If you’re considering whether to invest your money as a student or not, you’re probably already far ahead of the game. For many people, investing is not a priority whilst at University with alcohol, food and having fun usually on top of the agenda.

Whilst uncommon, it’s a good idea to start investing whilst at University whether that be in the stock market, bonds or other asset classes. The earlier people start to invest, the more years they can benefit from compounding and the earlier, in theory, they can become financially independent.

Here at The Progression Playbook, we often talk about reaching our FIRE (financial independence, retire early) date which is defined as the date at which you can live off of your passive investment income and are no longer required to work. The ideal situation for people chasing this dream is to reach this date as young as possible and live with complete financial freedom.

One of the best ways of doing this is to start early and let compounding work its magic. As the old saying goes ‘“the best time to invest was yesterday, the next best time is TODAY“.

How to start investing at University in the UK

Knowing how to invest your money as a student is simultaneously complicated and simple at the same time. Let me explain – when a new investor gets into the details of investing for the first time and gets bogged down in the intricacies of the stock market, investing can seem a daunting prospect.

Having said that, investing doesn’t need to be complicated at all. It’s my belief that a student could read two high-quality books (and a little of this blog), set up an account on an investing platform and start investing comfortably and confidently.

So what does it actually mean to invest? Put simply, investing is putting your money into a financial endeavour, whether that be company shares, bonds, real estate or even a friend’s project, with the objective of earning a return on your investment, which is often expressed as a percentage of the money you initially contributed.

For example, if you invested £100 and were looking for your money to return you 10% a year, by the end of the first year your investment would be worth £110. This is what is meant by the phrase “make your money work for you” – your money is earning you income without any active effort on your part, i.e. you’re not exchanging your time for money as you would be in a traditional job.

There are countless places to invest your money and these are commonly referred to as “asset classes”. The four that will be most important for a student are cash, company shares, bonds and real estate. Covering each of these in turn …

Cash – this one speaks for itself. Investors can place their money into a high-interest cash account to earn interest over time. It is worth being aware that cash loses its purchasing power over time due to inflation so it may be decreasing in actual value over time.

Company shares – money can be invested in company shares which allows an investor to own a portion of a publicly-traded company. This can be done by investing in an individual company like Apple or into a fund that owns hundreds of different companies.

Bonds – investors can purchase a bond which is essentially a contract of debt held with either a company or a governmental entity. The investor essentially lends money for a set period of time and gets paid interest to compensate them for the risk that the money will not be paid back by the lender at the end of the period and to compensate them for the time away from their money.

Real estate – investing in real estate involves purchasing property and renting it out for income or holding it for capital appreciation (or both). This can be done directly via physical property or indirectly by a real estate investment trust (REIT) which is a common vehicle to invest in real estate without the hassle of physically owning a property.

Regardless of which of these asset classes an investor chooses to invest into, it’s very important to know the risk and return formula. This basically states that the higher the risk, the higher the expected return will be.

For example, investing in cash is very low risk (i.e. there’s a very low chance of losing your money) but the return is also small when you look at the low-interest rates offered on most cash accounts.

Bonds are slightly more risky as it’s possible the borrower will default and not pay back the borrowed sum of money. Therefore, the returns are typically higher than cash but vary wildly based on the lender. An investor could expect a low rate of interest on a reputable borrower like a governmental body but a higher return on a more risky borrower.

Stocks and real estate are riskier still, in both cases, there is a chance that the investor’s money will decline in value over time. Due to this increased risk, the investor can expect a higher average return over time.

Generally speaking, investors with a high-risk tolerance and long time horizon (don’t need to access the money for many years) will be better suited to investing in stocks or real estate. Investors who are less comfortable with risk or who need the money in the short term may prefer cash or bond investing.

How to learn the basics of investing

There is clearly much more to learn than the bare-bones of investing I’ve laid out above. New investors need to strike the right balance between being well informed and understanding what they’re doing whilst not falling prey to ‘analysis paralysis’ and becoming so bogged down in learning the intricacies of investing, that they never act and actually invest.

Before pulling the plug, it’s crucial student investors understand some fundamental lessons. Investors must understand that, particularly in the stock market, there is the risk that your investment goes down over time.

Understanding asset classes, risk, reward, volatility, time horizons and the relationship between these factors is imperative before beginning to invest.

So that begs the question – how can I learn these things in the shortest amount of time?

My recommendation is two-fold, firstly – read the ‘financial independence‘ section of this blog. Secondly, I believe a solid, well-rounded understanding of investing can be gleaned from just two books.

My recommendations are:

- JL Collins – ‘Simple Path to Wealth’

Amazon Link – https://amzn.to/3949JjT

This is my single favourite book on investing. JL Collins makes a hugely persuasive case for passive, index-fund investing in the stock market and all of the considerations around this. This book is US-focused so for UK readers, not all of it may be applicable but it’s worth reading despite that for the brilliant education on investing it provides.

2. David Sawyer – ‘Reset’

This book is the best UK focussed financial independence book on the market. I wrote a full review here. This book will teach UK residents the specific, practical steps to investing in the stock market in the UK using the excellent Vanguard platform.

Amazon Link – https://amzn.to/2HqX2o4

Please note – I earn an affiliate commission if you purchase through either of these links but please note, I recommend these books regardless so feel free to search for these books yourselves.

Once you’ve read this blog and the two recommended books, you’re probably informed enough to bite the bullet and begin to invest your money and start to earn some investment returns.

Finding the balance between investing and spending

As well as gaining an understanding of the investing fundamentals, another key prerequisite to investing is having money available to invest.

I like to think of this as my personal surplus where the surplus is my income minus my total expenses. This surplus is then the money I have available to save or invest as I see fit.

When it comes to investing as a student, there are a couple of issues with this. Firstly, many students don’t earn an income whilst studying which means they will have to save a proportion of their student loan instalment instead. The second issue is it can be difficult not to spend, particularly when a lot of social opportunities depend on it.

I think it’s important to strike the right balance here – it would never be my advice to deprive yourself of opportunities or fun during University so you can save more money to be invested but it should be possible to save a small amount of money each month with a few small sacrifices.

One example might be to purchase cheaper alcohol at a supermarket rather than buying expensive drinks at bars or clubs or to shop at budget supermarkets such as Lidl rather than Waitrose. Two small changes like these may allow students to save enough money to invest a nice chunk each month.

Making this choice is a great example of the battle between instant gratification and delayed gratification. Humans are evolutionarily predisposed to instant gratification, historically if the chance of a high-calorie food was available for example, we’d take it simply because the chance of such a reward may not come around again soon.

With that in mind, it can be difficult to defer gratification to later. That’s what makes investing challenging. Investing your money now will provide no real gratification in the short term, in fact, the only real rewards will come years or even decades later.

To summarize, don’t deprive yourself of fun during what can be the most exciting and fun years of your life but keep a side-eye on your future. One day, your future self will likely thank you.

It’s worth checking out this blog post for some great tips on how to move away from living paycheck to paycheck: https://centbycent.co.uk/5-ways-to-stop-living-paycheck-to-paycheck

How to make the most of compounding

Put simply, compound interest refers to the interest earned, plus the interest earned on the interest that has previously accumulated over time. For example, £100 at 5% interest is £105 after 1 year and £110.25 after 2 years. The growth increases over time as you start to earn interest on the interest.

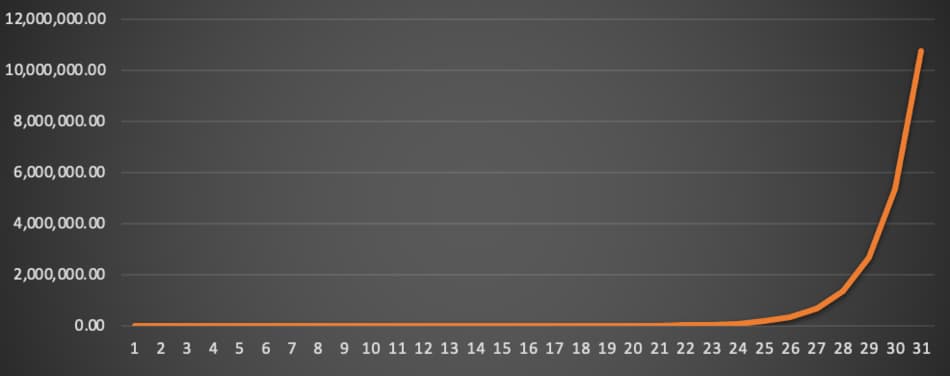

In Darren Hardy’s book ‘The Compound Effect’ (buy it on Amazon here using my affiliate link) he shares an interesting thought experiment. Which would you have rather – £3 million right now or £0.01 which doubles each day for a month? Intuitively, £3 million feels like the right choice.

Even after 20 days, the second option is only worth £5,243 compared to the £3 million of option a. However, by day 31, the second option is worth a whopping £10,737,418 which is over 2.5 times as much as option 1.

Whilst compounding doesn’t work in quite the same way whereby your investments double each day (I wish), this does illustrate an important lesson. When it comes to compounding, the increases are barely perceptible in the short term before exploding in the long run.

The main takeaway for potential student investors is this: the earlier you start investing, the more years of compounding you can take advantage of and the earlier in life you can become financially independent.

Let me give you an example, let’s say there are two scenarios:

a) You start investing after University at age 26

b) You start investing during University at age 21.

In both scenarios, we will assume you will invest £5,000 at the start of each year, average returns are 10% a year and in both scenarios, we will retire at age 65. So what are our closing values?

Under scenario A where we start investing after University at age 26 (giving us a 39-year investing period to age 65) – our closing invested balance is £2,007,238.

Under scenario B where we start investing during University at age 21 (giving us a 44-year investing period till age 65) – our closing invested balance is £3,263,204.

Whilst both of these scenarios gives us a great closing balance, I find it incredible how starting just five years earlier can increase our closing investment value by £1,255,965 (£3,263,204 – £2,007,238) or 63%.

If this doesn’t convince you of the substantial benefits of starting to invest early – nothing will.

Introduction to passive, low-cost index fund investing

So now we’ve covered the basics of what investing is and the advantages of starting early, the next big question is HOW we go about investing.

My personal preference when it comes to investing is low-cost, passive, index-fund investing in the stock market.

Let me break down what exactly each one of these terms means –

Stock market – as explained above, this just means investing in company shares also referred to as ‘equities’. In my opinion, this is the best tool available to everyday investors to increase our wealth over time.

Index-funds – A fund (sometimes referred to as a mutual fund or an exchange-traded fund ‘ETF’ ) is an investment vehicle that allows investors to invest in hundreds of companies at once rather than a single company. This has the benefit of diversifying your portfolio across industries and geographies. An index fund is simply a fund that mirrors an index such as the FTSE 100 or the S&P 500 – it will own companies that represent the companies that make up these indexes.

Passive – investing can be done actively whereby investors research and choose their individual investments based on what they believe will provide the best returns or passively, where they simply invest in all the companies in an index with the expectation that over time, these indexes will increase in value. As this strategy requires very little effort on the side of the investor, it is often referred to as ‘passive investing’.

Low-cost – As passive investment funds don’t require expensive asset managers who research and select individual companies to invest into, they are typically much cheaper. It’s crucial to understand how investment fees can eat into your returns. There are great examples in both of the books I recommended above which lay out exactly how much of an impact high-fees can have over time.

Low-cost, passive, index investing in the stock market is my preference simply because I believe (and have seen no strong evidence indicating otherwise) that this strategy offers the best combination of risk, reward and effort. Historically speaking, an investor in the S&P 500 index could expect to earn average investment returns of 10% a year which isn’t bad going considering there is very little effort or knowledge required to invest this way.

In fact, this underplays it a little. Numerous studies show that many active investment managers who dedicate their careers to investing in the stock market fail to outperform the market over time.

To illustrate this point, Warren Buffett, the famous founder of investment firm Berkshire Hathaway, won a bet with hedge fund managers that they couldn’t outperform the market. More can be read about this bet here.

Best UK platform to invest from as a student

So let’s talk practicalities – in my opinion, the single best place to invest in this way is Vanguard which can be signed up to here or by typing ‘Vanguard investor’ into your search engine.

The big advantage of this platform is its low fees. The platform fees are just 0.15% of assets and funds can be invested into for fees as low as 0.06% of assets.

This means, if you were to invest £10,000, your fees would be £15 for the platform and £6 for the fund per year which is clearly very reasonable.

Vanguard offers a great selection of index funds tracking numerous indexes such as the S&P 500 and has an excellent ‘LIfeStrategy’ range which is the fund I typically recommend to family and friends due to how simple to maintain it is whilst still giving historically excellent performance.

To find out more about this platform, check out my full how-to guide here.

There are a number of other great platforms to consider including Hargreaves Lansdown, AJ Bell or Trading 212.

If you want to get started with one free share worth up to £100 on the Trading 212 platform, sign-up and deposit £1 using my affiliate link below:

www.trading212.com/invite/GbfXJNLf

Why investing in individual companies may be a bad idea

Some readers of this blog post may be confused by my preferred index-linked investing strategy. After all, isn’t investing in individual companies you think are primed to grow rapidly with the chance of paying out big more exciting?

Well, kind of. At least, that’s what the financial news and media would love for you to believe. Investing and finance news shows dial up the drama of troughs and peaks in individual company share prices to such an extent that it all starts to resemble a fun game.

The problem is that when it comes to investing my money and building long-term wealth, I don’t want to have fun, I want to be successful and I want you to be successful too.

That’s why it’s my belief that investing in individual stocks is a fool’s errand. Individual investors, on the whole, can almost never accurately predict stocks (again, you’ll find much more on this in the ‘Simple Path to Wealth‘ book I recommended above) so it makes a lot of sense to me to own small slices of hundreds of companies across the stock market safe in the knowledge that over time, despite the fluctuations, my investments will grow.

Of course, this is only one person’s opinion based on lots of research over time and there will be many investors who disagree with me and follow a different approach which may or may not be successful. For the majority of people though, I truly believe investing in funds and benefitting from the built-in diversification has a lot of merits, particularly if you don’t have the time or expertise to research individual stocks.

Making the most of the Lifetime ISA (LISA)

One final consideration for students looking to invest is to consider the Lifetime ISA (LISA) which I wrote about here.

This LISA can be used for either purchasing your first home or for retirement and the big advantage is the government will contribute 25% of whatever you contribute up to a maximum of £4,000, meaning the government could give you £1,000 per year in the best-case scenario.

Conclusion

Investing as a student is a great way to get a head start on your long-term financial goals. Starting to invest as early as possible and giving your investments as many years to compound as you can have an incredible impact on the level of wealth you are able to build.

Whilst students will have to weigh up the extent they are willing to sacrifice immediate gratification in the form of spending their money, investing even a small monthly sum each month will bear fruit in the long run.

For students who are willing to take the plunge, getting a core understanding of investing first is crucial. This doesn’t have to be a daunting task and reading a few articles on this site and the two books I recommended above will give most people the core information needed to feel comfortable beginning their investment journey.

Whilst there are many different investment strategies being discussed today, my personal preference and the strategy I believe is most appropriate for the majority of students is low-cost, passive index investing into the stock market.

This strategy benefits from built-in diversification, a nice blend of risk and reward and low maintenance. My choice of investing platform is Vanguard which offers incredibly low fees and a highly intuitive website.

If you’re unsure of anything at all in this post – please reach out to me directly in the comments below or via the ‘contact us‘ page where I will be happy to answer any questions. Please bear in mind though that I am not a licensed financial advisor and nothing in this article or in my individual responses represents investing or financial advice in any form.

As always, please remember I am an Accountant, but not your Accountant. In this post (and all of my others) I share information and oftentimes give anecdotes about what has worked well for me. However, I do not know your personal financial situation and so do not offer individual financial advice. If you are unsure of a particular financial subject, please hire a qualified financial advisor to guide you.

This article has been written by Luke Girling, ACA – a qualified Accountant and personal finance enthusiast in the UK. Please visit my ‘About‘ page for more information. To verify my ACA credentials – please search for my name at the ICAEW member finder. To get in touch with questions or ideas for future posts, please comment below or contact me here.