If you want to learn accounting, you may find yourself signed up for a three-year professional qualification and struggling through a load of difficult exams. However, if you’re ok with no certificate, you can learn all of the key lessons of accounting in a much shorter period by reading this blog post.

It is worth studying accounting, even if you are not planning a career in the industry. Basic accounting knowledge is essential for understanding the financials of companies you may invest in. Solid knowledge of accounting also allows individuals to better understand their own financial situations.

Accounting may not seem exciting in the traditional sense but most of us pursuing financial independence will at some point invest our money in equities i.e. company shares. Investing titan Warren Buffett once said “never invest in a business you cannot understand” and the truth is, if you don’t understand basic accounting, you’ll struggle to truly understand the fundamentals of any business. So with that being said, let’s get started on our whistle-stop tour of accounting

What is the purpose of accounting?

Accounting is important in running any business via its role in ensuring compliance with local laws and providing financial information for management to base strategy on. Without accounting, stakeholders would simply not have sufficient information on the companies they are interested in.

The purpose of accounting is to record businesses transactions, summarise them within the financial statements and then analyse the financial performance and position of that business using the financial statements.

Taking a look at each of these in turn, the first part is to record all of the businesses transactions. As you can imagine, without the structure that modern-day accounting provides, it may be difficult to keep an accurate record of every single transaction an entity makes. If a business is unable to record its transactions, it won’t have access to accurate financial information to base future decisions on.

Having said that, a list of all of a businesses transactions isn’t particularly useful to most stakeholders such as an investor or a customer as it’s not intuitive to see how the company is actually performing. This is where summarizing the financial data into financial statements comes into play which allows users to see an aggregate position based on every transaction a business has made historically split by financial statement caption such as ‘inventory’ or ‘revenue’.

The final stage is analysing the information shown in the financial statement to draw conclusions about the financial health of the business. For example, if a business had annual expenses of £2 million and currently only had £150k in the bank, a fair conclusion may be that the business looks like it has liquidity problems and may at some point be unable to pay its debts. If you were a supplier to that business looking at these accounts, you may take the action not to extend much credit to that company knowing they may struggle to pay it back in the future.

What are the different types of business structure in the UK?

In the UK, there are 3 main types of business entities; limited companies, partnerships and sole traders. Each structure has different advantages and disadvantages but generally speaking, each type is accounted for in the same ways.

Limited Companies are incorporated with Companies House and the main advantage is “limited liability” which means the business is seen as a separate legal entity to the owner (unlike a partnership or a sole trader) this means the maximum potential loss a limited company owner can incur is the amount that was paid for the shares on incorporation (which can be as little as £1).

The most obvious disadvantage of a limited company is the administrative burden both in terms of the initial set-up of your company and the annual requirement to prepare financial statements. I wrote about how to produce limited company accounts here for any of you who may be interested.

A partnership is a business arrangement whereby two or more people enter into a partnership agreement together in order to share the risks and rewards of the business venture. This structure is common for accountancy practices and can come in the form of an ordinary partnership or a limited liability partnership (LLP) which allows for ‘”limited liability” for the partners as discussed above.

The big downside to a partnership is the possibility of disputes arising between partners. If two partners disagreed on the direction a partnership should take, this would cause a difficult conflict within the business. Similarly, if one partner is more interested than the other, resentment may build over the partner who contributes little but still gets half of the reward. These issues can usually be mitigated by a carefully written partnership agreement.

Finally, we come to sole traders. These are essentially just people who set up a business and work for themselves. The logistics of setting up a sole tradership is as simple as registering with HMRC. Sole trader refers to the ownership of the business and does not mean that employees can’t be hired. Whilst this business structure tends to involve a lot less administration and regulation, it doesn’t have the perk of limited liability and can appear less formal than fully incorporated companies in certain industries.

How is accounting regulated in the UK?

Accounting is regulated by the local legislation in place and the applicable accounting standards that the business operates under. This is typically either the international financial reporting standards (IFRS) or the local generally accepted accounting practice (GAAP).

The international financial reporting standards (IFRS) are set by the IASB (International Accounting Standards Board). Yes, accounting has too many acronyms.

The IFRS is based on the ‘conceptual framework’ which states “the objective of general-purpose financial reporting is to provide financial information about the business entity that is useful to existing and potential investors, lenders and other stakeholders in making decisions about providing resources to the entity.”

GAAPs, on the other hand, are simply the rules applicable to countries operating in a certain jurisdiction, for example, UK GAAP or US GAAP. Whilst certain accounting policies differ between these local rules and IFRS, there is consistency in terms of the requirement that financial statements are comparable, understandable, relevant and reliable.

In the UK, the Companies Act (2006) states that all companies financial statements must give a “true and fair” view of the company.

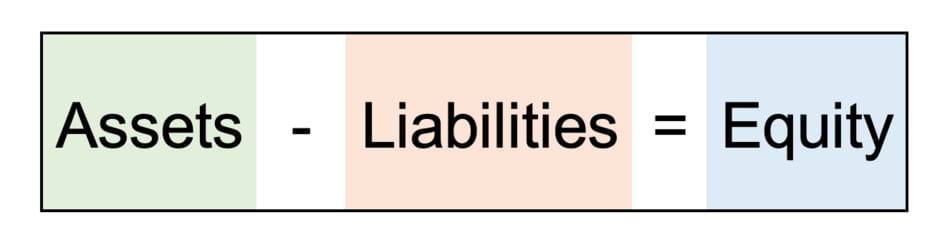

What is the “accounting equation”?

When it comes to accounting, the first thing to understand is the accounting equation which states that: assets – liabilities = equity.

Assets are simply that which is controlled by or owed to the business – for example land, machinery, inventory, cash or money owed from customers.

Liabilities are simply that which is owed by the business to external sources – for example; loans, amounts due to suppliers or accruals.

Equity is the amount invested into the business by the owners both in terms of the initial investment and the profit the business has made that is reinvested into the business each period.

Our accounting equation above of Assets – Liabilities = Equity is fairly intuitive, the value of the ownership of the business (the equity) is simply the value of everything the business owns (assets) minus everything it owes (liabilities).

As an example, let’s say our business had assets of inventory (£100), cash (120) and a laptop (£200) and liabilities of money owed to suppliers of £350. That would mean our net assets (assets – liabilities) is £70 (£100 + £120 + £200 -£350).

If our net assets are £70, that means our equity must also be £70.

Assets (£420) – Liabilities (£350) = Equity (£70).

Similarly, every single transaction posted by a business will work in a similar way. Let’s say our business made a sale of £20, we would recognise revenue and cash received of £20. In our accounting equation, this would be:

£20 cash assets – £0 liabilities = £20 equity (via profits reinvested in the business).

What are the primary financial statements in UK accounts?

The main financial statements are:

a) the profit and loss statement – which shows the performance of the business.

b) the balance sheet – which shows the position of the business

c) the statement of changes in equity – which shows the movement in equity each year

d) the statement of cash flows – which reconciles the amount of cash held by the business each year by showing what cash has been received and what cash has been spent.

Due to the accounting equation above, each of these primary statements are interlinked:

- The final profit for the year figure at the bottom of the profit and loss statement feeds into the ‘equity’ section of the balance sheet.

- Similarly, the statement of changes in equity shows the closing equity of the business, which is also seen in the ‘equity’ section of the balance sheet.

- The cash flow statement shows how the businesses cash balance changes over the course of the accounting period (usually a year). The final cash balance as per the cash flow statement is also shown in the ‘assets’ section of the balance sheet as cash.

Let’s take a greater look at each of these statements in turn.

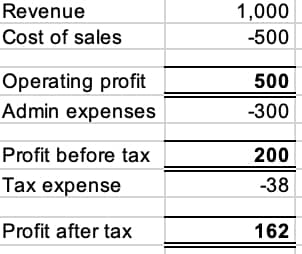

What is the “profit and loss statement” in accounting?

The first thing to note about the profit and loss statement is that it records a cumulative accounting period, usually of a year. Each year, the profit and loss statement resets to zero and at the end of the year, the profit or loss for the period is rolled up into the balance sheet under the ‘equity’ section.

Put simply, the profit and loss statement displays all of the income and expenses of the business over a reporting period. If the income exceeds the total expenses in the period, the entity will record a profit but if the expenses are greater than the income, the entity will record a loss.

Income

The main form of income is known as revenue (also referred to as “turnover” or “sales”) and is simply the amount a business has earned by selling its products or services. For example, if the business was a bakery and sold 10 cakes in a year for £10 each, the total revenue would be £100.

Only revenue earned during the period is recognised in the profit and loss statement each year. For example, if you paid an airline for the service of an aeroplane flight in December 2018, but the flight itself didn’t take place until February 2019, the revenue would be recognised in the 2019 reporting year despite when the cash was actually received. This is sometimes referred to as the ‘accruals basis of preparation”.

Other income is also possible which includes finance income. For example, if you had business money in an investment account earning interest, this would be treated within the profit and loss as ‘other income’ or ‘finance income’.

Expenses

On the other side, we have expenses. These are typically split into two different expense types:

Cost of sales – which are those expenses directly related to what we are selling. For example, if our product is cakes, our cost of sales will be the ingredients we purchase plus the labour costs of the bakers.

Administrative expenses – also known as ‘operating expenses’ relate to business expenses the entity incurs that are not directly related to sales – for example, overheads such as electricity.

Similarly, expenses are recorded in line with the period they relate to. For example, if we paid an electricity bill for the year July 2018 to June 2019 but our accounting period is the calendar year January – December 2019, we would only recognise the 6 months that relate to our accounting period within 2019 regardless of when we paid this bill.

Tax

Once the business calculates all of its revenue and all of its expenses, it will arrive at its “profit before tax” figure. The final step is to calculate the tax the business owes the government which for the current year (2020/2021) is 19% of profit before tax. Whilst tax can be significantly more complicated than this when things like deferred tax and disallowable expenses are entered into the mix, for the time being, you can assume it’s just 19% of profit before tax.

The balance sheet

Unlike the profit and loss statement which covers a cumulative period of a full accounting period (usually a year), the balance sheet simply shows all of the assets, liabilities and equity at a single point in time – known as the year-end date or 31 December 2019 in our example above.

As consistent with the accounting equation above, the balance sheet must, as the name suggests, balance. I.e. the net assets (assets – liabilities) must be equal to equity.

Assets

There are a number of different asset types which are split between current (liquid or collectable within 12 months) and non-current (illiquid or collectable after 12 months).

Non-current assets are typically things like land, buildings or machinery. These are often purchased by the business but rather than expensing these costs to the profit and loss statement, they are capitalised to the balance sheet as assets as they are expected to bring future economic value to the business.

With the exception of land, these non-current assets depreciate over time, meaning they lose value each year. Think of this in terms of a car, you’ve probably heard the expression that cars lose x% of their value as soon as they drive off the lot. It’s similar to non-current assets but the depreciation is typically more linear i.e. equal amounts depreciated each year.

Current assets include things like cash (the physical money held by the business as cash or cash equivalents), inventory (the products held by the business waiting to be sold to customers) and accounts receivable (money owed to the business from customers who are yet to pay for a product or service they have received).

Liabilities

On the other side, you have the liabilities which are also split into current and non-current. On the non-current side you may have a loan balance that is due to the bank in 5 years time whilst on the current side of things you may have balances you owe to suppliers, for example, if we have had sugar and flour delivered from a supplier but have not yet paid for it, this would be classified as accounts payable.

Another current liability is known as accruals which are similar to accounts payable with the main difference being an invoice hasn’t been received in respect of the supplies purchased or expense incurred so an estimated balance is reflected in the accounts.

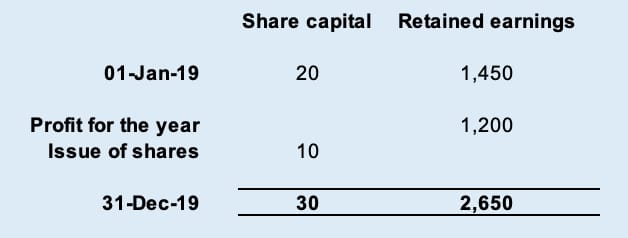

The statement of changes in equity

The statement of changes in equity is a more simple financial statement that simply shows the total equity of the business at the start of the year, the movements and the total equity at the end of the year.

This is usually presented in two main categories as shown below, share capital and retained earnings.

Share capital is the initial investment of the owners of the business in shares. Whoever owns the shares, owns the business. More shares can be issued each year to change the ownership structure of the business.

Retained earnings are the cumulative profit or loss from each year’s profit and loss statement which are reinvested into the equity of the business.

The cash flow statement

The cash flow statement is the least used of the four primary statements and smaller businesses are exempt from preparing it within their financial accounts.

The purpose of the cash flow statement is simply to reconcile the movement in cash held by the business throughout the year. For example, if a business had cash of £200 on 31/12/2018 and £350 at 31/12/2019 that extra £150 may have been earnt through one of three cash flow categories:

a) cash flow from operations e.g. sales made by the business

b) cash flow from investing activities e.g. buying or selling a piece of machinery

c) cash flow from financing activities – e.g. proceeds from the issuance of shares to new owners.

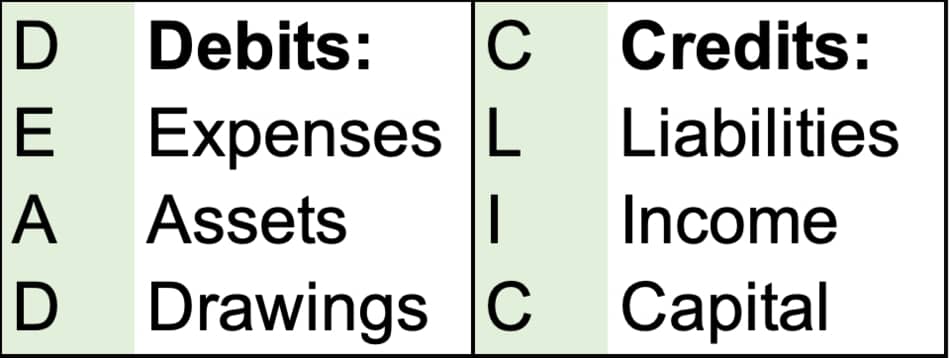

Double entry accounting

Double-entry accounting is a system whereby two bookkeeping entries are required for each transaction. The entries are made via debits & credits which can be remembered via the acronym DEAD CLIC which stands for Debits: expenses, assets, drawings and Credits: Liabilities, Income, Capital.

I recently wrote a full post explaining the concept of double-entry accounting using the DEAD CLIC acronym which can be found here. I highly recommend you read this post to properly understand how to record transactions before continuing on to our last couple of sub-headings.

Key accounting concepts

There are a number of key accounting concepts that underpin accounting:

Going concern

The first of which is the ‘going concern’ concept which basically states that a business intends to continue in its operations for the foreseeable future which is usually defined as over 12 months. If it looks like a business will not survive for this period, the business must prepare its financial statement on a non-going concern basis which discloses this fact.

The going concern consideration is a key thing auditors test in financial audits as if an entity wasn’t a going concern significant changes would be required to the financial statements. For example, it wouldn’t be correct to recognise non-current assets or liabilities as these would all be current if the business were not able to survive past 12 months by default.

Accruals basis

According to the accruals basis, when calculating income earned, a business must match the expenses incurred in order to produce that income against it. For example, if a sale is made in 2019, the expenses made to earn that sale would also be recognised in 2019.

Materiality

Materiality is a concept that allows a threshold for error within financial statements. For example. it would be ridiculous to expect a billion-dollar company to have financial statements correct to the nearest cent. There is far too much scope for human error for that to be realistic.

Therefore, materiality states that errors or omissions (either individually or combined) are material if they influence the economic users of the financial statements. As an example, if I looked at the financial statements of Coca Cola because I was thinking of investing in the business, an error of $1 would be completely trivial to me. In fact, an error even as big as $1 million may be trivial given revenues for 2019 were 37 odd billion dollars. These errors wouldn’t alter my judgement on whether the Company is a good investment or not as they make up such a small proportion of the total balances.

However, if I were to prepare financial statements for the local bowling alley, clearly a £1m error would not be trivial and therefore would be classed as ‘material’ as this amount of money would impact the decisions of the economic users e.g. an investor might purchase the bowling alley because it looks to be performing remarkably well when in reality this is due to an accounting error. In this case, the financial statements would be described as ‘materially misstated’.

Offsetting

Within accounting, the concept of offsetting simply states that assets and liabilities and income and expenses can not be offset against each other and must be presented separately.

For example, if you had £10 accounts receivable (money owed by customers) and £5 accounts payable (amounts due to suppliers) – you wouldn’t be able to net these off and simply record £5 receivable. You would have to show both elements.

What’s the benefit of learning accounting?

Ultimately, it’s only worth understanding accounting if you can use it to read a set of financial statements and understand what they tell you about the business. Using the information above, you should now be able to understand the business at a high level and work out what assets and liabilities it holds.

Here are a few other shortcuts’s to understand a business based on its financial statements:

Profit

Take a look at the profit and loss statement and see if the final line shows ‘profit for the year’ or ‘loss for the year’. Take a look in the prior year column and look for the same thing there. If the business has made a profit in both years and it’s trending up (i.e the current year profit is greater than the prior-year profit) that indicates the business is profitable.

It’s also worth taking a look at margins for example if you look at the gross profit (revenue – cost of sales) and divide this figure by revenue, you will get the gross profit margin. For example, if sales are 100, the cost of sales is 60, which makes our net profit 40. Out net profit margin is therefore 40%. The higher this margin is, the more money the business keeps on each individual sale as a proportion of the total sale.

There is also a net margin which is after other expenses and is calculated in the same way but taking ‘profit before tax’ divided by sales. This tells us what proportion of each sale is retained by the business of profit even after factoring in overheads and other administrative expenses.

Liquidity

Most businesses fail due to liquidity concerns or put more simply, running out of cash. If a business doesn’t have enough cash or liquid assets (assets that can be sold quickly to provide cash) then it will become untenable as it is unable to pay its debts as they fall due.

The easiest way to check the liquidity of a business is simply to look at the cash held within the ‘assets’ section of the balance sheet. If the cash number is big in comparison to the other numbers on the financial statements (including the annual expenses on the profit and loss statement) it’s fair to assume the business is in a good position liquidity wise.

Similarly, you can use the current ratio calculation which is simply current assets (cash, accounts receivable, inventory) divided by current liabilities (accounts payable, accruals etc) with any value above 1 indicating reasonable liquidity. It’s worth noting that if this ratio is too high, it suggests the business is sitting on cash or liquid assets which could be better used earning a return for the business.

Gearing

The gearing of the business tells us how the business is financed – either by equity (initial owner capital and reinvested profits) or by debt (loans from banks and other third parties). A quick way to look at this is to compare the level of debt as found within the ‘liabilities’ section of the balance sheet with the level of equity per the ‘equity’ section of the balance sheet. If the debt heavily outweighs the equity, this indicates that the business is highly geared which is riskier as the business, therefore, owes money and is more dependent on making money in order to fulfil these debts.

Net assets or liabilities

The final useful indicator is simply whether the business is in a net asset or net liability position. I.e. if total assets – total liabilities is above zero, the business has net assets and vice versa. If the business is in a net liability position, this indicates it is in a perilous position as it has greater liabilities than assets so may be unable to pay its debts as they fall due.

Conclusion

Simply put, accounting is a way of recording, summarising and analysing the business transactions of a business. These businesses are typically structured in the UK as a limited company, partnership, trust or sole trader.

Accounting in the UK is regulated via The Companies Act and all financial statements must be prepared under UK GAAP or IFRS which are the applicable accounting standards.

The financial statements are set up using the accounting equations which states that Asset – Liabilities = Equity and split into four primary financial statements; the profit and loss statement, the balance sheet, the statement of changes in equity and the cash flow statement. These financial statements are populated via double entry, whereby every single transaction impacts at least two financial statement captions such as revenue and accounts receivable.

Analysing the performance and position of a business can be done quickly with a rudimentary understanding of financial statements and the underlying accounting.

Overall, accounting is a crucial skill to understand both the finances of any business and also help put your own personal financial situation into perspective. Hopefully, the above has helped you all gain a solid foundation but if anything has been unclear, you can find some pretty solid explanations on Youtube or feel free to drop me a message in the comments below.

As always, please remember I am an Accountant, but not your Accountant. In this post (and all of my others) I share information and oftentimes give anecdotes about what has worked well for me. However, I do not know your personal financial situation and so do not offer individual financial advice. If you are unsure of a particular financial subject, please hire a qualified financial advisor to guide you.

This article has been written by Luke Girling, ACA – a qualified Accountant and personal finance enthusiast in the UK. Please visit my ‘About‘ page for more information. To verify my ACA credentials – please search for my name at the ICAEW member finder. To get in touch with questions or ideas for future posts, please comment below or contact me here.