To decide whether to do the CFA after CA (or the CFA after ACA or the CFA after CPA) qualification, you first have to work out what your objective is in terms of career path and the content you’re interested in learning. The CFA (Chartered Financial Analyst) is a challenging, post-graduate qualification that can be earned from the CFA Institute by those wishing to forge a career in a number of different financial industries.

The CFA (Chartered Financial Analyst) designation is certainly worth doing after an Accountancy qualification such as the CA, ACCA, ACA or CPA, particularly if the candidate plans to shift their career focus from pure Accounting to Investments and Portfolio Management.

In December 2017, shortly after becoming an ACA-qualified Accountant, I signed up and passed the CFA Level 1 exam. Take a look below to give yourself all of the information you’ll need to decide whether the CFA charter is worth doing for you having already achieved an Accounting qualification.

Check out all of my recommendations on books, professional qualification resources and more here!

Should I do the CFA after CA / ACCA / ACA / CPA?

There are many reasons to do the CFA after ACCA / ACA / CPA / CA or any of the other Accounting qualifications out there. This includes becoming eligible for different employment roles, increasing your future salary expectations, increasing your financial understanding and truly testing yourself.

Whilst completing an Accounting qualification such as the ACA (or CPA in the United States) is a great move for your career and gives you an evergreen safety net in terms of your future salary, it is not the qualification of choice within certain other lucrative financial industries.

If you hope to break into the highly competitive Investment banking, equity research, portfolio management or hedge fund arena, the CFA is a popular designation to start the process.

This qualification, more than many others, has the ability to dramatically increase your future earnings potential. In research carried out by 300Hours.com linked here, it is stated that having a CFA charter will increase your average pay by 39%.

Here at The Progression Playbook, we’ve spoken before about the importance of creating a surplus with your money (i.e income – expenses). One part of this equation is your income. If the CFA helps you to increase this by 39% i.e. £50,000 a year to £69,500 and you manage to keep your expenses stable, you will be able to create a significant surplus of £19,500 (before tax). That kind of money invested and compounded over time certainly moves the needle in terms of achieving your financial independence goals and will allow you to become financially independent significantly faster.

However, there are downsides to the CFA – particularly the significant upfront costs and the level of difficulty that many candidates don’t fully appreciate. Both of these things are looked at in more depth below.

To get an idea of how much work the CFA charter really is – check out my post on ‘CFA Level 1 – how long do you need to study in order to pass?‘

What topics are covered within the CFA

As mentioned above, there are 3 levels of the CFA charter and the topics within each level are broken down as follows:

| Topic | Level 1 | Level 2 | Level 3 |

| Ethics | 15% | 10%-15% | 10%-15% |

| Quantitative Methods | 15% | 5%-10% | – |

| Economics | 10% | 5%-10% | 5%-10% |

| Financial Reporting and Analysis | 15% | 10%-15% | – |

| Corporate Finance | 10% | 5%-10% | – |

| Equity Investments | 11% | 5%-10% | 10%-15% |

| Fixed Income Investments | 11% | 10%-15% | 15%-20% |

| Derivative Investments | 6% | 5%-10% | 5%-10% |

| Alternative Investments | 6% | 5%-10% | 5%-10% |

| Portfolio Management | 6% | 10%-15% | 35%-40% |

As you can see, Level 1 of the course gives a broad overview and looks to provide candidates with a strong basis in accounting and finance. By the time you get to Level 3, certain topics like Quantitative Methods (Maths and statistics) are scrapped from the syllabus and are taken as assumed knowledge.

You’ll also see that the portfolio management topic grows to 35%-40% by Level 3 which reflects the ultimate goal of the CFA charter – to get distinguished candidates into this sort of job role.

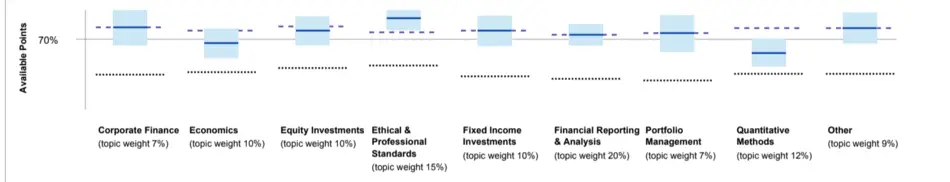

If you have done a professional Accounting qualification prior to the CFA, you will have a substantial advantage in certain topics such as Financial Reporting and Analysis and Corporate Finance which together are likely to make up 25% of the overall exam.

CFA uses a Minimum Passing Score (MPS) system to determine whether candidates pass or fail, which unlike most Accounting qualifications is not a fixed percentage. You can read more about this here. To simplify it, you will likely require around 70% to pass each level so having 25% of the exam being on topics you will have covered in-depth in your previous Accounting exams will be a significant advantage.

How much overlap will there be doing the CFA after CA and other Accounting qualifications

As alluded to above, there will be a substantial portion of the CFA content which is a direct overlap with your Accountancy qualification training. The material within the Financial Reporting and Analysis and Corporate Finance modules will pretty much all have been seen if doing the CFA after CA examinations or your country’s equivalent.

Similarly, most Accounting qualifications will have some material on Economics and Quantitative Methods within them which will provide further overlap with the CFA charter.

Although both the CFA and most Accounting qualifications will have a substantial proportion of the material dedicated to ethics, there is very little overlap between the two as CFA focuses on the organisation’s specific ethical code.

For the remainder of the modules, whilst you may be familiar with the topics through your previous studies, there will be almost no overlap in terms of the tested content.

For my posts on the difficulty of other related qualifications, click the below links:

How hard are the 15 ACA qualification exams? Exams ranked by difficulty

How Hard is the ACCA Qualification?

How Hard is the CIMA qualification?

How difficult is it to pass the CFA exams

The CFA exams are very challenging for most people. Despite the first level being entirely multiple choice, the exams cover a huge breadth of difficult content. The difficulty is reflected in the low overall average passing rate of 38% over the last decade.

The exams are typically easier for those who have already achieved a formal Accounting qualification. Firstly due to the overlap of content between the two qualifications as discussed above and secondly due to the fact that those who have achieved an Accounting qualification are more likely to succeed with the CFA simply because they have a proven professional level exam calibre.

In my personal experience of CFA Level 1, the exam content is on average easier than the ACA accountancy exams (the difficulty of which I wrote about in this post: ‘How hard are the 15 ACA Qualification exams?‘). However, the breadth of content in the CFA is much greater due to their being only 3 exams rather than 15 as with the ACA qualification.

The general consensus for Level 1 is it requires 300 hours of dedicated study to master the material. To put this into perspective, this is over an hour and a half a day studying for 6 months consecutively. Despite my Accounting qualification, I found the 300 hours timeframe to be pretty accurate for me to achieve a comfortable pass.

On top of the content, the exam itself is mentally difficult. For each level, you have two 3-hour exams in a day, separated by just a short lunch break. After months of preparation, exam day is very much the final hurdle but just how tiring this day is shouldn’t be underestimated.

How much does it cost to get the CFA designation?

It’s also worth considering how expensive the CFA is. If you’re successful, this will pay itself back but if not, it’s not a trivial amount that you will be shelling out. You can expect the below expenses:

- Signing up to the institute (1-time fee) – $450.

- Exam fees – $1,000 for each exam ($3,000 total if you pass each exam first time in a best case scenario). However, there are early resignation discounts available which take it down to $700 per exam.

- Materials / in-class tuition. The price here can vary enormously, for Level 1, I paid around £400 for a Schweser package of books and practice materials. A full in-class tuition can cost north of $2000 for the best options. In hindsight, I would have used Mark Meldrum’s incredible Youtube course which was free for Level 1 at the time I took the exam.

- I personally stayed in a hotel the night before the exam in central London to avoid the extra stress of commuting on exam morning and remove the risk of being late and therefore not getting admitted. This is of course optional but is another £100 expense at least.

- For the CFA, you will need one of two authorised calculators – both cost around £50 on Amazon. I ended up buying two due to the completely irrational fear that one would break during the exam (which it of course didn’t).

As you can see, all in, getting the CFA designation is not a cheap endeavour. If you’re confident of passing, don’t let that put you off though, as you will on average earn that money back many times over working in the industries the CFA is geared towards.

Conclusion

Overall, if you are shooting for a career in Investment banking, equity research, portfolio management or similar, the CFA is a near-essential right of passage and is well worth doing even if you already have an Accounting qualification.

I have found just doing Level 1 of CFA has been a great differentiator in interviews. When an employer sees you are serious about increasing your knowledge and competence in a related field, it’s difficult for them not to be impressed. The CFA has for me been a very handy tool in interviews to show I’m capable and willing to invest in myself.

Having said that, the CFA is difficult, highly time consuming and expensive so I wouldn’t suggest doing it on a whim or as a shortcut to a career in finance without fully thinking it through.

If you know anyone thinking of taking the CFA, send them this article!

This article has been written by Luke Girling, ACA – a qualified Accountant and personal finance enthusiast in the UK. Please visit my ‘About‘ page for more information. To get in touch with questions or ideas for future posts, please comment below or contact me here.

Trackbacks/Pingbacks