As an ACA qualified Accountant, whenever I speak with friends about the qualification, by far the most common question I get asked on the topic is ‘so, how hard are the exams?’

The ACA accountancy exams are difficult, especially for those with no prior training, with a large breadth and depth of technical information covered. However, with the right resources and commitment, they are passable – particularly given the attainable 50% / 55% pass mark across all 15 exams.

You may be considering starting the ACA qualification or simply be interested in what it involves, either way, I’ll let you know how hard I personally found the exams, how the exams are structured and the reasons to be confident you can pass the exams.

Check out all of my recommendations on books, professional qualification resources and more here!

How hard are the ACA qualification exams?

In short – I found the ACA exams challenging but not impossible. If you start the ACA qualification in the knowledge that it will require hard work and sacrifice, the majority of you should have no trouble getting through. For context, I took the exams as part of a big 4 training contract and of my class of 30, 27 ended up getting through all of the exams.

There are a few common reasons people can struggle with these exams; the volume, the steep learning curve and the pressure.

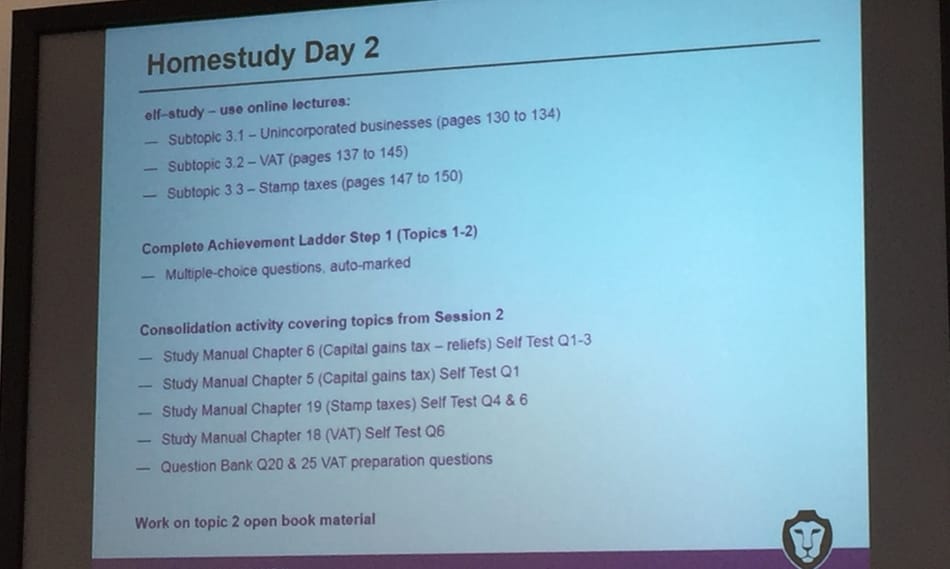

Each time I started a new topic, I remember walking into the classroom to be met with a mountain of resources containing a question bank, a folder of course notes and a study manual. This can be pretty overwhelming at first glance and it’s important to work out early what is and isn’t important. Generally speaking, the course notes to understand the content, the question bank to test your understanding and the mock exams are the resources you should be interested in.

Each exam covers a lot of content particularly as you progress to the more challenging professional and advanced levels, but it’s worth bearing in mind that the tuition providers are very helpful in preparing you for the information which is most common in exams. The fact that you only need 50% or 55% to pass depending on the exam should also give you confidence as it means understanding every single piece of the content is neither necessary nor practical. The content can be difficult but from personal experience, I can say that with repetition and practice this can be overcome.

These 2 things alongside the pressure of passing exams and staying on track with the rest of the class can make for a difficult time, but the collegiate atmosphere of a tuition class can also be a significant positive factor. In fact, my biggest recommendation would be to find a study partner/group with complementary strengths – without doing this, I know I would have found the exams all the more difficult.

How the ACA qualification exams are structured

As eluded to above, the 15 ACA exams are split into 3 levels; certificate level, professional level and the advanced level each increasing in difficulty and building on the skills developed in the previous levels.

Certificate level:

The base layer of this qualification is the certificate level, which comprises 6, 1.5-hour computer-based assessments covering the fundamentals of accountancy, law, tax, audit and company finance.

Although these are the most simple exams in terms of content, my experience was that these exams, particularly the opening ‘Accountancy’ exam, have the steepest learning curve. If you have no accountancy experience before studying for these exams, getting your head around the double-entry method of accounting can be difficult. You must understand this fully from the outset and make sure your understanding is perfect. if not, you will struggle with at least another 5 of the exams in the qualification.

Prior to starting the course, watch a few youtube videos on the concept of double-entry accounting using the DEAD CLIC system. This will be invaluable when it comes to your first study day.

The Progression Playbook tips

Professional level

The second level is the professional level, which builds on some of the modules covered in the certificate level and introduces a couple of new topics. This level has a further 6 exams, which are more substantial 2.5 or 3 hours in length each (typically studied in batches of 3).

At this stage, you will have built a good foundation in accountancy and finance but this level has some truly challenging content – particularly the Financial Accounting Reporting (“FAR”) and Business Planning: Taxation (“BPT”) exams, both of which I found truly difficult.

Advanced level

The final stage of the ACA qualification is the advanced level and at this stage, you are truly in the home straight. The level is split into a further 2 parts – the final content modules: Corporate Reporting and Strategic Business Management and then the Case Study which is typically the final exam taken at the end of your training contract.

Corporate Reporting and Strategic Business Management are both tough exams, with a huge breadth of content and a gruelling revision schedule required to be successful. The exams are 3 hours long each, highly time-pressured and with a greater focus on real-world style advice to fictional clients.

The case study exam is comparatively easier, it is a fully open book with very little technical knowledge required. The difficulty with this exam is remembering the highly formulaic approach to answering questions, but with practice, this shouldn’t be causing too many issues.

Every ACA exam ranked by difficulty

Every ACA student will find different exams the most challenging based on their own skill-sets but for me, I have ranked the exams as below with 1 being the most difficult.

| Ranking | Exam | Notes | Link to guide |

| 15 | Business, Technology and Finance (Certificate level) | The most simple of the 15 exams, most should get through this one without too much trouble. | https://theprogressionplaybook.com/how-to-pass-the-icaew-aca-business-technology-and-finance-exam/ |

| 14 | Assurance (Certificate level) | This exam will be many student’s first foray into audit which can take some getting your head around. Once you understand it, the exam is fairly straightforward. If you work in audit during your training contract, a lot of the concepts here will be easy to grasp as you will have practical experience. | https://theprogressionplaybook.com/how-to-pass-the-icaew-aca-assurance-exam/ |

| 13 | Law (Certificate level) | The only real difficulty here is the volume of content so the key to success is working through the question bank in full. (which is also the case for all exams up to the advanced level) | https://theprogressionplaybook.com/how-to-pass-the-icaew-aca-law-exam/ |

| 12 | Management Information (Certificate level) | This is actually the exam I got my highest score on throughout the qualification. However, a couple of sections in here such as costing & pricing can be tricky. | https://theprogressionplaybook.com/how-to-pass-the-icaew-aca-management-information-exam/ |

| 11 | Principles of Taxation (Certificate level) | The introductory tax module – I found this one surprisingly interesting and passed it reasonably comfortably. I partly put this down to having a truly excellent tutor for this module who shared some crazy exam tips including “wear what you would wear on exam day whilst you revise to boost memory”. | https://theprogressionplaybook.com/how-to-pass-the-icaew-aca-principles-of-taxation-exam/ |

| 10 | Case Study (Advanced level) | The final exam of the entire qualification and the most unique. Follow the tuition steps carefully and come well prepared and you should be fine. It is difficult to get over 70% but not too difficult to pass. This is a 4 hour, time-pressured exam so will likely feel draining but the knowledge that this is the final step in the process should help you cross the finish line. | https://theprogressionplaybook.com/how-to-pass-the-icaew-aca-case-study-exam/ |

| 9 | Business Strategy and Technology (Professional level) | There’s a reason this module was nicknamed ‘BS’ – the content is, in my opinion, largely nonsense. The good news is that this module is by far the easiest of the professional level. | https://theprogressionplaybook.com/how-to-pass-the-icaew-aca-business-strategy-and-technology-exam/ |

| 8 | Audit and Assurance (Professional level) | The 2nd exam within the audit and assurance series. A slight technical increase on the certificate level exam but very passable nonetheless. | https://theprogressionplaybook.com/how-to-pass-the-icaew-aca-audit-and-assurance-exam/ |

| 7 | Accounting (Certificate level) | The only exam I didn’t pass 1st time. This is likely the first exam you will take and naturally has the steepest learning curve. As mentioned above, get a rudimentary understanding of double-entry accounting before starting to get ahead of the game. | https://theprogressionplaybook.com/how-to-pass-the-icaew-aca-accounting-exam/ |

| 6 | Tax Compliance (Professional level) | The 2nd level of the tax series. Similar to the Principals of Tax exam but builds on what was learnt within the certificate level. | https://theprogressionplaybook.com/how-to-pass-the-icaew-aca-tax-compliance-exam/ |

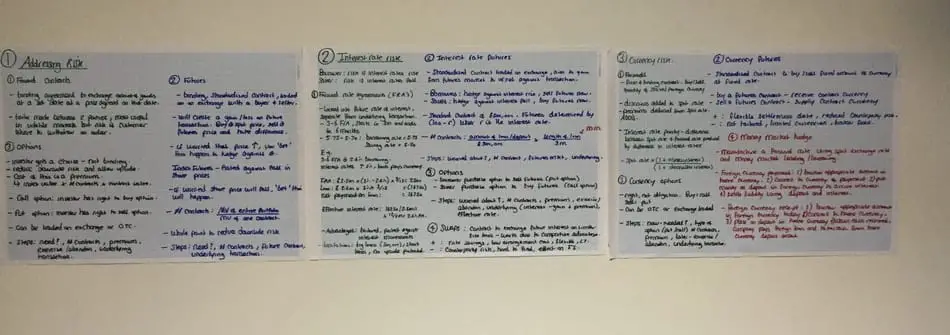

| 5 | Financial Management (Professional level) | An introduction to new, interesting topics such as net present value (NPV) calculations to value companies or projects and derivatives. Difficult in places simply due to the lack of foundational knowledge but one of the more interesting topics in my opinion. | https://theprogressionplaybook.com/how-to-pass-the-icaew-aca-financial-management-exam/ |

| 4 | Strategic Business Management (Advanced level) | A huge volume of content to study with gruelling, full-length 3-hour practice exams being particularly tough. At this stage, you’re close to completing the exams and you’ll be running on momentum. | https://theprogressionplaybook.com/how-to-pass-the-icaew-aca-strategic-business-management-exam/ |

| 3 | Financial Accounting & Reporting (Professional Level) | The 2nd accounting-based module after the introductory Accounting module. A step-up in difficulty with an increased focus on written answers, e.g. explaining the accounting treatment of various transactions. This is often the first professional level exam taken and the increase in difficulty by level can be felt most strongly within this exam. | https://theprogressionplaybook.com/how-to-pass-the-icaew-aca-financial-accounting-and-reporting-exam/ |

| 2 | Corporate Reporting (Advanced Level) | Similar to Strategic Business Management but with more difficult content. There’s no getting around it, this exam is tough. | https://theprogressionplaybook.com/how-to-pass-the-icaew-aca-corporate-reporting-exam/ |

| 1 | Business Planning: Taxation (Professional Level) | This has since been split into several options (taxation, technology and insurance) – however, when I took the exam in 2017, taxation was the only option. Although the exam was open book, I didn’t pass a single mock before exam day and the content was highly challenging. I’m still to this day not sure how I managed to scrape through on exam day. Maybe the technology or insurance variations will be easier? | https://theprogressionplaybook.com/how-to-pass-the-icaew-aca-business-planning-exam/ |

Conclusion

The ACA exams are genuinely difficult and not for the faint-hearted, the breadth, depth and technical detail of the topics means you have to be truly committed to your in-class tuition and a well-thought-through revision schedule to stand a chance of passing all of these exams.

I took all of these exams in a 10 month period on an ‘intensive ACA scheme’ and had to sacrifice pretty much everything else in my life for this period to be successful. Others with an accounting background and a few exam exemptions may find it notably easier.

There is cause to be confident – firstly, the pass marks are either 55% or 50% across the board depending on the exam. This gives many students confidence that they can achieve a pass without needing to know all of the content.

Secondly, the ACA qualification has good pass rates, especially compared with other qualifications like the CFA. The majority of the exams in the syllabus have pass rates in the 70-80% range which suggests that the exams are certainly passable, particularly when you realise that the 20-30% who don’t pass tend to be those not on formal training contracts with tuition providers like Kaplan and BPP. Taking these exams independently without formal training isn’t impossible, but it does make it far more difficult.

If you’re planning on doing this qualification, good luck. It can be difficult but the skills you learn, the knowledge you acquire and the work ethic you will develop are invaluable. The hard work pays off handsomely on completion of these exams once you become a fully qualified ACA accountant and get that shiny certificate (mine shown below). Not only does this put a floor on your future earnings, but it also provides a great basis to build a career off.

There are of course other accounting qualifications that are available. I wrote about three of these in my post ‘ACA ACCA CIMA – what’s the difference?’

For more information on the qualification and the individual exams, refer to the ICAEW website here.

This article has been written by Luke Girling, ACA – a qualified Accountant and personal finance enthusiast in the UK. Please visit my ‘About‘ page for more information. Please comment below or contact me here to get in touch with questions or ideas for future posts.

Congrats on passing! I’m a uni student and was wondering if you could provide me with some more info after the exams

Thanks for this, looking forward to contact and hear more from you as soon I start mine.

Thanks