts and send them to Companies House. This can be a difficult exercise for many business owners but with a good statutory accounts template and a full understanding of your responsibilities, this shouldn’t be more than a day’s work.

Within my career, I have directly produced or reviewed over 250 different sets of Company Accounts, many of which can be found today at Companies House, the place where all UK private Limited Company’s annual accounts are stored for public consumption. What I mean to say here is this: when it comes to UK Company accounts – I know what I’m talking about and if you read and implement the 7 tips below, so will you.

Tip #1 – Do your Accounting throughout the year, not on the accounts submission deadline.

Most companies will have to submit their annual accounts to Companies House nine months after year-end so for a Company with a typical 31 December year-end, you would have to file by 30 September the following year.

If you failed to properly account for all your business transactions in the year, it will be a hugely difficult task preparing these accounts, particularly if you’re only getting around to it six months post-year-end.

To make the submission of your UK Company accounts much smoother, I would recommend keeping a thorough log of your business’s transactions, you can do this manually via Excel or you can use Accounting software which is discussed further in tip #3.

At the end of each financial year, you will need to produce what is known as a trial balance “TB” which is basically just a summary of every general ledger account. Each general ledger account will represent a different item such as fixed assets, cash, receivables, payables, income or expenses.

At year-end, you should have a TB that sums to nil (i.e. Assets – Liabilities = equity). If you use Accounting software to post your transactions (known as journals) this should be done for you automatically and all you need to do is run a TB report at year-end.

If you have a very small business and are keeping the transactions recorded in Excel, for each transaction the business makes, you will have to post a double entry to your records. I recently wrote a post entitled Learn DEAD CLIC to quickly master double entry Accounting if you need a refresher.

This step is the hard work behind the Financial Statements process. Once you have an accurate, balancing trial balance – producing a set of UK Company accounts should be a relatively straightforward process from then on.

Tip #2 – Understand your reporting responsibilities for your Financial Statements

Before you make a start on producing your UK accounts, you need to understand your reporting responsibilities and by this I mean the following:

A) Understand what type of organisation you have i.e. Limited Company, Limited Liability Partnership, Sole Trader or other.

B) Understand which Accounting standards you will produce your accounts under – IFRS, FRS 101, FRS 102, FRS 102 section 1A or FRS 105.

Tackling problem ‘A’ first, you should have a pretty good idea which of these organisation types your business is. If you ever had to fill in an incorporation form, it should be fairly obvious on there. If you haven’t filled in a formal incorporation document and simply started a business, you’re likely a sole trader.

If you’re a sole trader, you do not need to file annual accounts with Companies House. You will, at some stage, need to register your sole trader business with the government for tax purposes but as you are essentially self-employed, there is very little paperwork (including the requirement to file annual accounts) for you to do.

Despite not sending Companies House your annual accounts when you are a sole trader, I would still suggest producing financial statements. Not only does this help when it comes to working out your tax burden, but it is also best practice and should help you to spot unnecessary expenses or income streams that could be further developed.

Both Limited Companies and Limited Liability Partnerships do have to register with Companies House on incorporation and have to file annual accounts. So if your business is either of these structures (you can tell if your business name ends with ‘Limited’, ‘Ltd’ or ‘LLP’), let’s move on to problem ‘B’.

Accounting framework

The next step is to decide which accounting framework to use, with the common ones being IFRS, FRS101 and FRS102 for larger companies and FRS102 S1A and FRS105 for smaller Companies.

These accounting frameworks lay out the guidance for which your annual accounts are prepared and is disclosed within the accounts themselves.

For a small UK Company, you are most likely deciding between FRS102 S1A and FRS 105 with the main difference being that FRS 105 is for micro-entities.

| Criteria | FRS 105 | FRS 102 S1A |

| Turnover | < £632,000 | < £10.2 m |

| Assets | < £316,000 | < £5.1 m |

| Number of employees | < 10 | < 50 |

| Applicability | All 3 conditions met | 2 out of 3 conditions met in both the current and prior year |

As you can see, unless your business is large, you will be able to use one of these two frameworks. It’s important you get this right each year as you are required to disclose much less in your annual accounts using these frameworks than those not listed in the table above which can save you significant time.

As a general rule, you want to be disclosing as little as you are able to. This will save your time, hassle and avoid competitors having information on your business that you didn’t need to give away.

Both of these frameworks will make you eligible for significant exemptions, for example, you won’t have to prepare a Statement of Cash flows under either.

Check out this article from AccountingWeb for more information on this choice.

Tip #3 – Decide which software (if any) you will use to prepare your UK accounts

You need to decide here whether you will use paid for Accounting software for your general Accounting, accounts preparation, both or neither.

Very small companies can get away with maintaining all of their bookkeeping records and producing statutory accounts in Excel. Medium-size companies will often maintain their Accounting records within software such as Quickbooks or Xero and then prepare the annual accounts themselves using Excel.

The premium option is to deploy an Accounting software that maintains your records and then spits out Financial Statements based on these records at year-end but this tends to be expensive. Even Companies earning millions of pounds a year that I have personally audited have ended up producing their Financial Statements within Excel, so there is really no shame in doing this.

If you do go with a software option for either your bookkeeping or your production of annual accounts, make sure to do thorough research first so that you are picking an option that is well-suited to your business.

Tip #4 – Find a good template so you are not starting your UK accounts from scratch

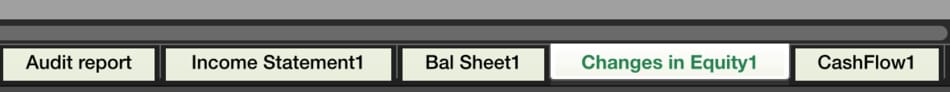

If you will be using Excel to make your annual accounts, the next step is to find a good template. What I mean by this is an Excel document that has tabs along the bottom for the title page, contents page, Directors Report, Profit and Loss Statement, Balance Sheet, Statement of Changes in equity and notes as applicable.

In the best templates, all of the mandatory wording will be included and you will simply have to go through and tailor it for your own Company. You would then paste in the Trial Balance (discussed in tip #1) into another tab and map through the TB data to the notes and financial statements themselves.

The very best templates are formula driven so that when you paste in your trial balance figures, the notes and primary financial statements (Profit and Loss Statement, Balance Sheet and Statement of Changes in Equity) are auto-filled which saves you significant time.

If you are intimidated by the idea of doing this, you can always engage an Accountant to do this final step for you which is discussed further in Tip #5 below.

If you wish to go ahead yourself, simply Google ‘FRS 102 Section 1A Excel Accounts Template’ and you should find plenty of good templates to choose from. If you are struggling, feel free to reach out to me using the ‘contact us‘ page and I can point you in the right direction.

Tip #5 – Consider engaging an Accountant for difficult Accounting scenarios your business faces

As mentioned above, if you don’t have any Accounting experience or this is simply not a good use of your time, it may be worth engaging an Accountant to manage this process for you.

Even if you do have experience and like getting involved in this process, if you have a high volume of transactions or complex Accounting situations, you may be best served finding a qualified UK Accountant using this link.

When it comes to hiring a qualified Accountant, you have three main options:

| Option | Details | Expensive? |

| 1 | Hire an Accounting firm to do all your Accounting including the year-end accounts preparation. | £££ |

| 2 | Hire an Accountant to prepare your year-end accounts based on the TB you provide them. | ££ |

| 3 | Consult an Accountant on a specific technical issue within your year-end accounts preparation. | £ |

How expensive each of these things is entirely dependent on the amount of time each takes but in some situations, you may be able to get free help (particularly with options 2 and 3) if you have a friend or family member who is a qualified Accountant.

Having said this, this expense is entirely avoidable, particularly if your finances are simple and you are preparing your accounts using FRS 105 which requires very little to actually be disclosed.

Tip #6 – Understand the concept of materiality

Materiality is an Accounting concept that relates to the significance of a balance or transaction. As an example, when big companies like Coca-Cola produce their annual accounts, due to the concept of materiality, they are never 100% accurate to the penny. In fact, in Coca-Cola’s case, the balances are probably rounded into millions, meaning theoretically £499,999 may not be accounted for simply as it doesn’t round up to another whole million within the accounts.

Similarly, you should consider this within your own accounts. The aim here is to produce financial statements that are materially accurate. That means if you recorded one sale at £16.98 rather than £16.89 due to a slip of the finger, you won’t have Companies House knocking at your door asking where this extra 9p has come from. However, if you typed in a sale of £16.98 million, clearly this may raise eyebrows.

It’s important to note that a Company’s materiality increases with its size. Company auditors typically calculate materiality as a percentage of sales or net assets and any discrepancies that exceeds this materiality threshold is recorded as an error.

Typically this calculation will be somewhere in the region 1-3% of the benchmark (revenue or net assets) – so if a business had sales of £100,000, the materiality indicator would be £1,000 (1% * £100,000). That means if something is recorded incorrectly by say £650, the accounts would still be materially correct.

Tip #7 – Understand the logistics of providing your Financial Statements to Companies House and HMRC

Prior to submission, you will want to self-review the accounts for things like spelling errors and internal inconsistencies. Once you are happy with the final version, you can convert your Excel template to PDF by going File > Print > Print as PDF.

Once in PDF format, have another check over your accounts and make sure things like page numbering and formatting are accurate. Once you are happy with this, you can move on to physically sending your accounts to Companies House.

For Limited Companies in the UK, providing your annual accounts to Companies House is straightforward and can be done via an online portal. You can even submit your HMRC tax return in the same form.

Doing both of these things together likely makes the most sense, if you engage an Accountant, you could ask them to prepare both your year-end accounts and your tax return at the same time to be most efficient.

To file both of these returns, simply go to this link and follow the prompts.

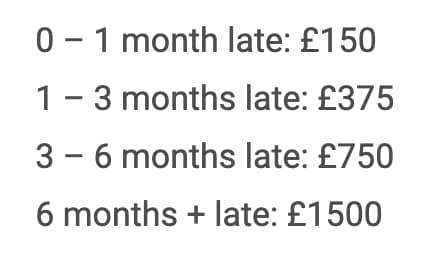

Make sure to submit your accounts on time (within 9 months of the year-end date) or you may be liable to your Company being struck off of the register or to fines as shown below:

It is also worth noting at this point, if you are considering starting a business, you should think carefully about whether setting up a Limited Company is necessary. Whilst there are benefits, the increased flexibility of a sole trader structure may be more suitable and allow you to avoid the accounts preparation process altogether.

Conclusion

Preparing your annual UK accounts can be a difficult and time-consuming process for most business owners. For certain businesses with a lot of transactions and/or complex Accounting situations such as implementing new standards, you may be best served to engage a qualified UK Accountant using this link.

If, however, you own a small UK limited Company with simple Accounting requirements, you can save on the professional fees and do it yourself.

Providing you have kept adequate Accounting records throughout the year, preparing a good set of annual accounts should be manageable in less than a full workday. Once you have done some initial research to work out your reporting requirements, most small business owners can produce their Accounts within Excel using one of the many Financial Statement templates online.

Going on to produce a set of materially correct accounts and going through the practical implementation of sending them to Companies House should be relatively straightforward.

To fully understand your reporting requirements as a UK Limited Company – please visit the UK Gov website here which provides all of the details you will need, regardless of your individual situation.

This article has been written by Luke Girling, ACA – a qualified Accountant and personal finance enthusiast in the UK. Please visit my ‘About‘ page for more information. To verify my ACA credentials – please search for my name at the ICAEW member finder. To get in touch with questions or ideas for future posts, please comment below or contact me here.

Thanks for the interesting tips.