The ACCA qualification is an excellent starting point for a career in Accountancy and if you’re someone considering this qualification, you have probably found yourself wondering just how difficult these Accounting exams truly are?

The ACCA qualification exams are hard, even for those with previous experience in Accounting at University or School. The volume and technical nature of the exams can be challenging for many. However, with the right resources and commitment, the exams are passable as shown by recent pass rates.

Whether you’re genuinely considering the ACCA qualification or are just beginning to research it, I will clarify exactly how hard the ACCA qualification is, specify which exams tend to be the most difficult and advise on the types of career this qualification can lead to.

How hard is the ACCA qualification?

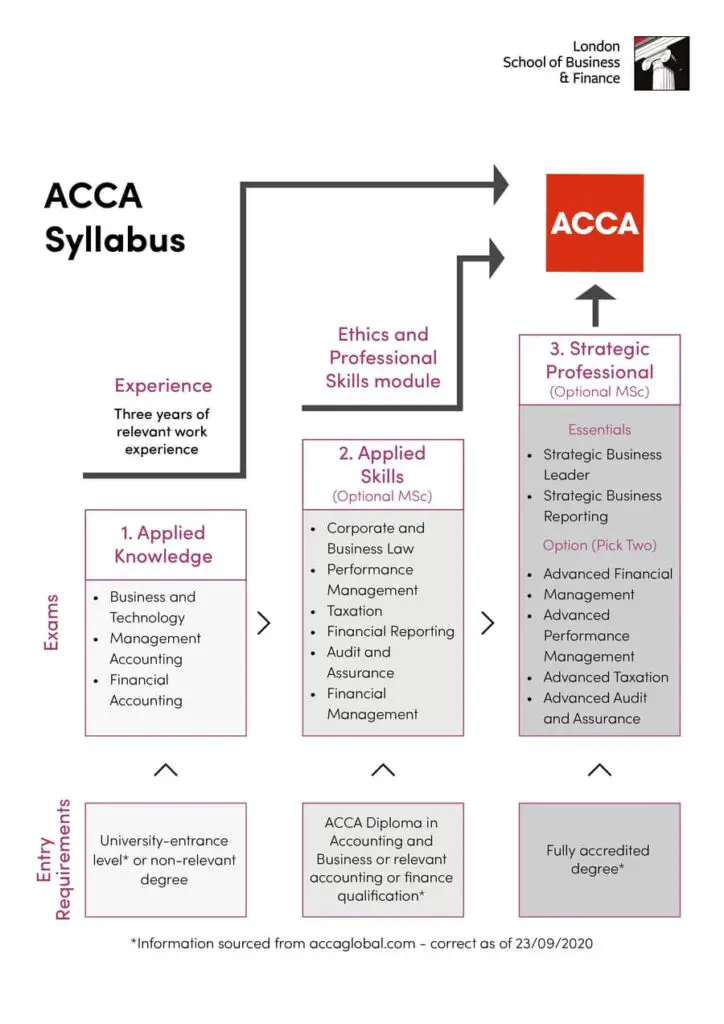

The ACCA qualification involves 13 exams split into three levels (as shown below) which include the Applied Knowledge, Applied Skills and Strategic Professional levels.

The Applied Knowledge level involves three exams; Business and Technology, Management Accounting and Financial Accounting.

The Applied Skills level involves a further six exams; Corporate and Business Law, Performance Management, Taxation, Financial Reporting, Audit & Assurance and Financial Management.

The Strategic Professional level involves two mandatory exams (Strategic Business Leader and Strategic Business Reporting) and then a further two exams from a choice of four with the choices being Advanced Financial Management, Advanced Performance Management, Advanced Taxation and Advanced Audit and Assurance.

The ACCA qualification has a reputation for being difficult but passable providing the candidate gives sufficient effort. This sentiment is backed-up by the pass rates which demonstrate the difficulty of these exams. For example, the Management Accounting exam in the first level had a pass rate of just 65% in the most recent exam sittings.

For all pass rates by exam in the most recent exam session per the ACCA website please refer to the below resource:

| Level | Exam name | Pass rate (most recent sitting) |

| Applied Knowledge | Business and Technology | 84% |

| Applied Knowledge | Management Accounting | 65% |

| Applied Knowledge | Financial Accounting | 71% |

| Applied Skills | Law | 83% |

| Applied Skills | Performance Management | 43% |

| Applied Skills | Taxation | 49% |

| Applied Skills | Financial Reporting | 50% |

| Applied Skills | Audit and Assurance | 38% |

| Applied Skills | Financial Management | 50% |

| Strategic Professional (mandatory) | Strategic Business Leader | 51% |

| Strategic Professional (mandatory) | Strategic Business Reporting | 48% |

| Strategic Professional (choose 2 of 4) | Advanced Financial Management | 41% |

| Strategic Professional (choose 2 of 4) | Advanced Performance Management | 32% |

| Strategic Professional (choose 2 of 4) | Advanced Taxation | 37% |

| Strategic Professional (choose 2 of 4) | Advanced Audit and Assurance | 34% |

The above table demonstrates the difficulty of these exams. Only five of the above fifteen exams have a pass rate above 50% so for the remainder, more people fail the exam than pass.

It’s also clear from the above table that the difficulty increases as the candidate progresses through the levels with higher pass rates seen in the initial Applied Knowledge phase.

This data can be useful for ACCA students in deciding which two out of four additional Strategic Professional level exams to take. Based on the above, Advanced Financial Management and Advanced Taxation look to be the most logical choices given more people pass these exams.

Having worked with numerous ACCA qualified Accountants, the common experience seems to be that the Audit & Assurance (and Advanced Audit and Assurance for anyone brave enough to take it on) are the most difficult exams.

As an ACA qualified Accountant myself (which is the equivalent qualification for those working in practice) my theory as to why ACCA candidates struggle with these particular papers more than others is because they are more removed from Auditing, typically working for Companies in the Accounting and Finance functions rather than as an auditor.

Similarly, many ACCA candidates report that one of the biggest obstacles to success is juggling the exams and other working commitments. This is especially the case for those looking to complete all the exams in a short time frame.

Is the ACCA harder than CIMA?

Similar to the ACCA qualification, the CIMA (Chartered Institute of Management Accountants) qualification is a possible route to becoming a Chartered Accountant.

The two courses have many similarities including a high volume of challenging exams to get through (13 for ACCA vs 16 for CIMA).

The biggest difference between the two is the focus of the content of each qualification with CIMA focusing more on management accounting and strategy whilst the ACCA tends to be more focused on technical financial accounting.

There is no clear indication of which is more difficult out of the ACCA and CIMA qualifications. Different candidates would likely find either more difficult depending on their experience and skillset at the outset.

A very small number of people would ever complete both qualifications (as there is no real benefit to doing so) so an apt comparison of the two courses is difficult to make but on the surface, they appear to be an equivalent level of difficulty.

For more on this, have a read of my recent post on ACA, ACCA and CIMA – what’s the difference?

What is the hardest exam in the ACCA qualification?

In the most recent sittings, the exams with the lowest pass rate in each level were as follows.

At the Applied Knowledge level, the Management Accounting exam appears to be the most difficult with a pass rate of 65% which compares unfavourably with the 71% and 84% pass rates in the Financial Reporting and Business and Technology exams respectively.

Within the Applied Skills level, the Audit and Assurance paper is the most difficult as mentioned above with only 38% of candidates passing. Performance Management is also tough with a pass rate of just 43%.

By the time candidates reach the Strategic Professional level, all of the exams are truly difficult with low pass rates in the 30s and 40s common across the board.

Ultimately, the hardest exam paper in the ACCA qualification will be subjective as it depends on each individual candidate’s skill-set and interests. For example, certain candidates may find the Taxation exam the most difficult as they struggle to recall the rules and dates as required whilst others find this paper straight forward.

What does ACCA stand for?

The ACCA qualification stands for the “Association of Chartered Certified Accountants“.

On completion of the qualification and necessary practical work experience, successful candidates will be able to use the ACCA letters after their names.

Using the ACCA letters after your name e.g. ‘David Jones ACCA’ demonstrates in professional settings that you are a fully qualified Accountant and can be thought of in the same way as Doctors using ‘MD’ after their name.

Alongside passing the 13 exams, candidates will need to complete 36 months of practical work experience and complete an ethics and professional skills module. This module is fairly simple and is not considered a formal exam.

What is the difference between the ACCA and ACA qualifications?

The ACCA and ACA are very similar qualifications in that they are both highly respected accounting qualifications with similar acronyms and a lot of overlapping content.

The main differences between the two are where the candidates who take each qualification work and the institutes which run each qualification.

The ACA qualification is awarded by the ICAEW (Institute of Chartered Accountants in England and Wales) whereas the ACCA qualification is awarded by ACCA (Association of Chartered Certified Accountants).

Generally speaking, the ACA is offered by audit and professional services firms such as the Big 4 (KPMG, EY, Deloitte and PwC) and others such as RSM, Baker Tilly and Grant Thornton.

Whilst there is a lot of overlap, the ACA places a greater focus on audit and taxation with four audit focused and three tax-focused exams across the 15 exam syllabus.

Meanwhile, ACCA is more common for those working within the Accounting function at Companies. The topic is slightly less geared to professional services like audit and tax and is more focused on management accounting and financial accounting.

For more on the difficulty of the ACA exams, check out my post on How hard are the 15 ACA qualification exams? Exams ranked by difficulty

What job roles can an ACCA Accountant do?

The ACCA qualification can lead to a variety of career paths. As an Accountancy qualification, clearly, the most common routes for ACCA graduates are typical accounting jobs like Management Accountant, Financial Accountant, Group Accountant etc.

However, due to the transferable skills in this qualification, jobs in audit, tax, law, advisory and strategy are also common.

Many of the CFOs and senior finance staff in the FTSE500 companies have ACCA qualification backgrounds which goes to show what an invaluable springboard the ACCA can be when it comes to forging a highly-paid career in the finance function.

Are you considered a Chartered Accountant after completing the ACCA qualification?

An ACCA qualified accountant is a chartered accountant as ACCA stands for the “Association of Chartered Certified Accountants“.

A Chartered Accountant can be simply defined as an Accountant who belongs to a professional body or ‘charter’ such as CIMA, ACCA or ACA.

It’s important to note that there any many people working as Accountants i.e. they perform the work activities associated with the accounting profession, that can not be considered chartered accountants as they have not received a professional qualification so don’t belong to a professional body.

The major benefit of becoming a chartered accountant is that it lends credibility and prestige to your job title. For example, individuals are more likely to hire a chartered accountant as they are reassured by the level of training the Accountant must have had.

Similarly. a Chartered Accountant is bound by the ethical standards set by the professional body they are a member of. Deviating from these ethical standards can result in expulsion from the professional body which, again, gives potential clients greater confidence in the professional.

To stand a good chance of achieving a top accountancy job, achieving a well-regarded accountancy qualification like ACCA, ACA, CIMA or CA is an important first step.

What qualifications do you need to study ACCA?

In the UK, you do not need an undergraduate degree or any previous background in Accounting in order to study for the ACCA qualification.

However, there are minimum entry requirements. This varies by locality but in the UK you will need to have a minimum combination of GCSEs and A-Levels.

The minimum requirement in the UK appears to be two A-Levels and three GCSEs in 5 different subjects although it’s also possible to use other qualifications such as BTECs to become eligible.

For more information, consult the minimum entry requirements on the ACCA website, which shows what qualifications are needed in each locality in order to be eligible to start the qualification.

What salary can you earn after becoming an ACCA Accountant?

How much an ACCA qualified Accountant will earn depends entirely on the specific career route and job role they find themselves in as well as the Company, location and career progression of each individual.

Generally, Accountancy as a field is a well-paid, stable career choice and achieving a qualification like the ACCA will put a floor on your future earning potential, meaning you will likely command a decent minimum salary for the remainder of your career.

This floor, at the time of writing, is around £45k-50k in the London area (adjust according to the cost of living in your area). Once fully qualified as an ACCA accountant, you should expect to be earning this amount which will increase over time as you progress to more senior roles.

There isn’t a cap to your earning potential as some ACCA qualified Accountants have gone on to earn significant salaries as CFOs or even CEOs of major FTSE listed businesses.

A strong performing ACCA qualified Accountant will most likely earn between £50,000 and £120,000 for the majority of their career.

As always, please remember I am an Accountant, but not your Accountant. In this post (and all of my others) I share information and oftentimes give anecdotes about what has worked well for me. However, I do not know your personal financial situation and so do not offer individual financial advice. If you are unsure of a particular financial subject, please hire a qualified financial advisor to guide you.

This article has been written by Luke Girling, ACA – a qualified Accountant and personal finance enthusiast in the UK. Please visit my ‘About‘ page for more information. To verify my ACA credentials – please search for my name at the ICAEW member finder. To get in touch with questions or ideas for future posts, please comment below or contact me here.